Junk Bonds

Post on: 25 Июнь, 2015 No Comment

You finally stashed away some extra savings. Rather than pouring your precious funds into some slick technology, you decide to play the market. That’s when you learn that there’s more to investing than buying a few shares of Google and retiring early. Stocks. bonds. mutual funds — there’s a whole raft of different securities to sink your money into, and perhaps the most dubiously named of them all is the junk bond.

Quick Glossary to Bond Terms

Bond. A loan issued by an institution to fund projects and operations. It can be issued by a company, a federal or state government or a municipality (cities and towns).

Date of maturity. The date on which the bond expires and the loan should be paid back in full. Maturity can take 90 days to 30 years.

Default. What happens when the institution that issued the bond cannot fully repay its debt.

Interest rate. The percentage of the amount borrowed that must be paid back in addition to the loan.

Principal amount. The face value of the bond.

To understand junk bonds, let’s clarify what bonds are and how they differ from stock. Whereas stocks represent partial ownership of a company, bonds are simply loans. When you purchase a bond, you’re agreeing to lend money to the bond issuer. such as a company or a government. The issuer in turn is promising to pay you back the loan with interest by the date of maturity. You receive that interest regularly, often every six months. That fixed payment is why bonds are called fixed-income securities. as opposed to stocks, which carry variable returns.

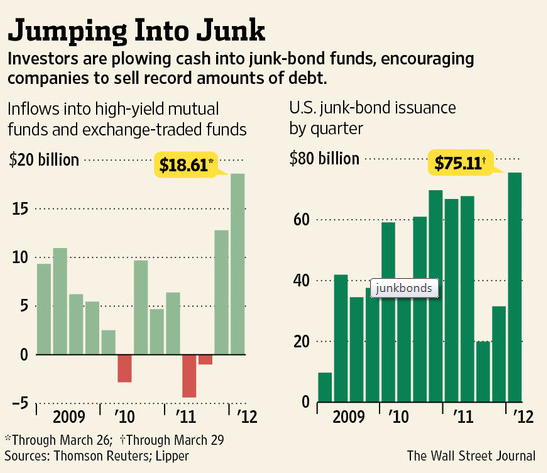

Junk bonds are bonds issued by companies with low credit ratings, as opposed to the investment-grade bonds offered by corporations with better credit and longer track records. Credit-starved companies offer to pay out high interest rates to investors like you, nice enough to loan them your hard-earned money. Because of their high rates of return. junk bonds are also politely called high-yield bonds.

So are junk bonds for you? In this article, we’ll explore this underdog of the investment world and its turbulent history. We’ll also learn why some bonds are dubbed junk and whether you should devote a portion of your financial portfolio to them. On the next page, we’ll find out how junk bonds exploded onto the financial scene in the 1980s with Michael Milken, later dubbed the Junk Bond King.