Know Your Stock s Beta and Predict Volatility

Post on: 16 Март, 2015 No Comment

Higher Betas Mean the Stock Is More Likely to Be Risky

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Investors in the stock market are concerned with the volatility of their portfolio as it relates to risk and return.

In other words, how much volatility should you expect from the particular stock?

What you want to know is how your stocks may move relative to the overall stock market. In most cases, you want your stocks to rise when the market goes up, but not fall as fast as the market when it turns down.

This is a delicate balance and one of the ways you can predict how a stock will move relative to the market is through its beta.

A stock’s beta tells you how the stock should react when the market goes up or when in goes down.

Beta is one of the most used and misused of the financial indicators. First off, let’s review what a beta is, then look at how you can use it in a meaningful way.

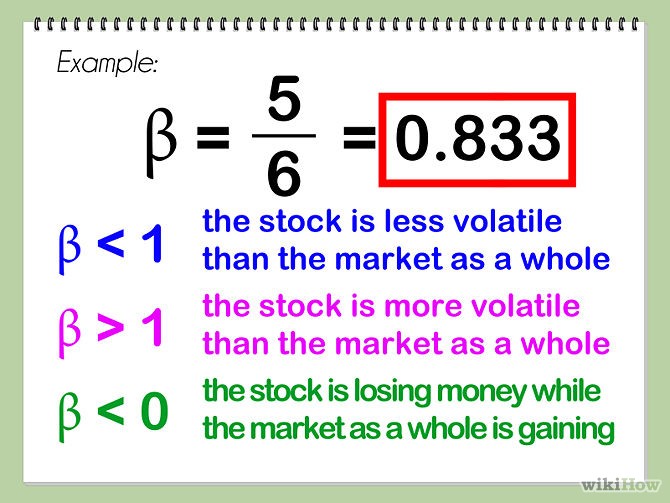

The beta is a measure of a stock’s price volatility in relation to the rest of the market. In other words, how does the stock’s price move relative to the overall market.

Beta Calculated

The number is calculated for you (thank goodness) using regression analysis. The whole market, which for this purpose is considered the S&P 500, is assigned a beta of 1. There is no single index used to calculate beta, although the S&P 500 is probably the most common proxy for the market as a whole.

Stocks that have a beta greater than 1 have greater price volatility than the overall market and may be more risky, but also may offer the potential for greater returns.

Stocks with a beta of 1 fluctuate in price at about the same rate as the market.

Stocks with a beta of less than 1 have less price volatility than the market and may be less risky, but may offer lower than market returns.

Beta and Risk

Of course, there is more to it than that. Risk also implies return. Stocks with a high beta should have a higher return than the market. If you are accepting more risk, you should expect more reward.

For example, if the market with a beta of 1 is expected to return 8%, a stock with a beta of 1.5 should return 12%. If you don’t see that level of return, then the stock is not a good investment possibility.

Stocks with a beta below 1 may be a safer investment (at least by this one measure) and you should expect a lower return.

Beta seems to be a great way to measure the risk of any stock. If you look a young, technology stocks, they will always carry high betas. Many utilities on the other hand, carry betas below 1.

Finding Betas

You can also compare a stock’s beta to its sector to get a picture of whether the stock is out of line with its peers.

You can find a stock’s beta through a number of online services such as offered by Yahoo!Finance .

You can find a stock’s beta among the summary information.

Problems with Beta

While the may seem to be a good measure of risk, there are some problems with relying on beta scores alone for determining the risk of an investment.

Beta looks backward and history is not always an accurate predictor of the future.

Beta also doesn’t account for changes that are in the works, such as new lines of business or industry shifts.

Beta suggests a stock’s price volatility relative to the whole market, but that volatility can be upward as well as downward movement. In a sustained advancing market, a stock that is outperforming the whole market would have a beta greater than 1.

How to Use Beta

Investors can find the best use of the beta ratio in short-term decision-making, where price volatility is important. If you are planning to buy and sell within a short period, beta is a good measure of risk.

However, as a single predictor of risk for a long-term investor, the beta has too many flaws. Careful consideration of a company’s fundamentals will give you a much better picture of the potential long-term risk.