Investors look to ETFs as fund managers disappoint

Post on: 6 Апрель, 2015 No Comment

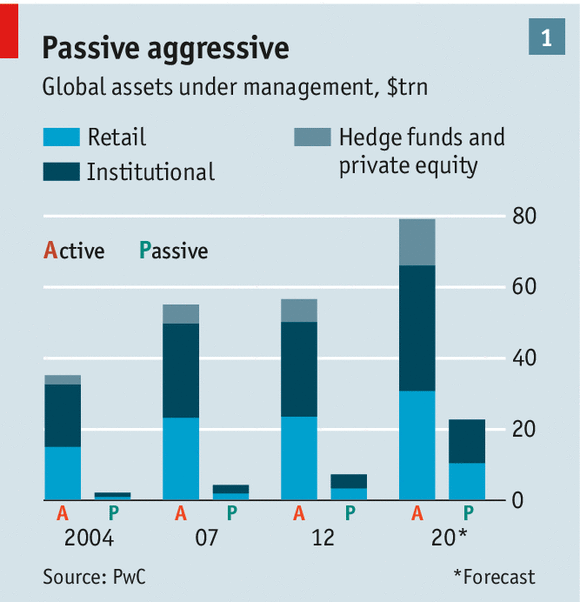

Assets under management in the passive index trackers or exchange traded product (ETP) market in Europe have doubled in size in the last five years, as investors tire of high fees and unpredictable returns.

Getty Images

As fears from Ebola and a global slowdown spread, stocks plunged on October 15, with the Dow falling more than 400 points during the afternoon before recovering slightly.

While the ETP market is still just a fraction of the size of the active asset management industry in Europe, it has ballooned to almost 362 billion euros ($450 billion) as of the end of September this year, according to a new report from fund data provider Morningstar.

This still pales in comparison to the 7.7 trillion euro market that is the active investment fund industry according to the European Fund and Asset Management Association (EFAMA).

But Morningstar expects the ETP industry to continue to burgeon as there has been a noted shift in how investors now perceive passive investing.

Indeed, the basic dual message that active fund managers are highly unlikely to consistently meet their targets and high management fees dramatically erode long-term returns, is increasingly gaining recognition amongst the wider investor community. This should facilitate the take-up of low-cost passive investment propositions such as ETPs, the report found.

Equity ETPs still dominate, making up 68 percent of Europe’s total ETP assets under management.

The dominance of equity market exposure is not surprising. The early development of the ETP market in Europe coincided with the latter stage of the equity market bull-run before the global crisis hit, report authors led by director of European passive strategies research at Morningstar, Hortense Bioy said.

But this dominance in the equity space has also often been blamed for volatility in stock markets. During the bout of intense selling in October, investors redeemed $13.7 billion in equity ETFs, with $10.6 billion of that from U.S. stock funds according to Nicholas Colas, chief market strategist at ConvergEx Group citing xtf.com data.

Whenever we see a bout of global capital markets volatility, we always head to the same place for some answers: U.S. listed exchange traded funds, he said.

Not only are the assets under management substantial, at $1,845 billion, but with over 1,600 products on offer you can readily see where investor attention is shifting. ETFs are the mood ring of capital markets, he added.

A new study published by the world’s largest ETF provider in the world, BlackRock’s iShares, said the industry is currently witnessing a coming of age as management fees are consistently being driven lower by competition between providers and growth in the size of the funds.

The number of ETPs which have assets under management of $1 billion or more has grown year on year, from 10 such ETPs in 2001, to 382 ETPs by September 2014, according to iShares.

Future contracts, commonly used derivative products that mean a buyer must purchase an asset at a predetermined future date and price, have faced headwinds in the last year such as a rise in price, which offers new scope for ETFs to act as financial instruments rather than just an investing tool, iShares added.

Follow us on Twitter: @CNBCWorld