Just How Does the Dow Jones Work

Post on: 16 Март, 2015 No Comment

Few understand how the index of 30 companies is calculated.

A BOARD ON the floor of the New York Stock Exchange shows Monday’s final number for the Dow Jones Industrial Average.

Last Modified: Monday, October 13, 2008 at 9:42 p.m.

NEW YORK | Amid weeks of stock market turmoil, many worried investors have been tracking the daily trajectory of the Dow Jones industrial average like never before.

But few understand how the index of 30 of the biggest U.S. companies is calculated — or what the closely watched measure of stock market performance really means.

Q: What is the Dow Jones industrial average?

A: The Dow, the oldest continuing U.S. market index, is a way of measuring the combined stock values of 30 big U.S. companies.

It started out with 12 components, including now-defunct companies like U.S. Leather Co. and Tennessee Coal, Iron and Railroad Co. The only original component is General Electric Co.

Now, the index has expanded to reflect the U.S. economy’s move away from big industrial companies. Staples of the modern Dow include big financial companies like Citigroup Inc. technology bellwether IBM Corp. and drug manufacturer Pfizer Inc.

Q: How is it calculated?

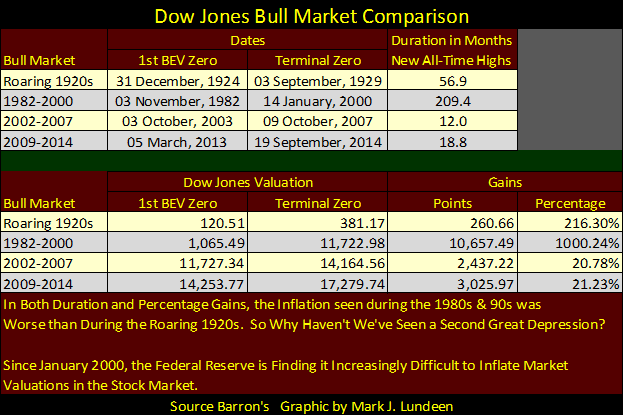

A: Charles Dow, who launched the index in 1896, originally took the price of one share of each company’s stock, added the numbers up and divided by the number of companies. The average when the index launched was 40.94 — a quaint number compared to Monday’s close of 9,387.61, or the record high of 14,165.43 on Oct. 9, 2007.

Today, Dow Jones & Co. has come up with a mathematical formula to adjust for things like stock splits — when a company doubles the number of stocks, splitting the price of each in half — or companies added or removed.

The idea is to keep the index consistent over time, and to make sure today’s value can be compared in a meaningful way to what it was a year ago or 10 years ago.

This can be done various ways mathematically, but at Dow Jones it is handled by changing the divisor — a number that is divided into the total of the stock prices. That divisor currently stands at 0.122820114.

Q: How does the index account for the fact some components are bigger than others?

A: The index is what’s called a price-weighted average, meaning expensive stocks have more influence over the number than lower-priced ones do. This is the case because the index is based purely on the dollar value of stocks; if a high-priced share goes up 20 percent, that’s a greater dollar increase than a cheaper share’s 20 percent jump. For example, a sharp drop in the price of General Motors last week didn’t have a huge effect on the Dow because the automaker’s stock was already so low. The stock fell $2.15, or 31 percent, on Thursday but only lowered the Dow by 17.1 points. GM’s drag wasn’t all that noticeable on day when the Dow plunged 679 points.