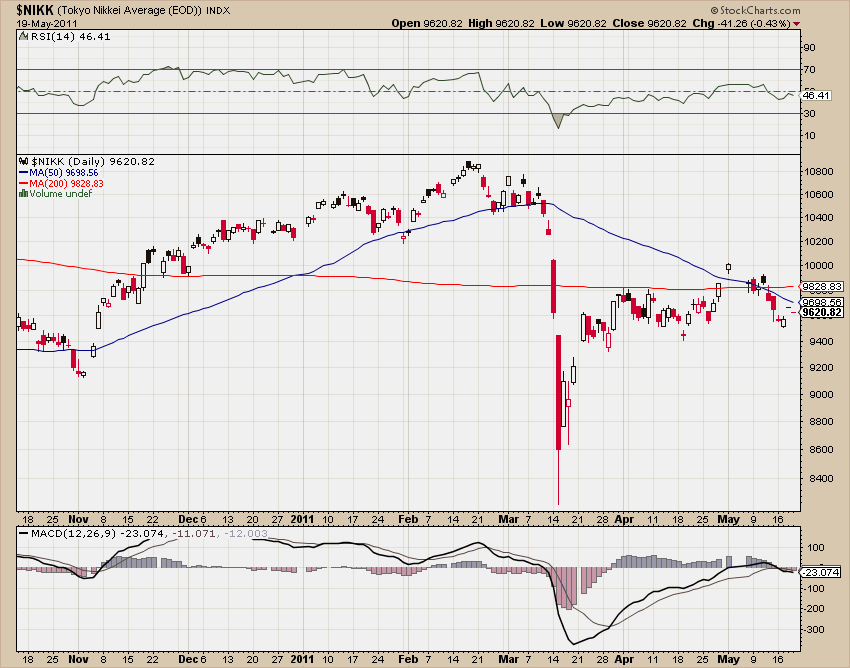

Japan s Badly Pummeled Nikkei Stock Index Roaring Back To Life

Post on: 5 Июнь, 2015 No Comment

After years of relentless selling, the benchmark stock index of long-troubled Japan is roaring back to life.

The Nikkei 225-share index shot up Thursday 1.7% to its highest in eight months. Volume soared 64% over its prior session.

Was this a reaction to the Federal Reserve’s policy statement? Maybe a little, analysts say.

But note that the region’s other major markets were mixed. South Korea’s Kospi index jumped 1.4%, and the Taiwan weighted rose 0.9%. Shanghai, Hong Kong, Mumbai and Jakarta all lost ground.

Japan’s big issue is this weekend’s national vote. Liberal Democratic Party candidate Shinzo Abe, who has already served as prime minister in 2006 and 2007, is favored to win.

Abe has been a loud critic of Prime Minister Yoshihiko Noda’s economic policies. Abe wants to see more stimulus spending, easier monetary policies and, many speculate, less independence for the central bank.

Anger is rising against Prime Minister Noda’s Democratic Party of Japan. Many are frustrated with Japan’s seemingly endless slump.

The prospect of an Abe win has sent the yen plunging.

Abe’s proposals would add to Japan’s inflation rate. To be more precise, they’d reverse years of deflation, one of the economy’s most serious problems. A low but positive inflation rate would be a bullish outcome for Japan.

The yen’s fall to 83.50 per dollar from 75.55 in late October may be a boon to Japan’s exporters, who have had to cope with a soaring currency for years.

Internet-content provider DeNA is one of Tokyo’s top-rated stocks. DeNA’s platforms offer e-commerce and social networking. The company offers more than 1,000 social games on its Mobage platform, which targets mobile devices.

DeNA broke out from a cup Nov. 30 and is still hovering just 1% past its 2,919 yen entry.

DeNA enjoys a 1.3 up-down volume ratio and a solid A- Accumulation-Distribution Rating.

Japan’s Internet-content group ranks 40th out of that market’s 165 industries, as of Thursday.

After two quarters of shrinking earnings, DeNA has logged gains of 17%, 23% and 84% in the past three reports. Estimates for the December-ending quarter foresee a 72% jump.

Revenue gains have accelerated for the past three quarters, from 16% to 32% to 37% to 45%.

Most impressive, DeNA shows a string of at least eight straight years of EPS gains. The company has done more than muddle through Japan’s tough times. It has thrived. Analysts look for a 27% improvement in earnings for fiscal 2013 ending in March and 10% for fiscal 2014.