LargeCap Stocks Knowledge Center

Post on: 16 Март, 2015 No Comment

Large-Cap Stocks

SmartMoney

Market Capitalization or market value is a term you’ll come across a lot, so we’ll define it right here. It’s the number of shares a company has outstanding in the market, multiplied by the share price. If a company had five million shares outstanding and each one traded for $5, its market cap would be $25 million.

As the name suggests, large-capitalization stocks are the biggest players in the market. How big? A market value of $5 billion is generally considered the low end, though most of the companies we now consider large caps actually bottom out at twice that. Many are much, much higher. Behemoths, usually corporations with a global reach, can weigh in at $200 billion or $300 billion, or more.

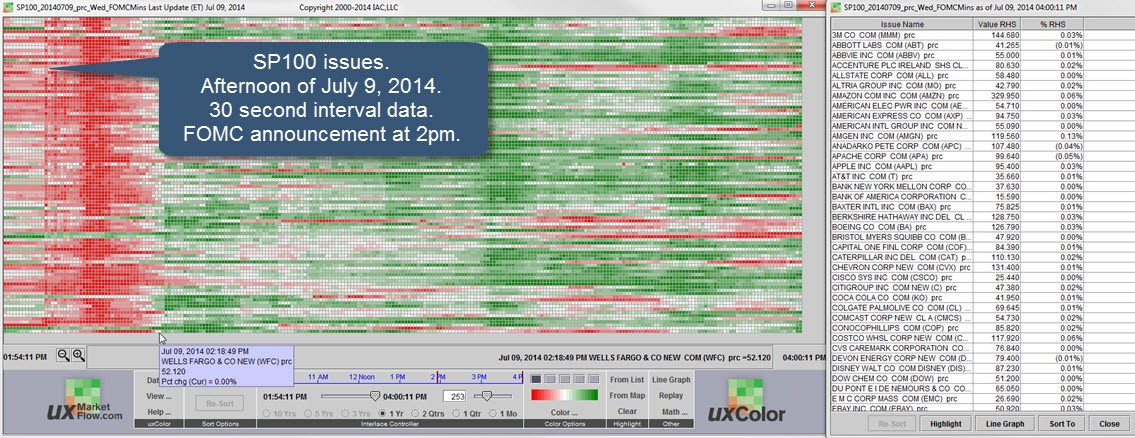

These companies play an especially significant role in driving the economy. That’s why everybody pays so much attention to them. The two most-watched indexes the Dow Jones Industrial Average and the Standard & Poor’s 500 are both composed of large-cap stocks. The Dow tracks 30 of the biggest stocks on the New York Stock Exchange and the Nasdaq. The S&P tracks 500 large U.S.-based companies.

The bigger you are, the harder it is to grow quickly, so large caps don’t tend to expand as fast as your average upstart. But what they lack in flash, they make up in heft. The classic blue chip has steady revenue, a consistent stream of earnings and a dividend. It also has critical mass, which means it can withstand ill economic winds better than its smaller cousins.

That said, the 1990s were notable for the blue-chip stocks in the technology sector growing much faster than these big stocks ever had. Many of the companies that led the technology boom back then have since seen their overall growth slow, both in terms of revenue and stock-price appreciation. Companies like these are still sometimes a little more volatile, but they’re generally survivors.

They shouldn’t be confused with smaller ones that achieve large-capitalization status based purely on unbounded investor enthusiasm. Back during the tech boom, many young start-ups achieved large-cap status well before they had earned it and then shriveled when the market tanked. It wasn’t uncommon to see market capitalizations go from $20 billion to $2 billion after the bust.

Lesson learned? Some companies might look like large-caps, when they’re really just bloated small or midcaps. And clearly, there’s nothing remotely steady about companies like these.

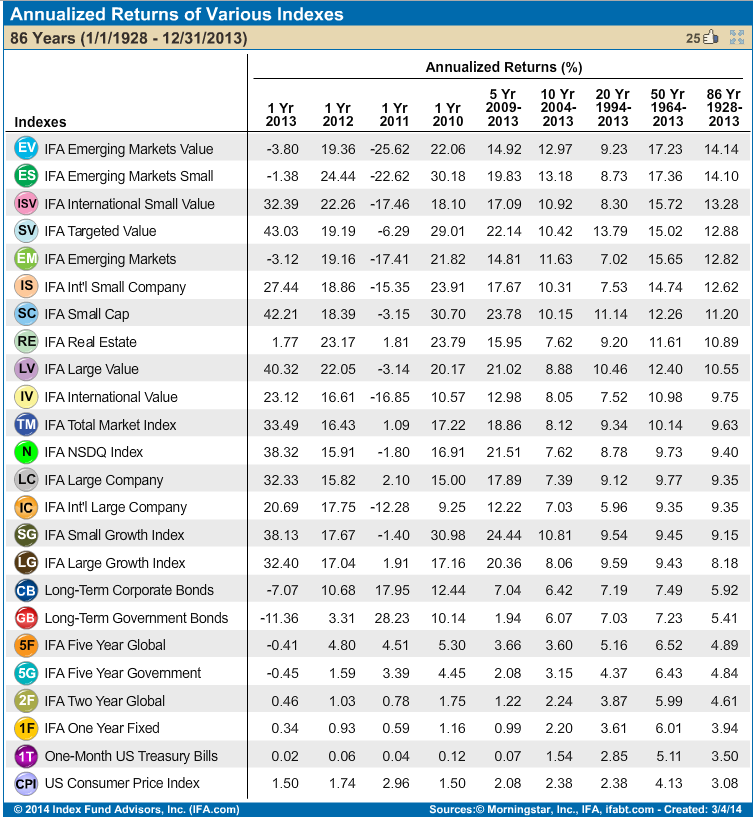

Risk/Reward

Because of their size and stability, true large-cap stocks are not generally speculative in nature and appeal to a more risk-averse investor. That’s not to say they can’t run into serious trouble, but they tend to grow along predictable trend lines and, since they are well known to Wall Street analysts, their problems often come with ample warning. Big companies (with the notable exception of many technology blue chips) also tend to pay regular dividends, which act as ballast by attracting income-oriented, long-term investors. Don’t be fooled: Large caps can experience jarring price swings. But there’s no doubt they are less volatile than small, hot-growth stocks.

Lower risk comes with a price, however. Except during periods of rampant uncertainty, large-cap stocks tend to produce lower returns than small caps over time. Still, many investors consider large caps their core holdings and augment their returns with a choice of fast-growth, higher-risk companies.