Joseph Piotroski 9 FScore Value Investing Model Pick Stocks

Post on: 19 Июль, 2015 No Comment

Playing and investing in the stock market is a gamble. But you can decrease and manage investment risk when you have a strategy that works, like Joseph Piotroski.

The American Association of Individual Investors tracks 63 separate stock picking strategies that include a mix of growth, value, momentum, changes in earnings estimates, and insider buying. By the end of December 2010, the winning strategy for the year was from Joseph Piotroski with a 138.8% stock market gain over 12 months. You can see the rankings for yourself on the AAII scoreboards.

How to Pick Winning Stocks

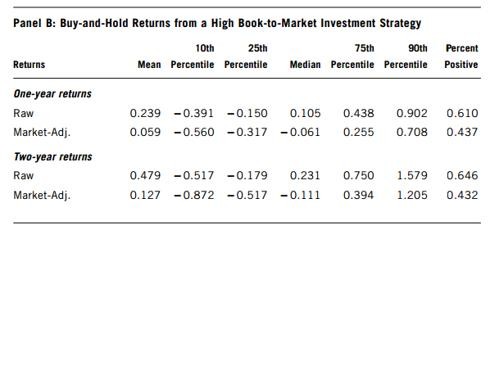

Joseph D. Piotroski works as an Associate Professor of Accounting at the Stanford Graduate School of Business. In 2000, he wrote the paper, Value Investing: The Use of Historical Financial Information to Separate Winners from Losers. It was this paper that outlined 9 fundamental ranking criteria for picking winning stocks. Using his stock picking criteria, he was able to theoretically average 23% annual gains between the years 1976 and 1996. During 2010 as the market sprang back to life, his strategy worked over 5 times better than his previous average.

What are the 9 fundamental rankings that he uses to achieve these phenomenal gains?

The 9 Point F-Score Ranking System

Piotroski uses low price to book stocks (high book to market) for his scan. This is in line with previous research that highlights the valuation upside to low price to book stocks over glamour or high-growth stocks (Fama and French, 1997, Value Versus Growth: The International Evidence ).

The 9 point fundamental scoring system (F-Score) has a binary value associated with each criterion. The more points a company earns, the better the stock pick is, and there is a maximum of 9 points. The following 9 points are carried out year over year, although a very keen investor may also choose to track smaller differences between quarters. This means that the bulk of your analysis will be performed after the annual report comes out, or you can also use 12 months of trailing data versus the 12 months of data before that to compare two annual periods at any given time.

Here are the 9 F-Score ranking criteria:

- Return on Assets. This ratio is simply net income dividend by assets. It shows how well the assets are being utilized to generate profit. This ratio must be positive to get a point. It is viewed as a measure of net income. This can be carried out using fiscal year over year, or trailing 12 months versus the 12 months before that.

- Cash Flow from Operations. This is another net income gauge. Many investors consider cash to be king. A company with increasing net profits but negative cash flow is not what you want. Cash is king and you want to see growth in real money instead of accounting tricks to boost an earnings report. One point is given if cash flow is positive. Again, this can be carried out using fiscal year over year, or trailing 12 months versus the 12 months before that.

- Increase of Return on Assets. Did the Return on Assets (ROA) grow? If so, the stock gains another point. Remember, this can be carried out using fiscal year over year, or trailing 12 months versus the 12 months before that.

- Cash Flow > Return on Assets. If net income, as defined by ROA, is higher than cash flow, this may spell disaster for future profitability. Cash is needed to pay dividends. employee wages, and debt. Without liquid assets, debt is hard to pay down and the temptation to borrow is always present regardless of how much cashless net profit is flowing. Cash flows should exceed ROA to get a point. Once again, this can be carried out using fiscal year over year, or trailing 12 months versus the 12 months before that.

- Long-Term Debt to Asset Ratio. Did the leverage ratio fall? If so score one. If long-term debt rises faster than profitability, this could harm a company. Year over year data makes this easy, as well as using 12 month trailing data versus the 12 months before it.

- Increase in Liquidity. The Current Ratio is achieved taking your assets and dividing them by your liabilities. If the liquidity improved, the stock gets another point. Same year over year criteria as the above points.

- Dilution. Did the company offer more shares? If so, no point is awarded to the company. Dilution might be necessary for a small company with little cash on hand, but it devalues the share value and is a slippery slope to go down. Companies that continually dilute need to be growing at very fast rates to overcome their self-inflicted inflation. Otherwise, another notch is earned. You can use the same annual or trailing data mentioned on all the other points.

- Gross Margin. An improvement in gross margin could highlight that the company was able to increase prices, or that some other cost went down. If gross margin goes up, another point is added. Need I say it again? You can analyze year over year or 12 months over 12 months for this number.

- Asset Turnover. Did the asset turnover increase year over year? Then perhaps the efficiency of operations is increasing or sales are up. If this ratio grew, then the final point is earned. You can analyze year over year or 12 months over 12 months for this number.

Why These 9 Points Matter

Why do these criteria matter as fundamental ratios to pick stocks with? We could categorize the 9 points into 3 broad categories important to most companies.

1. Profitability

Having positive earnings metrics with the Return on Assets. Cash Flow from Operations. as well as an Increase of Return on Assets for positive annual growth are crucial for strong value stocks. Cash Flows > Return on Assets is an important aspect of earnings to value firms, since if relative cash flow drops even while overall earnings and profitability goes up, this could lead to future liquidity problems.

2. Leverage, Liquidity, and Source of Funds

Basically, long-term debt is not desirable. A decrease in the Long-term Debt to Asset Ratio. or a rise in assets if there is no debt, creates a better environment for a company to operate in. Nobody likes the creditor banging on their door. An Increase in Liquidity is an important metric when considering if a company is well positioned to pay off debt. Also, generating monies from organic growth is also preferred to simply selling more shares. Point 7, Dilution. highlights that cash generation from share-dilution is not optimum.

3. Operating Efficiency

The last two F-Score points analyze Gross Margin and Asset Turnover. An improvement in gross margin can indicate an improvement in cost, a reduction in inventory, or the ability of a company to increase its prices. Higher asset turnover may show that the company is generating the same revenue on fewer assets (they sold a bunch of equipment just lying around), or sales have risen proportionately faster than asset purchase.

Stocks able to achieve high points overall, perhaps scoring 8 or higher out of a possible 9 points, are viewed as picks worthy of buying. A very low scoring stock with a total of 3 or less out of 9 points should either be avoided, or even sold short .

Increasing Both Risk and Reward

Before you run out and buy all the stocks scanned using the 9 point F-Score system, note the associated risk factor. AAII (American Association of Individual Investors) gives the Piotroski scan a risk rating of 2.0 since 1998. This means that the monthly variability has been twice that of the S&P 500 for more than the past decade.

- The highest gain since 1998 using Piotroskis system is 43.1% and the largest loss is -42%.

- The S&P 500 had a much smaller upside with a monthly 9.7% gain and a monthly loss of -16.8%.

With a larger upside comes a larger risk factor. What are some current high F-Score stock picks?

Finding Piotroskis Stock Picks

- The Graham Investor is one site that freely provides ranking of stocks based on Piotroski F-Scores.

- One other free scan that gives you a variety of possible high F-Score picks is found here .

What sort of stocks would turn up on such a scan? Below is a sample list generated around March 1, 2011.