Is Valuation of Preferred Stock Similar to Bonds

Post on: 16 Март, 2015 No Comment

Current Yield

Bond prices trade in points, where 100 represents maturity value, or par. The current yield is the interest rate paid on the bond, also called the coupon rate. Dividing the bond price by the coupon rate yields the current yield, an approximation of the yield to maturity. Preferred stocks do not have a stated maturity, otherwise they would be considered a bond. A preferred stock’s current yield is the sum of the stated annual dividend divided by the current value of the preferred stock. Preferred stock trades in dollars. Maturity values of $25, $50, and $100 are common prices for publicly traded preferred stock.

Yield to Maturity

Missed Coupon Payment

A bond that fails to make an interest payment when due can be considered in default. Some bond agreements allow for an additional period of time, usually no more than 10 days, for the deficiency to be cured and the investor made whole. Valuation of such bonds quickly reduces the creditworthiness of a bond, and the accrued interest is added to the principal due. Preferred stock may be issued as cumulative preferred, meaning it is not a default when interest payments are not made on time. They accrue interest like a bond, and missed interest must be paid before any stock dividends can be paid.

General Pricing Considerations

References

Resources

More Like This

What Are the Advantages & Disadvantages of Issuing Preferred Stock Vs. Bonds

Preferred Stock Vs. Bonds

How to Value Stocks & Bonds

You May Also Like

A perpetual bond is a bond without a maturity date that often offers a very high fixed rate of interest. In June.

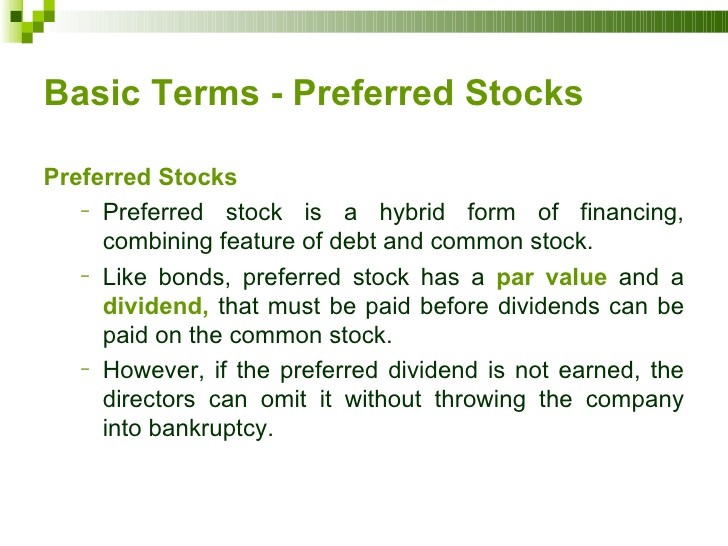

The primary distinction between preferred stock and bonds is that preferred stock is an ownership stake in a company and bonds are.

Preferred stock is a form of ownership that includes different rights and privileges compared to those included in common stock. An investor.

Preferred stocks are shares of stock that are similar to common stock in that they give investors ownership in a company. They.

Similarities Between Common Stock & Preferred Stock. Stocks are the way companies raise money. Instead of going into debt to finance new.

As ways of raising money, bonds are usually considered a better proposition than preferred stock. They have limited life, and the interest.

The ability to receive a steady income stream from an investment—particularly a relatively risk free institution like the federal government—is the bellwether.

Preferred stock is a security that has properties of both equity and debt. Preferred stock is also known as preferred shares or.

Stocks and bonds remain the most common and easily accessible forms of investing available to personal investors. There are options that exist.