Is It Possible To See Another 1929 Wall Street Crash

Post on: 26 Сентябрь, 2015 No Comment

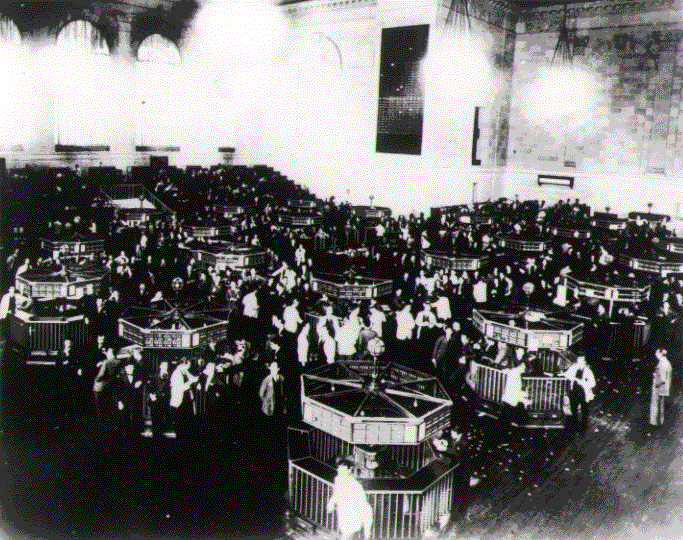

20repeats%20itself/1929_panic_on_wall_street.jpg /%

The 1929 Wall Street Crash Ushered In An Era Known As The Great Depression

History has taught us that the Great Depression, the largest financial crisis in modern history, was the result of the 1929 Wall Street crash, often referred to as the Great Crash. This market crash came on the heels of a massive speculative boom in the financial markets, and a decade of prosperity known as the Roaring Twenties.

Many have theorized that the severity of the crash was due to the intensity of the preceding boom, fueled by the excessive use of margin – the process of borrowing money at a low rate from a broker to purchase stock, and then using the stock as collateral for the loan, with the expectation that a rise in stock prices will result in gains for the investor.

While purchasing stocks on margin can increase profits from investments dramatically, it can also exacerbate losses. While the market was rising, this extravagant speculation was creating inflated wealth and prosperity that ultimately had its foundations in borrowed money.

Was The 1929 Wall Street Crash Preventable?

After reaching its peek of 381.7 on September 3, 1929, the Dow Jones Industrial Average began a period of historic market volatility that began with Black Thursday on October 24, 1929, and continued through October 29 th – Black Tuesday.

After these periods of panic selling, interspersed with brief periods of recovery, the Dow Jones Industrial Average fell an astounding 89%, and not returning to pre-1929 levels until late 1954. During this time, the Western industrialized nations fell into a depression that saw the massive loss of savings, and rampant unemployment.

Perhaps the most frightening aspect to this collapse of the financial system is the apparent failure of the worlds financial experts to predict the 1929 Wall Street Crash. and take steps to prevent it. While a handful of economists and financial experts predicted the crash in advance, their warnings went largely unheeded.

The New York Stock Exchange and other exchanges have instituted safety measures to prevent crashes of such magnitude in the future. Ultimately, what is needed to ensure that the suffering from loss of savings and massive unemployment is a change in the attitudes as well as the actions of financial and business professionals.

Can We See Another 1929 Wall Street Crash?

Was the 1929 Wall Street Crash inevitable in its magnitude, and can it happen again in the future? One of the most pivotal developments in recent economic history was the failure of the market economy to “right itself” in the aftermath of the crash.

Only by learning from the mistakes made by the professionals that failed to see the development of the bubble in the market, the causes for it, or to predict the bust and subsequent Great Depression can we prevent repeating such a disaster.

One of the significant issues concerning the 1929 Wall Street Crash was the inability of technology at the time to keep up with the events of the day, and communicate effectively with investors. On Black Monday, investors were unable to get information due to the overwhelming volume of trading on that day causing panic to prevail.

In addition to the safety measures implemented following the 1929 Wall Street Crash, such as temporarily suspending trading on the NYSE following significant drops in the Dow Jones Industrial Average, the considerable advances in communication technology keep investors fully informed, and trading current.

This ensures that there is no “run on banks” or panics in developed countries, and virtually eliminates the threat of a collapse in global markets as was seen in 1929.