Investor fatigue fatal to wealth

Post on: 20 Июнь, 2015 No Comment

Popular Stories

Real Estate For Sale

Fatigue and driving dont mix well, particularly on long trips. The same can be said about investment fatigue and long-term wealth creation.

For many investors, they may sense uneasiness in investing in stocks at present or find themselves fatigued by their experience in the sharemarket, which is understandable with the global financial crisis and recent natural disasters around the world.

Just like driving fatigued can be fatal to your life, investor fatigue can be fatal to your future wealth. When fatigue sets in, it is easy to lose focus and with this blurred vision questionable behaviour can be just around the corner.

So if you find yourself with the onset of investor fatigue dont make any rash decisions. Stop and ask yourself, why did I originally invest in the first place, and have my personal objectives and long term goals changed in any way?

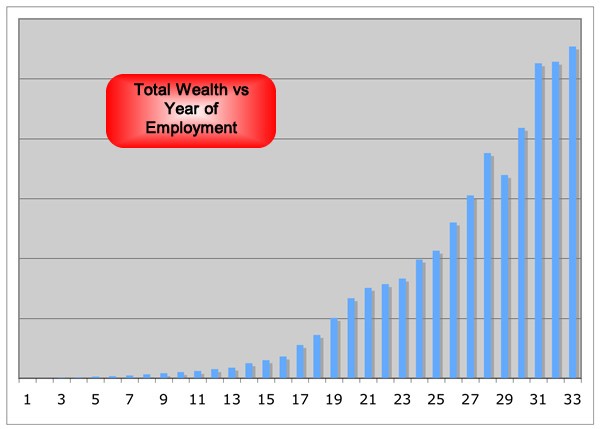

Recent studies on the flow of monies into managed investments over the past 50 years highlight the effects of investor fatigue and for that matter investor excitement.

When markets are rising and optimism is high the flow of money increases dramatically. In comparison the opposite is also true, when markets are down many retail investors start pulling their money out generally near the historical bottom of the downturn. When does that money start to go back into the market? Generally after markets have rebounded back to pre-downturn levels.

The stockmarket crash of over 40% in late 1987 gives a good example of how investor fatigue can set in. Looking at the Australian market return from October 1987 to January 1993 the market went backwards in total 2.32% (dividends reinvested). That is no real return for over five years. During the following seven calendar years Australian shares produced returns of 40.45%, -8.81%, 20.73%, 14.34%, 11.41%, 8.47% and 20.92 respectively.

Clearly it is easy to get fatigued while markets go backwards over five years however the disciplined investor who held their course were rewarded for continuing the journey.

How long we have to wait in the current environment is unknown.

What we do know is those who sold out when the Australian market hit 3300 points have missed a significant rebound to date. (Returns are based on a combination of simulated and actual returns of the S&P 500 accumulation index. Past performance is not indicative of future performance.)

Stephen Lowry CFP, DFP, is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No. 222107. While this information is of a general nature, readers should seek their own individual advice. Contact Alman Partners at office@alman.com.au