Is There A Pure Rice ETF On The Market Today

Post on: 18 Июнь, 2015 No Comment

Many investors are seeking the ability to add commodity exposure to their portfolios. This can be difficult for most home-based investors to achieve through traditional methods. Since the advent of exchange-traded funds, anyone with a brokerage account can now easily jump into the commodities market. When it comes to trading commodities, there isn’t an easier method than by utilizing commodity ETFs .

Why Invest in Rice?

When considering the different options of agriculture related commodities, wheat, soy beans, corn, and rice are all favorites. Why would you specifically want to add exposure to the price of rice to your portfolio? Lets look at some of the reasons below.

Hedge against inflation

Like the other grains within the agriculture sector, rice offers inflation protection. Since inflation is a measure of the CPI, or consumer price index, as the cost of goods and services rises, so does inflation. The cost of groceries is directly related to the price of the raw materials used to make them. A box of Rice Krispies will rise in price if the price of rice rises, for example. Many investors are worried about the current economic climate. They are worried that inflation is inevitable, and their gains and dividends will be eroded by the devaluation of the dollar. Adding exposure to commodities like rice that will rise with inflation will help to hedge against any future inflation.

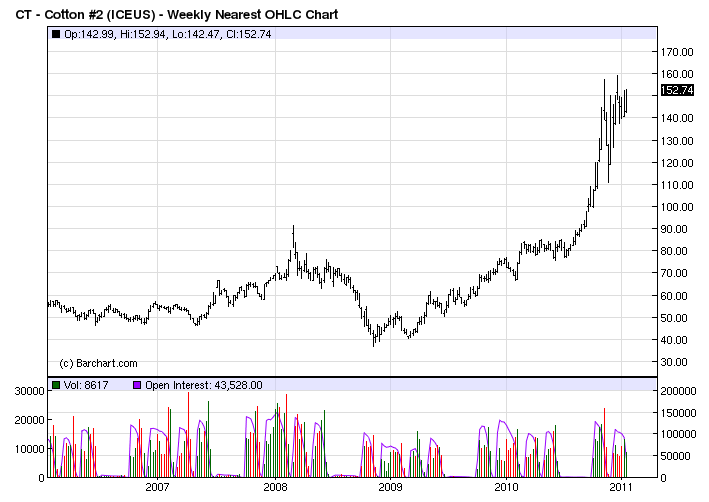

Decrease in rice farming

About a year ago, there was an article in the Wall Streat Journal that reported that many rice farmers planned on converting their land to grow more profitable soy beans and cotton. This was in response to the drop in long grain rice prices from their highs in April of 2008 through May of 2010. As reported, the effect could be as much as a 30% decrease in the rice farmland in the US. Since rice, cotton, soy beans, and corn often compete for the same farmland, this shift will increase the supply of the other commodities. When investing in agriculture related commodities, it is often advantageous to jump on laggard, which, in this case, is rice. The price of rice is already starting to trend towards the highs of 2008, but it is yet to be seen if the decrease in rice farming is the culprit of rising rice prices.

Natural disasters affect on supply

In another article published in the Wall Street Journal (October 2011), a major flood that wiped out 20% of Thailands rice production was reported. Add that cut in supply to the rice lost due to droughts in the US (totalling 10% of US production), and it is evident that natural causes can shift the price of rice upwards. These disasters are difficult to predict, and this may not be a reason to invest in rice, but more of a way that the price of rice can be affected.

Increased global demand

Because of natural disasters, reduction in rice farming, and an increasing global population that relies on rice as the number one staple food, the global demand will eventually outstrip the global supply of rice. This will eventually begin to raise the price of rice until supply increases (farmers decide to switch back to the now profitable rice crop).

How to Invest in Rice

Today, there are no pure rice ETF investing options on the market. Investing in rice isnt as easy as other commodities out there. For example, there are many gold ETF options out there to choose from. To gain exposure in rice, you need to be a little more creative. There are a few ways to do this:

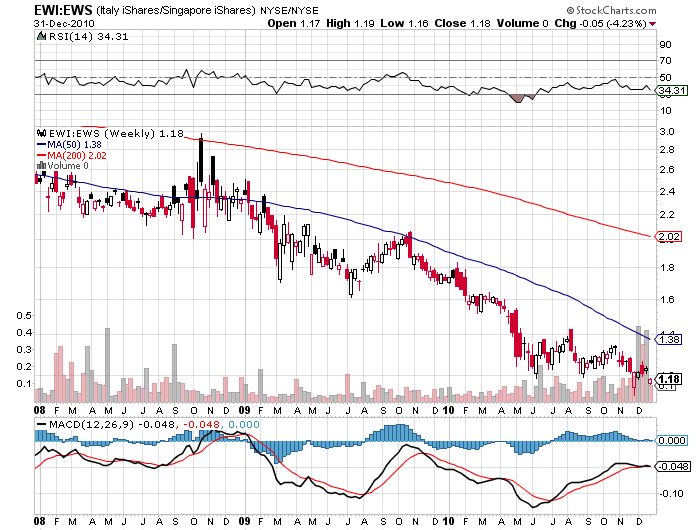

The first two methods are a more indirect ETF investing method. There are plenty of blended agriculture ETFs available, some that have holdings in rice, and some that try to track the sector as a whole without including rice. There will be a research starting point list below. Investing in countries that produce and export rice is a more creative method for gaining rice exposure. Vietnam and Thailand are the two largest exporters of rice in the world, and even though it might be a stretch to invest in an entire economy just to gain exposure in rice, both of these countries are heavily levered in rice, and probably more so than agriculture ETFs out there.

Buying rice futures directly is another method for investing in rice, but it is not as easy as utilizing an ETF. Buying futures contracts can be tricky and not remembering to roll the contract over to the next month can mean that you get a large shipment of rice at your door. For most investors, sticking with an ETF, if available, is the best way to go. Lets look at some options below.

Rice ETF List of Options

Agriculture ETF

Founded in 2007, DBA tracks the price and yield performance of the Deutsche Bank Liquid Commodity Index Optimum Yield Agriculture Excess Return. The index is a rules-based index composed of futures contracts on some of the most liquid and widely traded agricultural commodities, such as corn, wheat, soy beans and sugar. The index is intended to reflect the performance of the agricultural sector. Rice makes up less than 3% of the fund.

Also founded in 2007, JJA tracks the price and yield performance of the Dow Jones-UBS Agriculture Total Return Sub-Index. The note is designed to reflect the performance of agricultural commodities. The index is composed of seven futures contracts: soybeans, corn, wheat, cotton, soybean oil, coffee and sugar. While rice does not make up a part of the holdings, the index seeks to track the agriculture sector as a whole. JJA is also an ETN rather than an ETF, and a closer look at the credit-associated risk in needed.

Country ETF

THD, founded in 2008, tracks the price and yield performance of the MSCI Thailand Investable Market Index. THD invests 90% of its assets in the securities of the underlying index or in DRs representing securities in its underlying index. The underlying index is a free float-adjusted market capitalization index designed to measure broad-based equity market performance in Thailand. It will concentrate its investments in a particular industry or group of industries to approximately the same extent that the underlying index is concentrated.

Market Vectors Vietnam ETF (VNM)

VNM, founded in 2009, tracks the price and yield performance of the Market Vectors Vietnam Index. VNM invests 80% of its total assets in securities that comprise the index. VNM, using a passive or indexing investment approach, attempts to approximate the investment performance of the index by investing in a portfolio of securities that generally replicates the index.

In Conclusion

Adding commodity exposure to your portfolio through ETF investing is a great way to add diversity, as well as inflation protection. With the many advantages of ETF trading (intraday investing, low cost, transparency of assets), you can increase your bottom line with respects to investment results.

Rice has the ability to add inflation protection to your portfolio. While there are still no pure rice ETF options on the market today, there are ways to invest and lever towards rice, if you are creative. The above options will help you get started as you research ways to add this commodity to your portfolio.

Disclosure

I have no positions in any ETFs or ETNs mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: Please remember to do your own research prior to making any investment decisions. This article is not a recommendation to buy or sell any securities or stocks, and is the opinion of the author.