Journal of Asset Management An examination of alternative portfolio rebalancing strategies

Post on: 16 Март, 2015 No Comment

Journal of Asset Management (2007) 8, 18. doi:10.1057/palgrave.jam.2250055

An examination of alternative portfolio rebalancing strategies applied to sector funds

1 Associate Dean and Professor of Finance, East Carolina University, USA

2 Robert Dillard Teer, Jr. Distinguished Professor of Business, East Carolina University, USA

Introduction

It is a widely recognised tenet of finance that investors must rebalance their portfolios at regular intervals to prevent becoming over invested in one type of security. There are different rebalancing strategies that investors can follow. These include rebalancing at regular intervals of time, say annually, or rebalancing based on waiting until a particular type of security grows to some threshold that triggers action. In this study, we investigate these alternative strategies when applied to investing in sector funds.

A properly diversified investor will not want to hold a disproportionate share of wealth in any one type of security. So as a particular type of stock, say growth stocks, increases in value and begins to dominate the portfolio, conventional finance wisdom suggests that some of it be sold and that a different type of security be purchased. Sector fund investing is another example where rebalancing could be beneficial. If the investor does not rebalance at regular intervals, one sector fund could end up being overly represented and the investor poorly diversified.

While few investment advisors will argue the logic of the above, there is little research or theory to guide investors as to what specific rebalancing strategy will lower risk most efficiently. In this study, we closely examine two alternatives. In the first, we look at the benefits of rebalancing at regular calendar intervals. This portion of the study compares monthly, quarterly, semi-annual and annual strategies. We next examine whether basing rebalancing on a trigger prompts rebalancing when a particular sector fund exceeds various percentages of total investment. We first locate the most effective trigger and then compare this to rebalancing based on calendar intervals.

Data

Sector funds are a relatively recent innovation in mutual fund investing. A few sectors were available in the late 1980s and more have been added since. By 1995 a full spectrum of sector funds was available to investors. In this paper, we use a sample composed of 19 sector funds. This represents a reasonably comprehensive sample of sectors now available to the public. We obtained monthly index values for each fund and converted these values to monthly returns. Table 1 shows summary statistics for each sector.

The average annualised return on the 19 sector funds between December 1995 and December 2002 was 12.5 per cent. By comparison, the S&P 500 average return was 10.9 per cent and the DOW was 11.8 per cent. The Wilshire 5000 fell slightly behind at 9.5 per cent.

The internet sector stands out as having the highest average annualised return over this interval (42.1 per cent). This return is about twice as high as any other sector. Since this performance is unlikely to be repeated in other sectors in the future, we performed our analysis both including and excluding this sector.

Several other sectors performed substantially better than the rest. These include health care, financials, information technology, retailing and biotechnology. The worst performing sectors included materials, utilities and metals and mining.

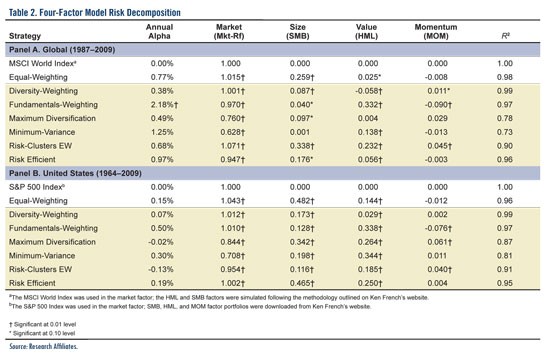

Table 2 reports the correlation in returns between the 19 sectors. Not surprisingly, the correlation between the financial services industry and banks is 96 per cent, and the correlation between the technology sector and the electronics sector is 99 per cent. The leisure and the retail sector are also highly correlated.

Methodology

We initially looked at the returns investors could realise if they invested equally in all 19 of the available sectors (5.26 per cent of their portfolio invested in each sector) over the period for which data was available. We then analysed the returns they could achieve by rebalancing their portfolios when any one fund grew to a trigger threshold. After looking at a range of triggers to rebalancing, we determined that optimal portfolio returns were achieved when the portfolio was rebalanced when any fund grew to a level of 9 per cent of the total portfolio value. The average annualised return was 3.676 per cent higher when rebalancing occurred when any sector’s fund rose to 9 per cent of its portfolio’s total value than if there was no rebalancing. These results are reported in Table 3. The average annual return increased from 7.575 to 9.519 per cent without a significant increase in the standard deviation of the returns. This strategy would have required the investor to rebalance their portfolio seven times over the seven-year interval.

The selection of the 9 per cent threshold for rebalancing is somewhat arbitrary. A slightly higher return could be earned with a 10 per cent threshold; however, this comes with a higher standard deviation. Nine per cent was chosen because it had the highest Sharpe ratio. The Sharpe ratio considers both the return and the risk and provides a measure of the return per unit of risk. Certainly, the optimal threshold for rebalancing will change from period to period. Our data suggest relatively little difference in the Sharpe ratios between 8, 9 and 10 per cent thresholds.

Another issue to be noted from Table 3 is that it is possible to rebalance too often. The 5 per cent rebalance trigger is included to show the affect of daily rebalancing. When the portfolio is rebalanced too often, the investors are prevented from capturing the gains from any sector that establishes momentum.

Figure 1 demonstrates graphically the affects of rebalancing. We see that the internet sector triggered rebalancing more often than any other sector.

Sector weights in portfolio rebalancing at 9 per cent

Full figure and legend (118K )

Figure 2 reports the risk return trade-off achieved by rebalancing at various thresholds. We see that very frequent rebalancing puts the portfolio at the bottom of the efficient frontier. As the rebalancing interval increases, the risk return trade-off improves.

Average annual return versus average annualised standard deviation (rebalance triggers 0.50 to 0.1