Investor Education Growth Stocks

Post on: 12 Июнь, 2015 No Comment

Investing 101

Background Information

Growth v. Value Stocks

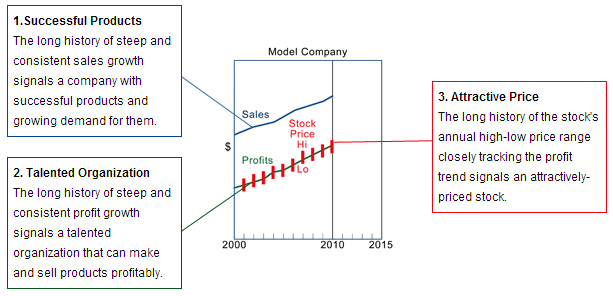

As an investor, you want to buy low and sell high. But you can also buy high and sell even higher to make a profitable investment. How is this possible? The usual buy low, sell high takes place with value stocks, but a type of stock called growth stocks enables you to buy stocks at an expensive price and sell at an even higher price. Now, the real question is how you can determine if a stock is cheap or expensive. Its value is not how much its selling for?that is its share price?but rather its price-to-earnings ratio (P/E) in relationship to the benchmarks for the U.S. stock market (such as the Standard and Poors 500 Index, known simply as the SP 500). For example, if the P/E for the SP 500 is 25, a 150 P/E for a particular company is considered expensive.

P/E is the price-to-earnings ratio. The P/E is found by taking the share price of a company and dividing it by the companys earnings per share (EPS). If the P/E is used correctly, it is a good indicator of whether you are paying too low or too high a price for a given stock.

Value stocks usually grow slower than the SP and are considered cheap. A stock can be considered cheap if its P/E is lower than in previous years or that of the SP. A low P/E may also indicate that a company has problems or is experiencing a slow down in earnings growth. Furthermore, a stock may remain at a given P/E for a long time. In general, if you buy the stock of a company that is in sound financial shape based on a reasonable explanation for its cheap share price, the stock will eventually resume growth. Value investors are bargain hunters and use the strategy of buy low, sell high.

Growth stocks tend to grow faster than the SP and have a higher P/E than that of the SP. Unlike value investors, growth investors look for stocks with high growth potential. They often buy stocks with high P/E ratios or even negative earnings. The most profitable situation would be if a generally fast-growing company has a dip on account of a temporary setback. It is then possible to buy the stock at the low price and make a profit when the company resumes its usual, fast growth.

Growth and value stocks are two types of stocks from which you can make a respectable profit. Value stocks will be selling at a lower P/E than usual and can sometimes stay at lower prices for a long time. Investors may have to wait patiently for the stock market to realize the intrinsic value of the company. Growth stocks can sell at very high P/Es but still have plenty of room for growth.