LargeCap MidCap and SmallCap Funds

Post on: 22 Апрель, 2015 No Comment

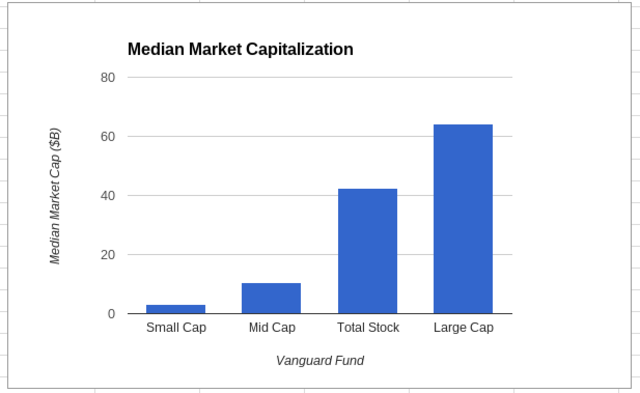

In the world of mutual funds, cap means capital, and it indicates the size of the companies the fund invests in. Large-cap funds invest in the major corporations; small-cap funds seek out smaller, often growing companies; and the investments of mid-cap funds are somewhere in between. The larger, more established companies usually present less risk and therefore large-cap funds tend to make safer investments. Small-cap stocks can take off and have often fared better, but present a greater risk since these companies are trying to establish themselves. While some small-cap companies have become huge quickly, others have moved along slowly or vanished into oblivion.

Small-cap funds can sometimes be deceiving. A company that starts out small and continues to grow is ultimately no longer a small-cap company. Yet it still may remain in the fund. After all, why throw out your ace pitcher even though he’s no longer playing in Little League? E*TRADE was a small-cap company found in many small-cap funds, but as it grew and brought the funds high returns, fund managers and investors enjoyed reaping the rewards, so it stayed.

Investing in different types of cap funds primarily serves to diversify your investments. You don’t want companies that are all the same size because success does go in cycles. In 1998, large-cap funds sitting with Coca-Cola, General Electric, IBM, and other giant companies performed better than the small-cap mutual funds. One of the possible reasons is the tremendous growth in investing by a much wider sector of the population. As more and more people get into the stock market and buy into funds from their home computers, they tend to be more comfortable at least in the beginning buying stock in larger, more familiar companies. There’s nothing wrong with this. After all, unless you’ve taken the time to sufficiently study some new, small-but-growing plumbing supply company, you too might lean toward the more familiar Wal-Mart or Disney.

What is a mega fund?

This is a fund that buys into other funds. Like a big fish eating smaller fish, it looks at the smaller funds and lets you diversify your diversification. As the number of mutual funds grows, you may see more mega funds buying mutual funds much the way mutual funds select from the thousands of stocks at their disposal.

Some small-cap companies, such as those in the technical sector, are also very well known to the computer-friendly population, which is why companies like Intel or Dell Computer can also shine. As the newer online investors become savvier, they too will branch out from safer, more familiar territory and explore the many growing companies.