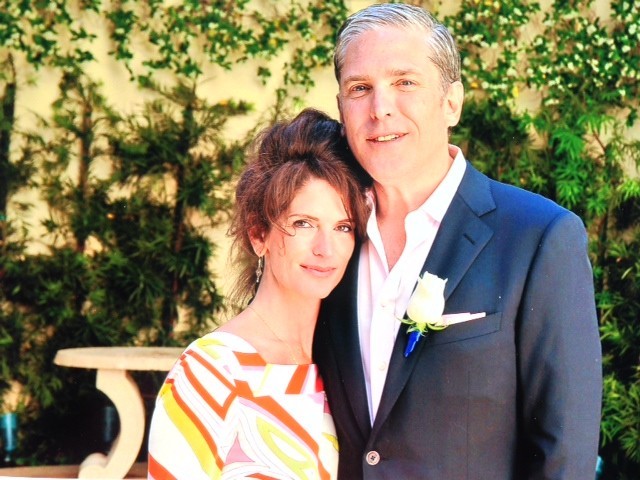

Jeffrey Arsenault

Post on: 22 Май, 2015 No Comment

“The appetite for hedge funds remains strong even after the $300 billion California Public Employees Retirement System, the largest U.S. pension fund, said in September it was pulling out of hedge funds because they are too costly and complicated,” reports Svea Herbst-Bayliss of Reuters. “Hedge funds took in roughly $112 billion in new money this year even though returns have been paltry, with the average fund returning roughly 4 percent this year through November. As hedge funds posted low single digit returns, the stock market raced to a series of fresh highs and the Standard & Poors 500 index gained 12.8 percent since January. Last year, investors added $62 billion in new money to hedge funds.”

eVestment’s 2015 Hedge Fund Industry Outlook is generally positive as well. Among the key points released include:

- Barring a large and unexpected global or financial event, hedge funds are positioned for another year of solid growth as institutional investors seek to gain alternative exposures to traditional equity and fixed income markets. We expect asset flows into hedge funds of at least between $90 billion and $110 billion in 2015.

- Multi-strategy funds appear headed for another good year in 2015, with flows that may surpass the $48 billion YTD they saw in 2014 as their diversity makes them a natural preference for long-term institutional assets coming from traditional strategies.

“The hedge fund industry is, barring the occurrence of an outlier event, well positioned for another year of solid growth. The roles of hedge funds, and the expectations of their results, have become better defined for institutional investors’ portfolios. While there will always be investors for whom certain strategies do not fit within their scope or scale, the global institutional investment landscape dwarfs any one participant,” relayed the report released by eVestment. “With long-term trends in place and the future of global markets ever uncertain, hedge funds will continue to evolve into an institutional staple, with some casualties and great successes along the way.”

“Emerging market hedge funds saw clients allocate an additional $3.5 billion in 2014 through September,” wrote Lawrence Delevingne of CNBC. According to HFR, this makes up nearly half of the $6.45 billion in inflows from 2013. All in all, $185 billion of hedge fund capital was invested in emerging market hedge funds. This is either a good thing or bad thing, depending on which emerging market your hedge fund focused on.

The returns of hedge funds focusing on emerging markets have been rather spotty, leading to disparate results in investment returns across the board. Hedge funds that focused on India for example, enjoyed a 4 percent increase in the third quarter and well into the fourth quarter. Their net of fees in 2014 through October, according to HFR, is up an average of 41.9 percent, which is quite impressive indeed.

According to Reuters. India share prices have rocketed as investors placed hope in the countrys new pro-business prime minister, Narendra Modi. Delevingne concurs, noting that: “Thanks to optimism about economic reform and growth under new Prime Minister Narendra Modi, the South Asian giant is by far the best performing hedge fund strategy in the world this year.”

India is one of the few countries with real growth that looks to accelerate, whereas the rest of the world is slowing down,” said Pratik Sharma, managing director of $150 million Atyant Capital. The Atyant Capital India Fund is up 65 percent in the first three quarters of 2014 by focusing on bullish long bets on relatively small stocks.

Hedge funds that invested in Russia, in contrast, did not fare so well, losing an average of 12 percent net of fees, according to HFR. Delevingne pointed out that such a result might not be so surprising, “given the conflict in Ukraine, a record low for the rouble and falling oil prices.” Hedge funds focused on Latin America did not perform positively either, showing a decrease of 3.5 percent on average, “hit by declining currencies, such as the Brazilian real versus the mighty U.S. dollar.”

For Marko Dimitrijević, founder of emerging markets-focused hedge fund firm Everest Capital, abstaining from playing in the emerging markets sector is not a viable choice. Buying or avoiding all emerging markets as a group doesnt work anymore… Selectivity is the key.

Fitch Ratings, a global ratings agency, reported that the outlook for seven publicly traded alternative asset managers is “stable”. Indeed, Stephen Ellis of Morningstar has noted that despite the Alternative Asset Management sector being generally misunderstood by the public due to its relative newness and the complexity of its accounting, the industry is actually quite structurally attractive and offers investors opportunities in a fairly valued market.

First, what exactly are alternative asset managers? The publicly traded ones are global institutions that leverage years of experience investing in nontraditional asset classes. They usually provide services to wealthy individuals, private and public pension funds, endowments, foundations, and other institutions. Counted among the industry’s biggest players are The Blackstone Group, Apollo Global Management, Carlyle Group, Ares Management, Fortress Investment Group, KKR & Co. and Oaktree Capital Group.

The Alternative Asset Management Industry, over the years, has shown an inclination to following a consistent business model when it comes to going public, usually structuring themselves as partnerships, with the investment managers listed as the general partners, and investors in their funds filling the role of limited partners.

Since the recent financial crisis, investors have shown an increase in awareness and interest in the products being offered by alternative asset managers. “[P]ension funds many of which have turned to riskier and higher-returning assets during the past 10-15 years in an attempt to close funding gaps – [are] leading the way,” reported Ellis.

The performance of the private equity sector has also played an important role in increasing the level of investor interest in the industry. The numbers speak for themselves, as returns for the top quartile of private equity funds have reached 26% and 29% over the past 10 and 20 years, respectively. This has amounted to a sizable increase in the AUM for the industry overall during the past 20 years. Compare those numbers with the single-digit returns for the MSCI World Index over the same period and there really isn’t any question with regards to the performance.

“Given the level of interest that still exists for alternatives, we expect continued healthy levels of growth in AUM for the industry overall going forward,” concluded Ellis.

Emerging hedge fund managers find increasing capital not an easy undertaking despite the tremendous influx of industry assets over the last few years. Most of the incoming assets reach managers with at least $5 billion in assets. Indeed, only the elite ones in the realm of hedge funds occupy a large bulk of the capital being managed. In addition, this is a stark contrast from studies that show that smaller, not-so-elite hedge fund managers (Emerging) are capable of working better than them. Because of this seemingly large discrepancy in the distribution of capital, hedge fund managers who are still building themselves from the ground up are looking for capital sources that can help them be on par with the high-asset managers.

In fact, there are a lot of them that are readily available, such as hedge fund seeding. as well as acceleration capital. While these are more popular sources of capital for these hedge fund managers, there is one that is gaining steam as of late that could be of great help for them. This one is called “risk-based managed accounts,” also known as first-loss capital or FIRLO.

The structure of the FIRLO program goes like this: the capital provider distributes towards the manager’s separately managed account through a master feeder. The manager only receives the allocation if the manager contributes to the capital that is the same as 10 to 20 percent of the total managed account, which is dependent on the capital provider. Likewise, the manager receives a performance fee that is greater than the industry standard. In case losses were incurred during the first month of the program, the manager’s capital first absorbs them. The incurred losses would then be returned once the manager obtains 100% of the future profits in the succeeding months. Profits would be shared with the fund once the manager gains those losses back.

This setup is beneficial for startup hedge fund managers for a number of reasons. First of all, payouts for the manager are greater than the normal payout within the industry. Second, the base capital used for distribution towards managers often ranges from $25 to $100 million. Third, managers obtain a cut on the profits and losses every month instead of receiving them on year’s end, thus increasing their risk of posting an audit. Lastly, managers gain ownership on their track record, with capital providers allowing them to operate portfolios that are not the same as their core funds.

Although risked-based managed accounts are becoming increasingly popular as the other capital sources, FIRLO programs are much preferred than hedge fund seeding or acceleration capital setup. This is mainly due to the various restrictions placed on managers who enter seed or acceleration deals, wherein managers are forced to give up their ownership stake to the capital provider. This is absent in FIRLO programs, wherein managers maintain the upper hand in overseeing their respective businesses and growing their assets under management without having to give up something. Considering the abovementioned benefits likewise make risk-based managed accounts a better choice for hedge fund managers.

Jeffrey D. Arsenault has over 25 years of experience in the field of hedge funds, risk and portfolio management. He is currently the principal and owner of Old Greenwich Capital Partners, an investment management company based in New York City.