Is Russia Risky Two Top Investors Disagree

Post on: 19 Июнь, 2015 No Comment

Europe’s two best-performing equity fund managers over the past decade invest in Russia from offices three blocks apart in Stockholm. Their assessments of the riskiness of Russian stocks are miles apart.

Peter Elam Hakansson runs East Capital Group’s Russia Fund, with €1.9 billion ($2.7 billion) in assets. If you had invested $10,000 in the fund 10 years ago, it would have been worth $97,700 as of Mar. 15. That return, an average of 26 percent annually, makes it the best-performing European stock fund that has more than $500 million of assets, according to Morningstar. (MORN )

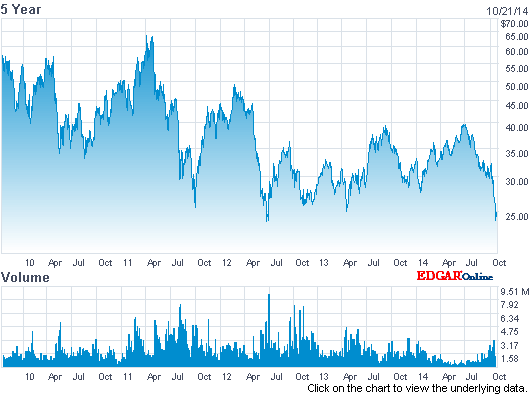

The second-best performer was Carnegie Fonder’s Russia fund, run by Fredrik Colliander. A $10,000 investment in Colliander’s fund 10 years ago would be worth $70,700—a 22 percent annualized return. The same $10,000 investment in the Standard & Poor’s 500-stock index in 2001 would now be worth $12,900. Despite such returns, investors remain wary of the Moscow market. The evidence: the market’s relatively low price-earnings ratio, a measure of how much investors value a company’s potential profit growth. The Micex Index of Russia’s 30 largest publicly traded firms has a p-e of 9.4, while Brazil’s Bovespa Index has a p-e of 11.6. The main exchanges in China and India as well as the U.S. and the U.K. have price-earnings ratios of 14 to 16.3, according to data compiled by Bloomberg.

Hakansson of East Capital says that perception is wrong: The country is no more risky than other emerging markets. As investors come to agree with his view, he says, they will be willing to pay higher prices for Russian stocks, helping Russia outperform Brazil and other emerging markets by at least 25 percent. There’s definitely risk when you invest in emerging markets, including Russia, but I don’t see a reason for having a lower p-e than Brazil, says Hakansson, 48, sipping tea in his 14th-floor office overlooking snow-covered central Stockholm. The amazing thing is, people are not perceiving this.

Carnegie Fonder’s Colliander says corruption and corporate governance issues make the Russian economy inherently more volatile than emerging economies such as Brazil. Colliander says Russian stocks ought to trade at a 15 percent discount to those in rival economies, still an improvement from current levels. The present government has its own interests, messing with the economy in so-called strategic sectors, such as oil and gas, says Colliander, 47, who has managed Carnegie’s $884 million Russian fund since 2000. It’s Russia risk.

Differences aside, both managers expect Gazprom and Lukoil to benefit from higher oil and gas prices and are buying stock in such banks as Sberbank. Gazprom, which accounts for about one-sixth of the Micex Index, has a p-e ratio of 5.1, less than half European rival Royal Dutch Shell’s (RDSA ) p-e of 10.4. Investors have little confidence in the company’s management, Colliander says, because officials at Russia’s Energy Ministry use the company for their own purposes. Gazprom sold a 9.4 percent stake in Novatek, Russia’s second-largest gas producer, for $1 billion less than its market price last month. Why in hell would you do that? Colliander says. Even so, he thinks governance problems are priced into the stock and says high oil prices boosted by political tensions in North Africa should help it rise over the next six months.

Hakansson, who has run his fund since 1998, says the biggest threat to Russian growth today is from a potential global economic slowdown—as opposed to the late 1990s, when the country’s economic problems were internal. Colliander, unlike his crosstown rival, is still wary of Russia’s propensity to cause its own problems. We always get reminded of this special Russian issue, he says. Something happens every two or three years. It’s difficult to say what it’s going to be next time, but something’s going to happen. It always does.

The bottom line: Assessing risk in Russia depends largely on views of how disruptive corruption can be to the economy.

Crowley is a reporter for Bloomberg News in London.