Jim Rogers’ Warning Riots Coming To America (NYSEARCA GLD NYSEARCA SLV NYSEARCA TZA NYSEARCA

Post on: 16 Март, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

“We saw it in London; we’ve seen it in several countries in Europe in the last year or two. Yes, I expect to see it here, too. If you don’t, look out your window”

When asked about Bernanke’s credibility regarding his latest FOMC public statement, in which he said the Fed will be able to contain inflation, Rogers became noticeably irritated.

“Mr. Bernanke has zero credibility as far as I’m concerned. The Federal Reserve has zero credibility,” Rogers said forcefully. “Simon, go back at everything Mr. Bernanke has said in the last seven or eight years he’s been in Washington. He’s never been right about anything. The man has zero credibility for anyone who would take the time to look at his history.”

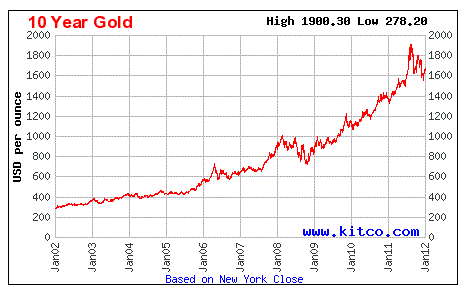

As far as further inflation down the road, Rogers stated inflation is already in the pipeline, and will manifest in higher commodities and consumer prices—of which, historically, have lagged money supply expansion by six months to one year.

As of the week ending Apr. 25, 2012. the Fed reported its balance sheet reached a total of $2.92 trillion, up from $2.71 trillion a year ago, and up from $920 billion in March 2008—well before the brunt of the financial crisis took its toll on markets later in 2008 and early 2009.

A tripling of the Fed’s balance sheet within fours years won’t be the extent of the damage to the Fed’s debt monetizing scheme and the value of the U.S. dollar, according to Rogers, who sees much more Fed money printing to come as well as consumer price inflation as a result.

“Absolutely, they’ve been printing staggering amounts of money; they’ve been taking staggering amounts of debt onto their balance sheet, much of it is garbage,” said Rogers. “The federal government is spending huge amounts of money they have. We have inflation in the U.S. and it’s going to get worse, Simon.”

Rogers said investors have it easier today than prior to the crisis. It’s a heads-you-win, tails-you-win scenario. The emergence of Asia as a source of consumption of raw materials and finished goods will exact pressure on harder-to-find natural resources. If demand is crippled by the financial crisis, however, central banks will respond by debasing their respective currencies, forcing smart money into ‘things’ as a means of protecting wealth.