Is Apple Inc (NASDAQ AAPL) A Growth Stock A Value Stock Or Neither

Post on: 9 Июль, 2015 No Comment

Apple Inc (NASDAQ: AAPL ) is one of the most popular and controversial stocks in the market.

In the past, Apples growth rate was staggering, with products like the iPod. iPhone and iPad taking the world by storm. However, Apples impressive earnings have also made the stock a very appealing value at times.

After a well-received earnings beat this week, Apples stock is now trading at new all-time highs. At this point in time and at these price levels, is Apple still a growth stock, is it now a value stock or is it neither?

Its a tough job to find peers for comparison to the largest company in the world, but here are four large American technology stocks to look at for comparison when analyzing Apple: Verizon Communications Inc. (NYSE: VZ ), Facebook Inc (NASDAQ: FB ), Google Inc (NASDAQ: GOOG ) (NASDAQ: GOOGL ) and Amazon.com, Inc. (NASDAQ: AMZN ).

Growth

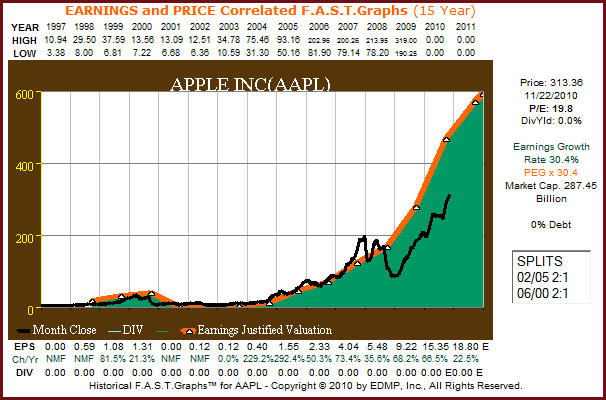

Theres no question that Apples revenue growth has slowed over time. Just look at this chart:

Even though Apple is no longer growing 40 percent annually, how does its 11.5 percent projected growth rate over the next five years stack up against its peers?

Google, Amazon and Facebook all outshine Apple when it comes to projected growth. but Apples 11.5 percent rate handily beats Verizons 6.5 percent clip.

While Apples growth no longer blows its competition out of the water, 11.5 percent is not too far off the 13.5 percent average earnings growth rate of the S&P 500 as a whole.

For a company with a $610 billion market cap, thats pretty impressive, but it would be hard to argue that Apple is a pure growth investment anymore.

Value

Maybe Apples growth rate is nothing to get worked up about, but what about its stocks current valuation compared to its peers? Take a look at this P/E ratio comparison of the five companies:

Not surprisingly, the companies with the highest growth rates are the ones with the highest valuations.

Amazon and Facebook have absurdly high P/E ratios of more than 800 and 80, respectively. Googles P/E ratio of 27.6 is still much higher than the S&P 500 average of about 18.9. Apples 16.6 P/E comes in slightly lower than average, and convincingly lower than all of these peers other than Verizon.

Despite Apples relatively good valuation when compared to these other large tech companies, a 16.6 P/E ratio is still not much to get excited about, and these numbers are again not convincing that Apple is a pure value investment at this time.

Neither?

While Apple may not be the fastest grower or the best value, there are certainly elements of both value and growth to the company. One metric that is appropriate for looking at Apples combination of growth and value is PEG ratio. Heres a comparison of the PEG ratios of these five companies:

Clearly, the combination of value and growth is one place Apple continues to shine among its peers, setting the standard for this group of five companies at 1.4. It would be tough to argue that any of these other five companies have the combination of value and growth that Apple does. However, when compared to the S&P 500s average PEG ratio of 1.4, Apple is simply average at the moment.

In conclusion, it would be as unfair to say that Apple is neither a growth stock nor a value stock at this time as it would be to say that it is both.

It feels strange to call the largest company in the world, the company that revolutionized communication worldwide, average in any way. When it comes down to the growth and value numbers of its stock, however, the numbers dont lie.

Disclosure: Wayne Duggan holds shares of Apple and holds a short position in Amazon at this time.

2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.