IRA Hedge Funds

Post on: 9 Апрель, 2015 No Comment

Psst! Hey, Fool! Want to invest in a hedge fund. Maybe you meet the net worth limit, but don’t have the cash handy?

How about buying a piece of that strip mall that’s going up down the block? Maybe some precious metals? Or perhaps you’d rather make like Fortress Investment Group ( NYSE: FIG ) and BlackRock ( NYSE: BLK ). with a little private equity action? Who needs Goldman Sachs ( NYSE: GS ) when you can do it yourself, right?

Sound crazy? How much have you got in your IRA?

That’s right, your IRA. Several companies now offer alternative-investment IRAs that can invest in a huge range of assets, and they’re attracting more investor interest than ever. If you have a sizeable IRA balance (more than $50,000 or so) and you’re thinking of moving beyond stocks and bonds — or you’re just curious — read on.

So what are these things?

As you probably know, an investor with an ordinary self-directed IRA can invest in nearly anything that the IRA’s custodian — the company that makes the IRA available to you, and holds the assets on your behalf — offers for sale. Since most IRA custodians are brokerages or mutual fund companies, most of us have stocks, bonds, and mutual funds in our IRAs.

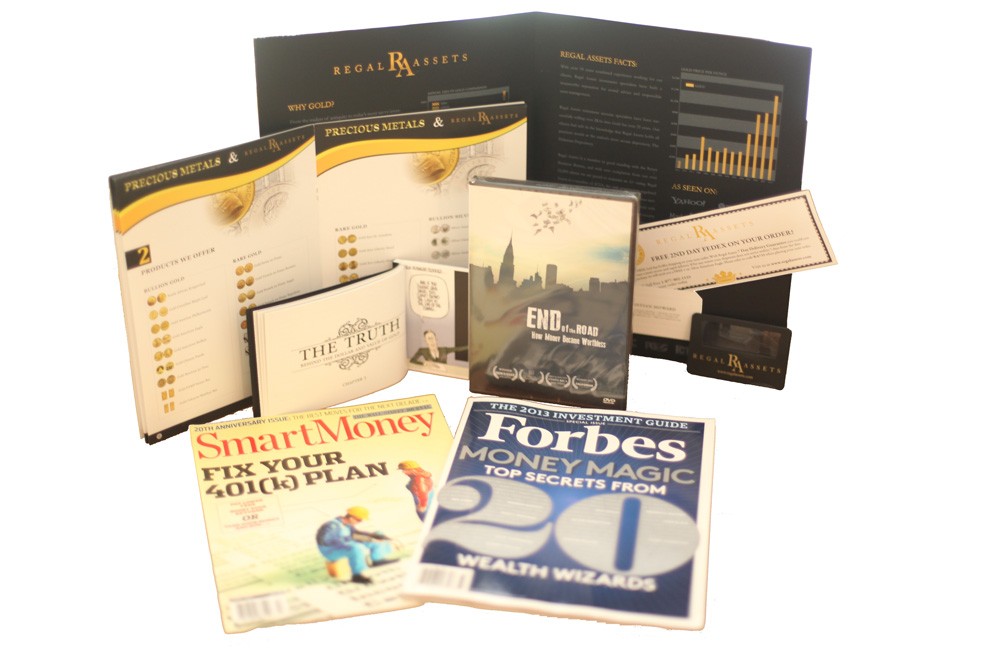

There are, however, a growing number of firms offering custodial services for a wide range of alternative investments — and when I say wide range, I mean really huge. Want to buy commercial real estate? Privately traded stock? Precious metals? Foreclosure properties? Limited partnerships or hedge funds? Firms like EntrustGroup and Guidant Financial offer structures and products that they claim allow investors to hold assets like these in an IRA easily and affordably — without compromising the IRA’s tax-deferred status.

The secret here isn’t the IRAs themselves. They’re just like any other IRAs, and they come in the standard flavors — traditional, Roth, rollover, etc. — with the standard rules. These products’ uniqueness comes from the legal research their custodial firms have done, enabling them to offer standardized products that operate within IRS rules and exemptions while allowing investors to hold nontraditional assets.

The limits

Like anything involving the IRS, there are limits on what you can buy while preserving the IRA’s tax status. Transactions that provide immediate financial gain to the IRA holder are out — that’s called self-dealing , and it makes the IRS grumpy, since it believes that your IRA is supposed to provide you with a financial benefit after you retire, not before. (You can’t sell your house to your IRA, for instance, and you can’t live in or lease a property owned by your IRA.) The rules also prohibit investments in most tangible personal property, such as antiques, rugs, stamps, or other collectibles.

Still, that leaves a lot of attractive choices. Ready to dive in? Well, hang on, Fool. There are pitfalls aplenty out there. Here are a few things to keep in mind as you investigate further:

- Invest where you have an advantage. Choose one of these products only when you have a reasonable chance of generating market-beating returns — not just for diversification, which you can easily get elsewhere. For instance, if you have years of experience buying and managing commercial real estate, then setting up a special IRA to invest a portion of your retirement portfolio directly in real estate might make sense.

The upshot

Given the high commitment needed (and the potential for high fees), most Fools are probably better off diversifying via more mainstream products. If you’re looking to add real estate exposure to your retirement portfolio, consider an ETF that focuses on real estate investment trusts. such as the Vanguard REIT ETF (AMEX: VNQ ) or iShares Cohen & Steers (AMEX: ICF ). You can find ETFs and mutual funds that give you exposure to commodities and specialized debt as well.

Finally, if you clicked on this article because you’re drawn to the outsized returns of some hedge funds, why not let the Fool help you take another look at mutual funds. The very best mutual funds have most hedge funds beat hands-down, with much lower fees and liquidity that no hedge fund can match. Shannon Zimmerman and his team at Motley Fool Champion Funds can help you find them. You can get full access to their fund recommendations and results free for 30 days, with no obligation.

Fool contributor John Rosevear does not own any of the stocks mentioned in this article. The Motley Fool has a disclosure policy .