Investment Vehicles Individual Stocks Bonds Mutual Funds or ETFs

Post on: 24 Август, 2015 No Comment

Investment Vehicles: What is the Optimal Mix?

Individual stocks and bonds, mutual funds, and ETFs are popular investment vehicles. But what is the best or optimal mix of investment vehicles for your portfolio?

Each investment vehicle has advantages and disadvantages that need to be considered. Investors should contemplate the goals of each investment asset before deciding which vehicle best meets the objectives of the portfolio.

Individual Stocks and Bonds

Investing in individual stocks and bonds gives the investor the most flexibility. Investors can easily target specific investments that fit their particular investment style. It also makes it possible to own the the best stocks, which are companies with sustainable competitive advantages.

Investing in individual stocks and bonds allows investors to avoid high management expense ratios that are associated with many mutual funds and ETFs. Avoiding fees and taking advantage of low commission rates are two benefits that boost returns.

The disadvantage of individual investments is you must have the time and knowledge to form a properly diversified portfolio. A portfolio manager needs to diversify a portfolio to the point of reducing unsystematic risk (specific risk) but not participate in over diversification. Both under diversification and over diversification are causes of poor portfolio performance.

Mutual Funds

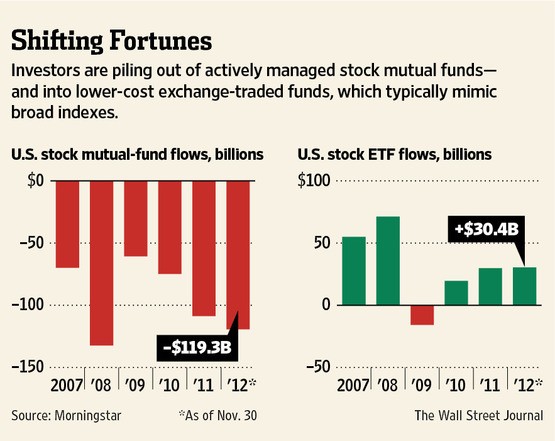

Equity and bond mutual funds are losing market share to Exchange Traded Funds (ETFs) and individual stocks and bonds due to the lower costs of individual transactions and the advantages of exchange traded funds. Equity mutual funds, in general, have been poor performers in the last decade due to over diversification and high expense ratios.

Mutual funds are still a viable alternative for investors with a small amount of investment capital. Occasionally, you will find an exceptional fund manager worth the extra management fees, but I believe this is rare and unpredictable.

Exchange Traded Funds (ETFs)

Exchange Traded Funds have many of the attributes of mutual funds but trade similar to a stock on an exchange. Advantages include low expense ratios, instant diversification, liquidity, tax efficiencies, and a wide variety of different segments or sectors to choose from.

ETF disadvantages include the fact most follow a specific index and therefore may not own the very best companies. In addition, because they do not rebalance their portfolios they own more of stocks that have already risen in price, and own less of the stocks that that have done poorly and therefore may be bargains.

Choosing the Optimal Investment Vehicle Mix

If your goal is minimal time spent managing your portfolio and the ability to add small amounts to your portfolio then mutual funds might be your best choice. However, be sure you know what those advantages are costing you!

If your goal is low costs, broad diversification and/or sector investing, you might favor ETFs. ETFs are the perfect investment vehicle for diversification in industries where the portfolio manager wants broad exposure to specific sectors.

There are clear long term advantages to controlling your own investments. The goal is to use the optimal mix or combination of investment vehicles that best meets your objectives and goals.

Personally, I like to use a combination of individual stocks and ETFs. This allows me to meet the important portfolio management goal of keeping expenses low. Investing in individual stocks allows me to target the best companies which are priced with a margin of safety. ETFs allow me to select specific sectors or countries where I might want broader diversification.

Do you stick to one investment vehicle or use a combination?