KISS Retirement Portfolio David Swensen s Unconventional Success

Post on: 19 Апрель, 2015 No Comment

Summary

- David Swensen, manager of the Yale Endowment, recommended this portfolio in his book “Unconventional Success”.

- We backtest the portfolio with the recommended 70/30 Stock/Bond split and modify the portfolio slightly to test a 60/40 Stock/Bond split.

- How do these portfolios stack up compared to the S&P 500?

- We also compare the three KISS portfolios discussed in this series.

In this series of articles, we will present simple index fund based portfolios. Each KISS (Keep It Simple Stupid) portfolio is backtested and we compare both the Compound Annual Growth Rate and risk-adjusted returns against the S&P 500 index.

The portfolios are rebalanced once per year and dividends and distributions are reinvested.

For each portfolio we will examine:

- How large a $10,000 initial investment would have grown between 1972-2014

- How our $10,000 investment did during bear markets.

- How our portfolio did if we started with $10,000 and made contributions every year starting at $5,000 and adjusting the contribution for inflation every year.

- How our portfolio did if we started with $100,000 and made a withdrawal every year starting at $4,000 and adjusting the withdrawal for inflation every year.

As with the previous articles, this article is intended to start a conversation. I consider this a group effort. The primary benefit of SA, in my view, is it gives us an opportunity to discuss investment ideas. I encourage you to participate in the conversation.

The Portfolio

David Swensen has managed Yale’s Endowment since 1985. In the endowment he is known for investing in low-liquidity assets, believing that investors pay too much for liquidity, so low-liquidity provides for higher returns. Prior to 2008 the endowment posted outstanding returns, since that the luster has worn off a little.

For individual investors, he believes focusing on diversification and limiting expenses are key.

Amongst the KISS portfolios, reviewed in these articles, this is the closest to my personal portfolio. My portfolio contains each of these asset classes and similar to the Swensen’s portfolio my bond holdings consist of only Treasuries and TIPs. The major differences are my portfolio is more tilted towards value and small caps.

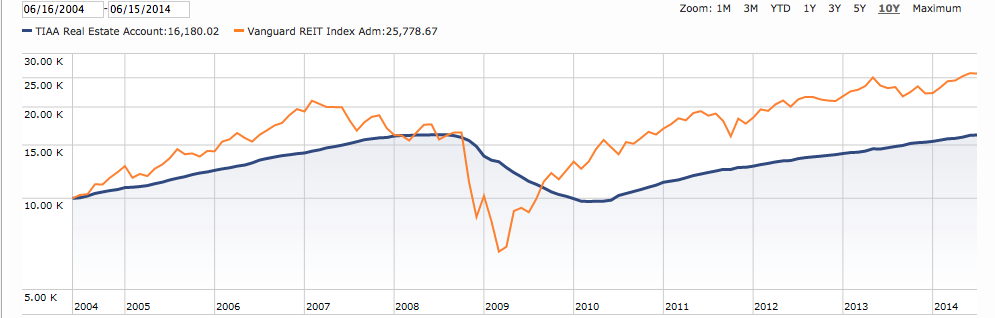

In this version of the portfolio there is a high percentage of REITs. As mentioned in this SA article. Swensen later suggested lowering REITs to 15% and raising the emerging markets to 10%. I stuck with his original allocation, as it is the one that I have seen mentioned the most in investment articles.

I also wanted to see how the portfolio would perform if I altered it slightly to have 40% bonds. As a semi-retired investor, avoiding large drawdowns is especially important to me; more bonds, should lead to less volatility. To create the portfolio with 40% bonds, I reduced the amount invested in Total U.S. market to 25%, REITs to 17% and International Developed to 17%. I increased the holdings of both TIPs and Intermediate Treasuries to 20%.

The backtesting was done at PortfolioVisualizer.com. The data used by Portfolio Visualizer:

Portfolio 1

- 30% US Stock Market

- CRSP Market Decile 1-10 1972-1992

- Vanguard Total Stock Market Index Fund (MUTF:VTSMX ) 1993-2014

Portfolio 2

- 25% US Stock Market

- 17% Reits

- 13% International Developed

- 5% Emerging Markets

- 20% TIPS

- 20% 5-Year T-Bills

Portfolio 3 (for comparison)

- S&P 500: Standard & Poors 1972-1976

- Vanguard 500 Index Fund (MUTF:VFINX ) 1977-2014

TIPS were not available for the entire time period; PortfolioVisualizer uses Simulated TIPS before 2000.

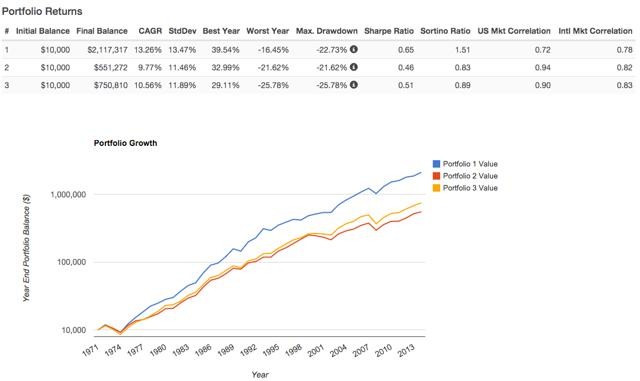

Performance from 1972-2014

The portfolio with 30% bonds beats the S&P across the board, better CAGR, a smaller Max. Drawdown and better risk adjusted returns based on both the Sharpe and Sortino Ratios. The portfolio with 40% bonds has a slightly lower CAGR but a lower Max. Drawdown and better risk adjusted returns. I am semi-retired, neither withdrawing from nor contributing to my retirement accounts; the lower volatility of the 40% bond portfolio is more appealing to me than trying to squeeze out a little extra CAGR.

For those that are not familiar with the Sharpe Ratio and the Sortino Ratio both are attempts to relate portfolio performance to risk. In Modern Portfolio Theory, risk is measured by volatility and the theory is that taking on more risk will enhance the upside potential of a portfolio. However, it will also enhance the downside risk of a portfolio. Both the Sharpe Ration and the Sortino Ratio attempt to even the playing field by measuring the portfolios on a risk-adjusted basis. For a better understanding of these ratios follow the links earlier in this paragraph.

During Bear Markets

Many investors believe that markets always bounce back and that they will patiently wait through any bear market holding their positions until they recover. I believe both beliefs are incorrect. Most investors given a long enough bear market will panic; in fact bear markets can only occur when there are more sellers than buyers causing prices to drop until the demand matches the supply. As far as waiting out a bear market, I believe investors are biased by the fact that recent bear markets have had quick recoveries. It can take decades for markets to recover, as shown by the great depression and the fact that the Nikkei (Japan’s Nikkei 225 Stock Average) is still less the 50% of its 1989 high. Given a long enough bear market most investors will panic or simply not be able to afford to wait it out, especially those who are in withdrawal phase and using their portfolio to fund their retirements. This is one reason it is important to look at how portfolios have performed in Bear markets.

1973 — 1978

Both KISS portfolios perform better than the S&P 500 across the board. They have less drawdown, recover quicker and do not have the double dip that hits the S&P 500 Portfolio.

2000 — 2005

The tech wreck provides another good time frame to assess how the portfolio did in bear markets.

During this downturn the KISS portfolio with the 40% bonds really shines, having a Drawdown of only 1.50% compared to the S&Ps drawdown of 37.71%.

2008 — 2011

Finally, we look at the Great Recession.

This is the downturn that took some of the luster from Swensen’s reputation. His endowment portfolio did not hold up well. However, even given the high concentration of REIT holdings, the portfolio he recommended for individual investors held up well. Both the 30% bond and 40% bond portfolio beat the S&P across the board and portfolio with 40% bonds did especially well minimizing the drawdown.

In Accumulation Phase

In the accumulation phase, market downturns, especially early on, can work to an investor’s advantage allowing them to buy low. In this case the bear market of the early 1970s benefits all the Portfolios.

During the accumulation phase the CAGR for all of the portfolios were within spitting distance, with the S&P 500 edging out each of the KISS portfolios by a few tenths of a percent. I would gladly trade off that small edge,for the S&P 500, for the lesser volatility of the KISS portfolios. Even the slightest decrease or delay in portfolio contributions, during the worst of the bear market would have caused that small advantage to disappear, and there is something to be said for sleeping at night.

In Withdrawal Phase

A market downturn during the withdrawal phase is particularly painful, as investors are losing money in the market and compounding the problem by withdrawing living expenses. The negative effect is made worse when it occurs early in the withdrawal phase.

Here we see how both Swensen KISS portfolios provide much better results in the withdrawal phase than the S&P 500. The portfolio with 30% bonds has the higher CAGR, but many retirees may prefer the less volatile 40% bond portfolio.

Comparing the KISS Portfolios

We now have three KISS Portfolios: the barbell portfolio, the Ferri Portfolio and the Swensen Portfolio. Let’s see how they compare to each other.

Portfolio 1 is the portfolio from the first article in this series consisting of: small cap value, emerging markets and treasuries. We had two versions of the portfolio one using short-term treasures one using long-treasuries, in this comparison I used the portfolio with the long-term treasuries.

Portfolio 2 is the portfolio from the second article in this series, Rick Ferri’s 3 fund portfolio consisting of: total U.S Stocks, Total Internation Stocks and Total U.S Bonds.

Portfolio 3 is the Swensen portfolio from this article. I used the original version with 30% bonds.

The Barbell Portfolio, from the first article, that invested in only Treasuries, small cap value and emerging markets had the best overall results. It had a higher standard deviation than the other portfolios, but had a substantially higher CAGR and better Sharpe and Sortino ratios.

The past performance of Ferri’s and Swensen’s portfolios are very similar. These portfolios, both provided a CAGR very close to the 10.29% returned by the S&P 500, but did it with much less volatility.

Portfolio Components

There are many funds that can be used to create or approximate the Swensen portfolio including those listed below.

Total US Market:

- Vanguard Total Stock Market Index Fund

- Schwab Total Stock Market Index (MUTF:SWTSX )

- iShares Core S&P Total U.S. Stock Market ETF (NYSEARCA:ITOT )

- Vanguard Total Stock Market ETF (NYSEARCA:VTI )

- Schwab U S Broad Market ETF (NYSEARCA:SCHB )

REITS

- Vanguard REIT ETF (NYSEARCA:VNQ )

- Vanguard REIT Index Fund

- Schwab U.S. REIT ETF (NYSEARCA:SCHH )

- SPDR Dow Jones REIT ETF (NYSEARCA:RWR )

International Developed

- Vanguard Developed Markets Index

- iShares Core MSCI EAFE ETF (NYSEARCA:EFA )

- Vanguard MSCI EAFE ETF (NYSEARCA:VEA )

- iShares Core MSCI EAFE ETF (NYSEARCA:IEFA )

Emerging Markets

- Vanguard Emerging Markets Index

- Vanguard FTSE Emerging Markets ETF (NYSEARCA:VWO )

- Schwab Emerging Markets ETF (NYSEARCA:SCHE ),

- IShares Core MSCI Emerging Markets ETF (NYSEARCA:IEMG )

TIPS

- Vanguard Inflation-Protected Security Fund

- iShares Barclays Treasury Inflation Protected Securities FundTIP)

- Schwab U.S. TIPS ETF (NYSEARCA:SCHP )

- Vanguard Short-term Inflation-Protected Securities (NASDAQ:VTIP )

Intermediate Treasuries

- Vanguard InterTerm Treasury Fund

- Intermediate-Term U.S. Treasury ETF (NYSEARCA:SCHR )

- ISHARES 3-7 YEAR TREASURY BOND ETF (NYSEARCA:IEI )

- VANGUARD INTERMEDIATE-TERM GOVERNMENT BOND ETF (NASDAQ:VGIT )

Conclusions

The past can be used to give us some insight into the future, but the insights must be used with some caution. Market situations now and in the future will never exactly match what has occurred in the past. Backtesting provides some useful information, but its ability to predict the future performance is far from perfect.

Swensen’s portfolio is more complex than the three fund portfolios reviewed in the first two articles in this series. The portfolio six funds cover the following asset classes Treasuries, TIPs, U.S. Equities, REITs, Developed International and Emerging markets. This portfolio is the closest to my current portfolio. I consider myself a semi-passive investor; I am no longer select stocks, but I will change how I weight asset classes based on my analysis. For me, or someone like me, the Swensen portfolio may provide a good starting point

Comparing the past results of the KISS portfolios, it is hard to ignore how much better the portfolio discussed in the first article performed. The barbell approach over the time frame from 1972-2014 was clearly a winning strategy.

Will the barbell approach continue to be a winning strategy going forward? I don’t know. I’m intrigued, but still feel more comfortable with a more diversified portfolio. My portfolio does tilt towards small caps and contains a healthy percentage of emerging markets, but at this point I plan on continuing to hold a wider range of asset classes.

What do you think?

I am not a professional advisor or researcher. I am an individual investor who studies investing and shares my thoughts. I encourage all investors do their own due diligence and please share your findings. I strongly feel the best thing about Seeking Alpha is the sharing of ideas. Please comment; I value your input. Divergent opinions are welcome.

Disclosure: The author is long IEFA, SCHE,SCHP, SCHR,VNQ, VTIP,VWO. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.