Jobs and stocks Investors weigh Fed s next move

Post on: 21 Июнь, 2015 No Comment

Andrew Burton, Getty Images

The takeaway from Jobs Friday: Consistency is good. A steady-as-she-goes, not-too-hot, not-too-cold job market is not such a bad thing for the stock market.

The reason: While the job market is improving, it is still not strong enough to prompt the Federal Reserve to aggressively push up its timetable for its first interest rate hike next year. Investors are pricing in a mid-year 2015 hike, or sometime in the second quarter. Still, if the job market continues to strengthen, and slack in the labor market continues to be reduced, a Fed rate hike moves ever closer. The Fed currently has rates pegged near a record low of 0%.

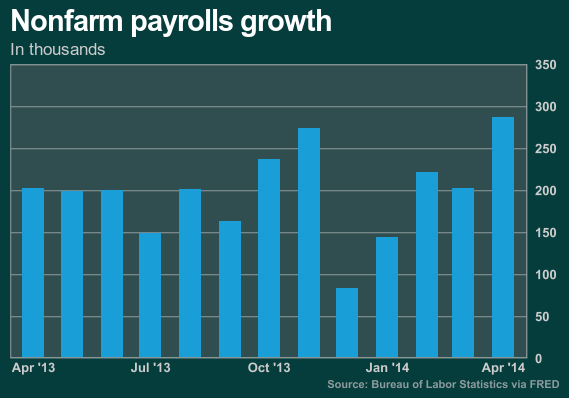

The government reported that the economy created 214,000 new jobs in October and that the unemployment rate fell to 5.8%, its lowest level since July 2008. While the number of jobs created fell short of the 230,000 Wall Street was expecting, it still continued a trend of the economy churning out more than 200,000 jobs each month.

Signs of a solid yet unspectacular job market is yet another bullish underpinning for the stock market. The Dow Jones industrial average and Standard & Poors 500-stock index closed at record highs Thursday. And the mixed jobs report this morning has stocks edging modestly lower today. Around 10:15 a.m. ET, the Dow was down 33 points, or 0.2%, to 17,521. The S&P 500 was 0.1% lower at 2020 and the Nasdaq was down 0.4% to 4620.

The takeaway: Consistency is good.

From a stock market perspective it was almost a non-event number, says Jack Rivkin, chief investment officer at Altegris Advisors. If the (job creation) number had been significantly higher, I think you would have had concerns about what the Fed was going to do. If the number had been significantly lower I think there would have been concern with what is going on with the economy.

Still, on balance, the jobs report as it relates to the timing of the Feds first rate increase was neutral to possibly moving forward the rate hike timetable,” Rivkin told USA TODAY.

But Barclays and UBS both reiterated that they see no change in their forecast that the Fed will raise rates in June 2015 and the second-quarter of 2015, respectively.

In short, the miss on the job creation number and the fact that wage inflation is absent, offsets the drop in the jobless rate to 5.8%, which is getting closer to the 5.2% to 5.5% range that the Fed views as a sign employment is healed enough to start easing off the stimulus gas pedal.

The unemployment rate fell to 5.8%, below the 5.9% analysts were expecting. Workers saw their average earnings rise just 0.1% month over month, which was below the 0.2% gain expected.

Stocks have rallied back sharply from a mid-October swoon. The rebound has been driven by a very strong corporate earnings season, with roughly 75% of S&P 500 companies topping analyst expectations, according to Thomson Reuters I/B/E/S. Stocks also got a boost Thursday when the European Central Bank hinted once again that more stimulus is on the way for the struggling eurozone economy. The drop in fear related to Ebola has also put investors in a buying mood.

The Dow headed into todays trading session at a record 17,554.47 and the S&P 500 at a new closing peak of 2031.21.