Is It Time For High Yield Or High Quality Bond ETFs

Post on: 22 Июнь, 2015 No Comment

Stay Connected

Income investors have seen their portfolios come under fire for really the first time in several years as interest-sensitive investments were walloped in the second quarter. There was virtually nowhere to hide in the fixed-income markets as both high quality and high yield bonds sold off. This has generated a great deal of hype about the monthly outflows from bond ETFs and mutual funds as investors have stampeded for the exits. However, I believe that the selling in bonds has been overdone and that July may be a turning point for this asset class. The key will be positioning your portfolio to profit from this opportunity and using higher interest rates to your advantage.

High Quality

Investors that felt they were in highly diversified investment grade bond ETFs such as the PIMCO Total Return Fund (NYSEARCA:BOND ) or the Vanguard Total Bond Market ETF (NYSEARCA:BND ) got a rude awakening when the 10-Year Treasury Note yield rose from a low of 1.65% to a high of 2.6% in less than two months. BND fell nearly 5% from high to low over that same time frame.

201_BND.png /%

If you have been shortening the average duration of your fixed-income exposure to the Vanguard Short-Term Bond ETF (NYSEARCA:BSV ), then you have likely been more insulated from this sell-off. However, with interest rates sitting at highs that we haven’t seen in two years, this may be an opportunity to start looking at getting back into bond ETFs with longer duration.

If you have continued to hold your traditional fixed-income positions through this dip, then I would recommend that you wait to make additional changes at this juncture. I don’t believe that the road for interest rates is straight up from here, especially if we see additional weakness in stocks throughout the remainder of the summer. A back filling in interest rates will likely serve as a much better spot to make changes to your core bond holdings.

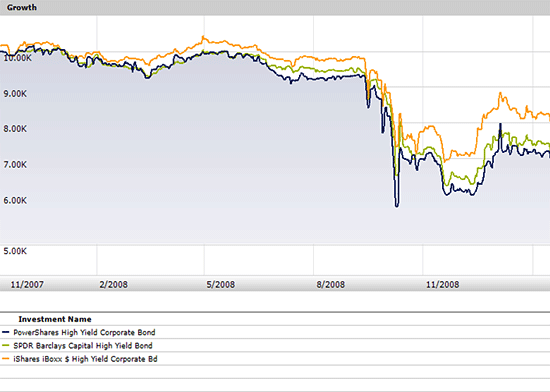

High yield bonds have also come under pressure in the last two months as soaring interest rates and widening credit spreads have hit the iShares High Yield Corporate Bond ETF (NYSEARCA:HYG ) and the SPDR Barclays High Yield Bond ETF (NYSEARCA:JNK ). In fact, according to Index Universe. JNK is in the top 10 ETFs for investor redemptions so far this year.

202_JNK.png /%

High yield bonds have certainly fallen to more attractive levels, however I am still cautious on this sector because of its tendency to move in the same direction as stock prices. If we see another rollover in stocks, I would not be surprised if high yield bonds followed suit as investors flocked to Treasury, mortgage, and other investment-grade debt.

Any bounce in high yield bonds could be viewed as an opportunity to shorten your duration to an ETF such as the PIMCO 0-5 Year High Yield Bond Fund (NYSEARCA:HYS ) or the SPDR Barclays Short Term High Yield ETF (NYSEARCA:SJNK ). This would still allow you to participate in this sector with a slightly lower yield and smaller price fluctuations.

No matter how you adjust your fixed-income portfolio in the coming week or months, it just doesn’t make sense to dump everything right here. I would recommend making small adjustments that will have a measurable impact on your performance or reduce volatility. Moving a large portion of your portfolio all to cash right here might be a short-term psychological stress reliever but ultimately it won’t help you achieve your goals for income and capital appreciation.

Read more from David Fabian, Managing Partner at Fabian Capital Management: