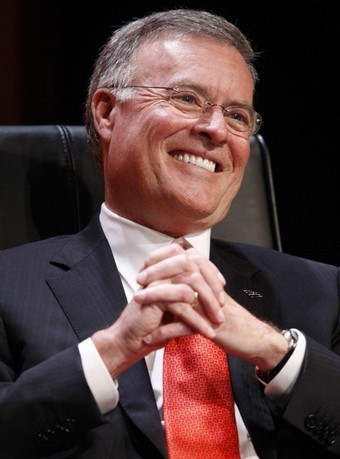

Ken Lewis ousted as BofA chairman

Post on: 16 Март, 2015 No Comment

After shareholders spent four hours railing against Bank of America’s brass, executives said Ken Lewis lost his chairmanship but kept his title as chief executive.

Updated: April 29, 2009 6:08 p.m.

(AP) — Ken Lewis has been ousted as chairman of Bank of America Corp. after angry shareholders voted to separate that job from that of the bank’s chief executive.

Mr. Lewis will remain in the CEO position, but board member Walter Massey will become BofA’s chairman.

Shareholders narrowly voted to split the job following months of rancor over the company’s acquisition of Merrill Lynch & Co. After the deal was sealed Jan. 1, Merrill reported $15 billion in fourth-quarter losses.

The vote came after an angry four-hour annual meeting Wednesday.

Before the vote came down, industry analysts saw the delayed announcement as a sign that Mr. Lewis has lost support following the Merrill acquisition.

In effect, it’s a vote of confidence against him, banking industry consultant Bert Ely said of Mr. Lewis. It’s a strong statement from stockholders that they’re not happy with leadership.

Mr. Lewis has been chairman and CEO of Bank of America since April 2001.

The bank’s annual meeting was the angry affair that most people expected, and shareholders’ ire only increased when the company delayed the release of the shareholder votes. The company said it was aiming to release the vote totals later Wednesday, but the announcement was met by boos and some in the audience of more than 2,000 got up to leave although the meeting was continuing.

Big investors including California’s employee pension fund had called for shareholders to oust Mr. Lewis and his fellow directors at the meeting. And shareholders lined up early in the gathering to speak at microphones, with many hurling criticism at Mr. Lewis and the Bank of America board for the government-brokered purchase of Merrill Lynch. After the deal was sealed, Merrill Lynch announced $15 billion in fourth-quarter losses.

I find it incredible you didn’t have the guts to stand up to the U.S. government, said Judith Koenick of Chevy Chase, Md. who said she lost thousands of dollars when BofA shares plunged after the Merrill Lynch purchase.

The government pressured Bank of America into buying Merrill Lynch during the same weekend in September that another investment bank, Lehman Brothers Holdings Inc. collapsed, setting off one of the most intense periods of the financial crisis.

Shareholder Gerald Abrams, of Boca Raton, Fla. also had an exchange with Mr. Lewis about the deal, asking, What happened to due diligence in Bank of America’s investigation of Merrill Lynch’s finances?

Mr. Lewis responded that Bank of America didn’t anticipate the worsening credit conditions in the country, which elicited from Mr. Abrams, Why do the deal? Mr. Lewis replied that it wasn’t in the best interest of shareholders for BofA to pull out of the agreement.

Later, Mr. Abrams told a reporter, I listened to Lewis, and he came off like a good guy and a knowledgable guy, but I just can’t see him staying.

But some shareholders who spoke at the meeting were complimentary of the CEO.

Joe Baker, who said he was from Mississippi, said, We need Ken Lewis and his board in control. The audience applauded.

Mr. Lewis was also greeted by applause as he took the stage. In his remarks, he defended the company’s acquisition of Merrill Lynch and another troubled company, mortgage lender Countrywide Financial Corp.

Mr. Lewis said the companies are providing the positive counterbalance to our traditional banking businesses, which at this point of the business cycle are under much more stress from rising credit losses.

Countrywide and Merrill Lynch are two of the most important reasons Bank of America is the most profitable financial services company in the United States so far this year, Mr. Lewis said. Today, I can state without reservation that these acquisitions are not mistakes to be regretted. Both are looking more and more like successes to be celebrated.

The Charlotte-based banking giant and Mr. Lewis have been under intense scrutiny because BofA is one of the biggest recipients of government bailout money and because the losses at Merrill Lynch turned out to be much higher than anyone expected.

Shareholders who have been calling for Mr. Lewis to resign or be dismissed as chairman and CEO are also irate over the precipitous drop in the company’s stock price. Bank of America has fallen 42% since the beginning of the year, closing Tuesday at $8.15 and rising to $8.72 Wednesday afternoon in a general stock market rally before they closed at $8.68. But shares fell as low as $2.53 in late February.