Is Union Pacific Still A Good Dividend Stock

Post on: 4 Май, 2015 No Comment

Railroads arent going anywhere. Not only is it virtually impossible for a competitor to secure enough right-of-way real estate to compete with U.S. Class I railroads, but also the cost advantages for the countrys biggest railroads like Union Pacific compared to other means of freight transportation for long distances, e.g. trucks, aircraft, barges, and ships, is irrefutable. Pair this durability with consistent free cash flow and a history of consistent dividends and many railroad stocks are ideal for buy-and-hold investors looking for income.

But with Union Pacific stocks 240% run-up in the last five years and nearly 30% increase in the last 12 months, is it still a good dividend stock?

UNP data by YCharts.

The companys dividend history, free cash flow, and payout ratio suggest that not only is Union Pacifics dividend sustainable, but it is also likely to continue rising.

Dividend history

Union Pacifics dividend on its common stock goes way, way back. For 116 consecutive years, the railroad has paid dividends to shareholders. Better yet, the company has a long history of a general uptrend in dividend payments.

UNP data by YCharts.

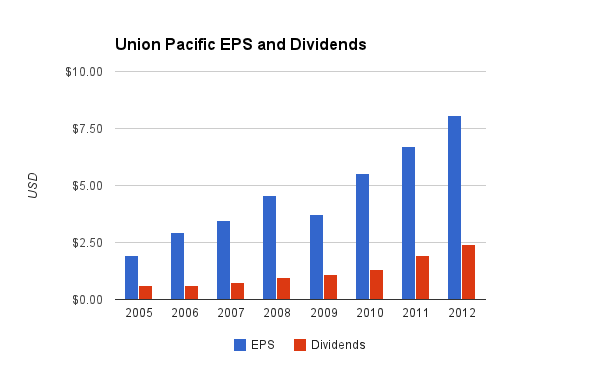

The companys more recent dividend history is particularly impressive. For the last five years in a row, Union Pacific has increased its dividend every single year. In the last three years, the average annualized increase has been an impressive 28.3%.

On Feb. 5, Union Pacific announced a 10% dividend increase to its regular quarterly dividend. The first payment of $0.55 per share will be on March 30, 2015.

Free cash flow

Dividend investors looking for an increasing and consistent dividend should look for both rising and consistent free cash flow, or operating cash flow less capital expenditures. On both of these aspects, Union Pacific is a stellar performer.

Free cash flow growth is significant. Union Pacifics free cash flow of $3 billion in the trailing 12 months is up significantly from levels below $1 billion just five years ago.

Furthermore, management has conservatively managed its operations and capital expenditures in a way that provides consistency in free cash flow. In the last 10 years, free cash flow has been positive every year and capital expenditures have been fairly predictable, ranging between $2 billion and $4.3 billion.

Payout ratio

To ensure that a companys dividend is sustainable over the long haul, investors can turn to the payout ratio. A payout ratio is simply a companys dividend divided by its earnings. The higher the payout ratio, the less likely current dividend payout levels can be sustained if the business faces headwinds.

Union Pacifics payout ratio of just 33% is excellent. This means the company is only spending 33% of its earnings, leaving plenty of breathing room to maintain the dividend even if things turn sour. Furthermore, the low payout ratio means that Union Pacific also has room for further dividend increases, even if earnings dont continue upward in the near term. Although, in light of analysts expectations for an average compound growth rate of 13.7% over the next five years for Union Pacifics EPS, the company likely wont need to increase its payout ratio meaningfully to continue increasing its dividend over the long haul.

Union Pacifics dividend clearly looks not only sustainable but also likely to continue to see increases over the long haul. While the stocks nearly 30% run in the last 12 months may mean that its dividend yield of just 1.9% isnt incredibly juicy, Union Pacifics consistent business and excellent stewardship help make up for a fairly small dividend.

Sure, Union Pacific stock may not be a bargain enough to buy today. But an analysis of the railroads dividend potential shows that income investors who already own the stock seem to have no reason to sell.

The $ 60K Social Security bonus most retirees completely overlook

If youre like most Americans, youre a few years (or more) behind on your retirement savings. But a handful of little-known Social Security secrets could ensure a boost in your retirement income of as much as $60,000. In fact, one MarketWatch reporter argues that if more Americans used them, the government would have to shell out an extra $10 billion every year! And once you learn how to take advantage of these loopholes, you could retire confidently with the peace of mind were all after. Simply click here to receive your free copy of our new report that details how you can take advantage of these strategies.

Daniel Sparks has no position in any stocks mentioned.