Junior Mining Stocks

Post on: 1 Июль, 2015 No Comment

Comments ( )

It’s no secret giant corporations dominate the natural resources industry. And they stick with it because it’s profitable now and will remain profitable until the end of days. The industry offers endless possibilities and opportunities for all sorts of investors.

Mining for rare earths, copper, and silver bring an overwhelming surge of profits and soaring stock levels. but the real wealth is found when miners strike gold.

Nonetheless, gold juniors have seen some steep dips in recent weeks. The stocks are hitting record lows in a gold-stock sector that has been a top-performing market for more than a decade.

That being said, its important you understand why these gold juniors are perfectly positioned with the potential to bring you quadruple-digit gains.

Yes you read that right: Experienced gold bull traders could have the opportunity to make up to a 1,000% profit!

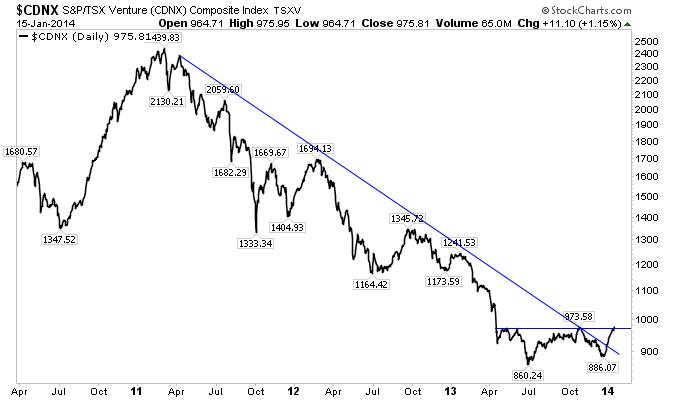

If you think that’s a crazy projection, just take a look at a chart of the TSX Venture market, home to the highest-risk/highest-reward gold and natural resource exploration and development stocks:

Lets Break That Down.

If you notice, last time juniors tanked dramatically in the market collapse of 2008 they soared substantially by about 300% shortly after hitting rock bottom. From the looks of it, something similar is happening again.

The TSX has obviously taken a nosedive, and now the stars have all aligned and market forecasts have never looked better for gold juniors.

But How Can You Profit from Their Tanking Stocks?

Well, mostly because everything else in todays financial markets and economy is equally negative.

No matter how you slice it, any close analysis reveals why the most educated analysts and precious metals experts are unnaturally bullish in lieu of recent gold market corrections. Everyone seems to be saying the same thing: Now is the time to buy while these exceptional gold juniors are still so cheap.

While the Fed announced a third round of quantitative easing this past September. interest rates are hovering near nothing. and gas prices are soaring, investors worry that perhaps our economy hasnt really improved at all over the past year.

Investors are truly fearful for the current and future states of the global economy. Such widespread fear alone could send gold soaring to new record heights in no time.

That kind of traffic in the gold markets often triggers massive profits for gold junior resource companies.

In rare scenarios like these, it is common for junior gold stock profits to spike by 300%-1000%.

Luckily for you, the mainstream media tends to overlook junior mining companies in times of crisis. In other words, if you act quickly, you could invest at a fraction of the price it would cost you to invest in more mainstream gold stocks.

So if youre waiting for another gold correction, I wouldnt risk it. With the way our economy is crumbling, you’ll find it well worth your time and money to take advantage of this time-sensitive opportunity.

Related Articles on Junior Mining Stocks

Silver is a popular investment lately amid economic uncertainty and an industrial resurgence. Mining companies allow investors to get in at the source.

The sea floor can hold up to an estimated $150 trillion of precious metals alone. And companies are interested in mining.

In a partnership with Carnegie Mellon University, miner Anglo American (LON: AAL) is developing robotic technology to aid mining efforts.