Japanese Yen Currency War Conspiracy (Is It Real ) (7

Post on: 16 Март, 2015 No Comment

Everyone is praising Prime Minister Shinzo Abes economic policies that have given the Japanese economy a badly needed jumpstart. Since Shinzo Abes economic policies have taken effect last November, the Nikkei is up over 25%! But the real question is at what cost has Japan seized these economic gains?

The Japanese Yen has plunged 25% since last November.

Jim Rogers says that Mr. Abe is playing a very dangerous game. He believes that the Japanese government is not telling the public about the negative effects of the Yens plunge because Mr. Abe wants to win elections this summer. Jim Rogers warns that everything Japan imports is going to go up in price. Source: Steep Slide in Japan’s Yen is Very, Very Dangerous

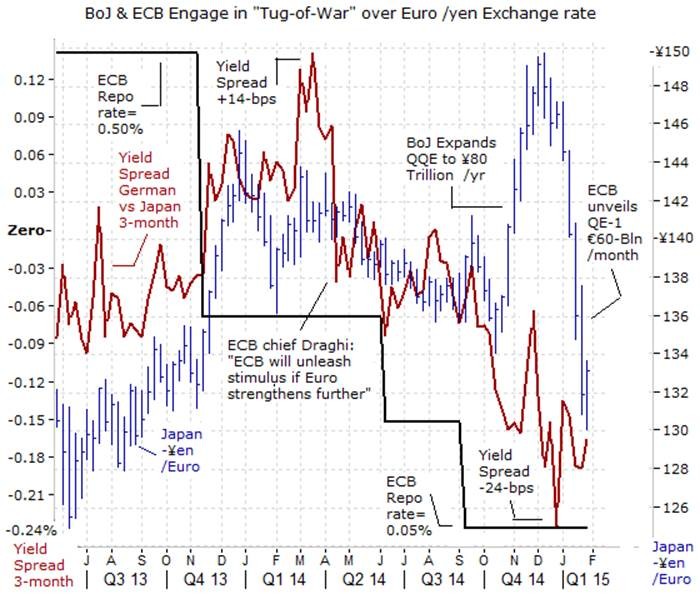

The Bank of Japan (BOJ) has started a massive quantitative easing program. Traders have taken this as a sign that Japan will continue to weaken its currency. The result is called the Japanese Yen carry-trade. The carry-trade works like this. Everyone shorts the yen and takes that money to invest in other assets around the world like the U.S. dollar or U.S. stocks. As long as the yen continues to drop, no margin call takes place. Eventually the short seller covers his yen short position with the profits from his other investments and he keeps the profits (the difference between what he has to buy the yen to cover the short and the profits made on his other investments around the world). As long as the yen goes lower or stays flat, the Yen carry-trade is profitable.

Many are calling the BOJs move to crush the Yen Big Bang QE. Just how big and how fast is the BOJ devaluing the Yen? Tokyo plans to double Japans monetary base from ¥135-trillion ($US1.4-trillion) to ¥270-trillion in two years. Gary Dorsch of Financial Sense says that the BOJs QE is 3x larger than the U.S. Federal Reserves QE. Source: Japan Green Light to Crush Yen

Many countries are complaining that Japan is starting a currency war. In reality, the U.S. and U.K. started the currency war back in 2008 in an effort to save the banking system. This was Currency War 1 that was won by the U.S. and the U.K. against the BRICS and emerging market countries. The Bank of England, the U.S. Federal Reserve, and the Bank of Japan have worked together to win Currency War 1.

Thanong Khanthong of The Nation writes that the BRICS were so angered by the falling value of the U.S. dollar as well as U.S. Treasuries that they met in South Africa and drew up plans to destroy the U.S. dollar as the worlds reserve currency. Source: Its war in the currency markets

SoberLook did an article back in April of 2013 where they noted the increase in Japanese exports. SoberLook writes, Very little has changed over the past few months in Japans product and service offerings or in the way the nations companies market their products. The yen however is down nearly 14% against the dollar this year alone. And in this price sensitive global economy 14% makes a great deal of difference. It didnt take long for Japan to be rewarded for its currency devaluation policy. Source: Japan Rewarded for Launching the Currency War

Japan is being rewarded BIG TIME for devaluing their currency. The Yen is down 20% from November of 2012 meaning that Japanese products are 20% cheaper for U.S. consumers than they were just 8 months ago. As a result, U.S. consumers have been buying a lot more Japanese products. In fact, Japan just overtook China for the #1 importer of products to the U.S.

Fabian4Liberty did a video on the on-going currency wars. Check it out and let me know what you think in the comments section below.