Is 100% Stocks OK for a Retirement Portfolio

Post on: 25 Июль, 2015 No Comment

A reader writes in, asking:

Both my wife and I expect to retire within 5-10 years. Weve never owned any bonds. Our portfolio has been all stocks right from the start: first investing in specific stocks, then mutual funds, and most recently a portfolio of index funds. Ive read over and over that retirees should take less risk in their portfolios. But I just cant bring myself to buy any bonds.

Weve always been able to handle the risk of stocks in the past. 2008 was scary, but we didnt sell low. If we can handle the risk of stocks, shouldnt we use them because of their higher returns? Is it crazy not to own any bonds even in retirement?

As weve discussed in the past, your asset allocation should be determined by your risk tolerance. And your risk tolerance, in turn, is determined by two factors:

- How emotionally/psychologically comfortable you are with volatility, and

- How much risk you can actually afford to take with your money.

Emotional Risk Tolerance

If youve had a 100%-stock portfolio through your entire investing career and havent ever bailed out of the market during downturns, then you have very good evidence that your emotional risk tolerance is high far higher than most peoples.

That said, Ive heard from many retirees who found that their emotional tolerance for volatility fell through the floor on the day they retired. They found that a portfolio decline feels quite different once the portfolio (as opposed to work income) is whats paying the bills.

Economic Risk Tolerance

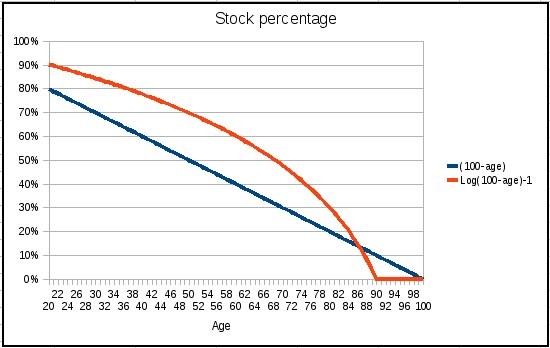

When it comes to assessing your economic risk tolerance, I think a good test is to calculate what percentage of your portfolio you have to liquidate each year to pay for expenses.

For example, if your Social Security (and pension, if applicable) cover your most important expenses, then you can get by without spending anything from your portfolio, which would mean you have a very high economic risk tolerance. That is, you could afford to take on as much (or as little) risk as you want with your portfolio without having to worry about financial ruin.

And a similar thing can be said for withdrawal rates that, while greater than zero, are still very low. For example, if your annual expenses (after subtracting pension and Social Security income ) are equal to just 1-2% of your portfolio balance, you can probably get away with a super aggressive portfolio, a super conservative portfolio, or anywhere in between.

But when we start to get to withdrawal rates of 3%, 4%, or 5%, the economic risk of a 100% stock portfolio starts to show up. Historically speaking, for withdrawal rates in that range, 100% stocks has a higher probability of portfolio depletion than a middle-of-the-road portfolio.

Of course, with interest rates as low as they are right now, the bond portion of most retirement portfolios is likely to contribute a lesser amount of return than it has in the past. Still, its worth noting that for a normal length retirement using a 3-4% starting withdrawal rate, the biggest risk is not a period of low returns (such as those youre likely to get from bonds right now), but rather a big loss early in retirement (which is the kind of thing thats more likely to happen with a very stock-heavy portfolio).

If that last statement is confusing, consider an investor using a 3.33% initial withdrawal rate thats adjusted upward each year in keeping with inflation. If the investors portfolio just matches inflation each year (i.e. earns a 0% real return), his/her money will last for 30 years, which is slightly longer than the typical retirement.

In other words, for modest withdrawal rates, you dont need super high returns. For the most part, you just need to avoid the scenarios in which regular spending coupled with a severe market decline causes a portfolio drawdown early in retirement from which you cannot recover.

In short, under certain (uncommon) circumstances, a 100%-stock portfolio could make sense in retirement, but its important to understand that:

- Emotional risk tolerance often declines sharply upon retirement, and

- If youre using a withdrawal rate in the 3-5% range, going all-in on stocks probably makes it more likely that youll run out of money, even if your emotional risk tolerance is absolutely ironclad.