IShares MSCI France Index Fund Is The France ETF A Good Choice (NYSEARCA EWQ)

Post on: 16 Март, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

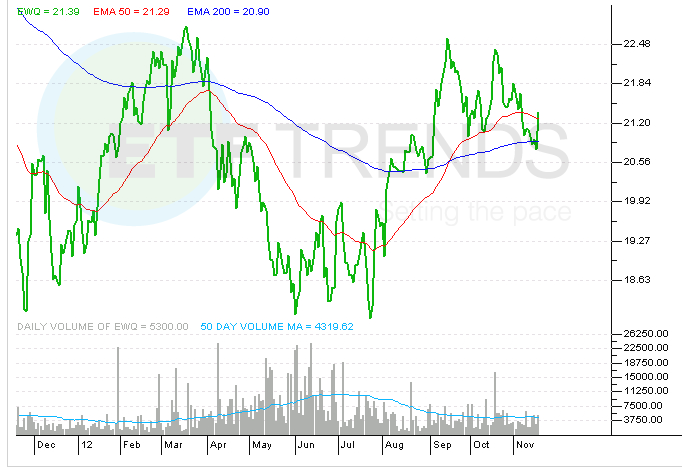

While the backdrop may not be very promising, the France CAC 40 Index (considered the country’s benchmark) has grown more than 6% in the first quarter. This is reflective of solid performance, considering the weakness in other developed European markets (Read: Three European ETFs That Have Held Their Ground ). Even iShares MSCI France Index Fund (NYSEARCA:EWQ) generated excellent returns of 12.12% in the first quarter.

However, the fund has since underperformed after the victory of the new president Francois Hollande in May, sending year-to-date returns to the negative territory. This has also been reflected in the aforementioned EWQ, which has plunged as of late and is underperforming many of its neighbors at this time.

This comes despite the relatively high level of concentration that the fund exhibits in its biggest companies. In fact, the product holds 74 securities in total and puts about 50% of the assets in the top 10 companies.

Total SA and Sanofi are the key elements in the basket with 11% and 10% share, respectively. With AUM of about $248.4 million, the product is skewed towards the industrial sector followed by financials and the consumer discretionary space. (Read: Three Industrial ETFs Outperforming XLI )

While giant and large companies hold more than 86% of the assets, mid companies take the rest of the position in the basket. The product is quite inexpensive, charging 52 bps in fees per year and trades with good volumes of about 6,000,000 shares on average on a daily basis.

The fund yields an annual dividend of 3.54%, reflecting strong commitments to enhance investors’ returns. It offers ample flexibility as investors can trade using derivative instruments and lends out one-third of the portfolio securities. This strategy often put a limit to loss and can generate additional income even in the face of economic and political insecurity. (See more ETFs in the Zacks ETF Center )

Yet while the high dividend yield and focus on large caps may be promising, investors need to keep the broad economic conditions in mind before purchasing or even considering this product. Although events are not as good as they are in Germany, France is arguably much better off than any member of the PIIGS bloc at this time.

The ruling of Hollande also poses a significant challenge to the French economy, as some are not satisfied with the president’s walk away from austerity measures and his promise to focus more on spending. The reduction in austerity packages and increase in taxes will certainly disrupt the fiscal and monetary policies laid by Merkel, the chancellor of Germany, and Sarkozy, ex-president of France.

France Outlook

After growing at an average rate of 1.7% last year, France, is expected to slow down to 0.5% this year. However, many forecast this to just be a temporary drop as the economy will, according to the IMF, rebound to a 1% growth next year. Meanwhile, inflation remains low at 2.1% as interest rates are also low at 1.0%, suggesting that the country still has policy tools at its disposal, although monetary policy decisions still originate out of Frankfurt.

Though the country is making several efforts to narrow its budget deficit from 5.2% of GDP in 2011 to 4.4% in 2012 and 3% in 2013, the thinning of this gap remains a question at present. The European Union fears that the budget deficit will be higher than expected and will put Europe in a danger zone in 2013. (Read:Spanish Bailout: Did It Help European ETFs? )

It also doesn’t help that the country has high bank exposure to a number of PIIGS economies, as well as its own uncertain economy, and heavy trade dependence on a number of weak markets including Belgium and Italy.

Given these issues, we believe France’s economic and political conditions are not very promising and show no signs of turning around in the near future (Read: Three European ETFs Beyond The Euro Zone ). While EWQ may be promising from a dividend perspective, the lack of concern over the budget deficit, as well as the weakened state of many of the country’s top partners, suggests that the product should probably be avoided at this time until more certainty is realized on the country’s economic future.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days . Click to get this free report >>

Written By Eric Dutram From Zacks Investment Research

In 1978, Len Zacks discovered the power of earnings estimates revisions to enable profitable investment decisions. Today, that discovery is still the heart of the Zacks Rank, a peerless stock rating system whose Strong Buy recommendation has an average return of 26% per year.