Is TaxLoss Harvesting Right for You

Post on: 17 Август, 2015 No Comment

While we’re all happy to see gains in the value of our portfolios, we’re not so happy to pay capital gains taxes on them. In this post, we’ll discuss tax-loss harvesting, which can help investors reduce their capital gains tax liability. This may be particularly important for high-earners in 2013.

First, let’s examine how much of a burden capital gains taxes can be for 2013:

- Long-term gains (on assets held for 12 months or more) will be taxed at a rate of 15% unless:

- Your adjusted gross income (AGI) doesn’t exceed $72,500 as a joint filer or $36,250 as a single filer. If it doesn’t, you won’t owe any capital gains.

- Your AGI or net investment income is above $250,000 as a joint filer or $200,000 as a single filer. If this is the case, your capital gains rate will remain 15%, but you will also owe a new 3.8% surtax (as a Medicare contribution) on the lesser of your AGI or net investment income.

- Your adjusted gross income is above $450,000 as a joint filer or $400,000 as a single filer. Earners at this level have a new capital gains rate of 20%, plus the 3.8% surtax.

If you live in California, there’s no tax break for long-term capital gains. California will tax you on your investment gains at the same rate as ordinary income, up to a rate of 13.3%, on top of your federal taxes (although you can deduct those federal taxes).

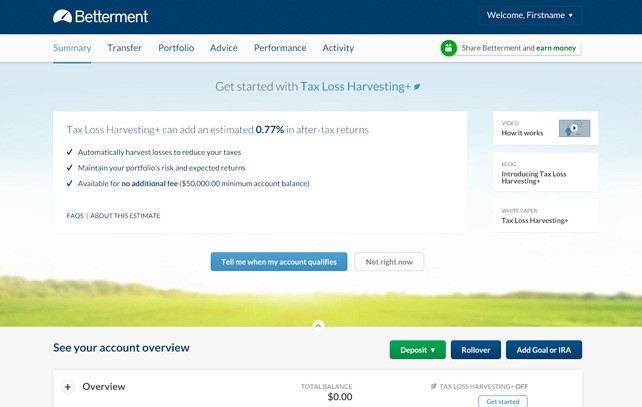

What is tax-loss harvesting?

Basically, tax-loss harvesting means selling stocks in a taxable account that have lost value and using those losses to offset gains elsewhere in your portfolio. You must have owned each stock for at least 30 days and not buy back that same stock or a stock that the IRS would deem “substantially identical” for another 30 days (this is called the “wash rule”).

This doesn’t necessarily mean that you can’t continue to have a portfolio with equivalent diversification during those 30 days. You can buy a different stock with a similar exposure. If you are particularly fond of the stock you sold, you can buy it again on the 31 st day (of course, you do run the risk of the stock having gone up in value during that month).

How do you use the tax losses you’ve harvested?

If you have long-term losses, they are first applied to offset long-term gains. If your long-term losses are greater than your long-term gains, these losses can be applied to your short-term gains. Similarly, short-term losses are first applied to offset short-term gains. If they exceed your short-term gains, they can be used against long-term gains.

Capital losses can do more than offset capital gains. They can be used to offset up to $3,000 a year of ordinary income, which includes earned income as well as dividend and interest income that’s taxed as ordinary income. If you still have capital losses left after these steps, you can carry forward your losses into future tax years (indefinitely, but with a few limitations).

Separately managed accounts

Some people think that tax-loss harvesting is something you do in the fall, right before the end of the tax year. You look at your portfolio and dump the losers. You probably can harvest losses then, but it’s likely that you passed up some good opportunities earlier in the year.

Really effective tax-loss harvesting is considerably more complicated than the simple explanation we provided above, and it’s probably best left to investment managers who specialize in it. When tax-awareness is particularly important to one of our clients, we suggest that the investor consider opening up a tax-aware separately managed account (SMA). With an SMA, a client’s holdings are kept separate from those of other clients and managed according to the specifications that the client dictates.

Although SMAs are typically offered only for very large portfolios, we have strategic relationships with two leaders in tax-loss harvesting—Advisor Partners and Aperio Group —that reduce their minimum account size for our clients. Both manage tax-aware accounts without compromising a client’s other investment goals by:

- Customizing individual portfolios to target each investor’s situation, preferences, and desired benchmark (for instance, an investor with a concentrated position in a tech stock can have the rest of the assets managed to reduce concentration risk, or an investor can have a Sharia-compliant portfolio)

- Controlling tax liability by defining and implementing an ongoing tax plan

- Mitigating portfolio risk through diversification and then monitoring the portfolio so that trades do not alter the requested market exposure

- Improving returns by minimizing turnover and management costs as well as tax liability

In addition to tax-loss harvesting, there are many other perfectly legal strategies that you can pursue to lower your overall tax liability. You might want to read a very helpful article that we found on Forbes.com: “How To Beat The Big 2013 Capital Gains Tax Hike.”

If you’d like to find out more about tax-loss harvesting, please call us at (925) 365-1533, or send an e-mail to lifeplan@accretivewealth.com .

Accretive Wealth Management is not a tax firm or a certified public accountant and cannot offer tax advice. Please consult your tax advisor. If you don’t have one, we can recommend one to you.