Investment Policy Statement Helps Investors

Post on: 15 Июль, 2015 No Comment

Are you the sort of investor who is easily rattled by market volatility? Do you wish you hadn’t drastically cut down on your stock exposure during the financial crisis? And did you get back in the market late in the game, after stock prices were well past bargain levels? If so, an investment policy statement, or IPS, could be your friend.

As with a GPS, an IPS directs you toward your goals. A written statement of your long-term investment objectives helps provide a framework for how your financial adviser will handle your investments. And it helps ensure that you don’t lose sight of your long-term investment objectives, even as markets go through their ups and downs.

It is similar to having a blueprint that you would use before you build a house, or writing a business plan before you start a business, says Daniel Goldie, president of Dan Goldie Financial Services and a registered investment adviser in Menlo Park, California. You want to have something thought out that is long term in nature, strategic and in writing.

IPS keeps you on track

An IPS prevents an investor from emotionally reacting to market events and deviating off course, Goldie adds.

To set up an investment policy statement, you and your investment adviser should begin with a discussion of your goals. Are you saving up for retirement or do you want to buy a house?

You would also take into account the time horizon you have in mind for your portfolio, your risk tolerance and what sorts of assets you want to invest in — the different types of stocks and bonds. Your goals, time horizon and risk tolerance would help you and your adviser determine the target range of exposure you want to each asset class. For instance, you might allocate 40 percent to large and small domestic stocks, 20 percent to foreign stocks and 20 percent to 25 percent in bonds, with the balance in cash equivalents.

More On Investing:

investing

What’s in an investment policy statement?

In addition to defining your goals, time horizon, risk tolerance and target allocation, an IPS can be used to outline your investment philosophy about expenses, trading and taxes.

It might also include answers to these questions:

- How much will I invest each month to meet my goal?

- How much do I expect my portfolio to return each year?

- What benchmarks will I use to measure my portfolio returns against?

- What criteria will I use to select investments?

- What criteria will I use to sell investments?

An IPS introduces accountability

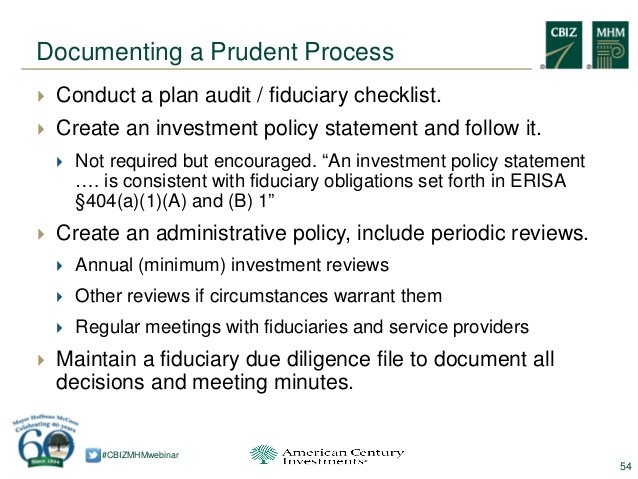

While investment policy statements are a matter of course in the institutional investment world, and typically considered standard procedure by fiduciaries of workplace retirement plans, there are no specific requirements for an investment policy statement in the case of individuals. So, it is up to you to bring this up with your financial adviser.

I think that it is incumbent upon every investor that works with an adviser to demand that there be an investment policy statement in the relationship, says Linda Lubitz Boone, president of The Lubitz Financial Group,a Miami-based financial advisory firm. It puts the adviser on record as to what they are going to be doing. It adds to the transparency in the relationship and helps avoid surprises.

Not only that: It could help clarify whether the adviser is acting in a fiduciary capacity or in a sales capacity.

It gives the adviser the opportunity to state they are working in a fiduciary capacity and have the client’s best interests in mind, says Blaine Aikin, CEO of fi360, a Pittsburgh firm that provides support services for investment fiduciaries. It also serves the important purpose of making sure that the client and the adviser are aligned in their thinking, particularly whenever times are turbulent.

Timely rebalancing

By sticking to an investment policy statement, your adviser would rebalance your portfolio from time to time to keep your portfolio aligned with your target asset allocation and risk tolerance. This means that during times of market downturns, when stock values go down, she would buy stocks. And when markets boom and you have a stock exposure that’s beyond the upper range you desire, she would then sell stocks to cut down on the exposure.

Your adviser might gauge your portfolio at periodic intervals, every quarter for example, to see if there is a need to rebalance.

Rebalancing is somewhat counterintuitive, says Goldie. Most people would say, ‘Why are you buying something that has underperformed? Why are you selling something that has outperformed?’ But the reason is that you want to buy low and sell high on average.

Just by engaging in proper rebalancing, an adviser could actually add a percentage point annually to a portfolio over a 20-year period, he says.

Be mindful of your commitment, too

While having an IPS is to your advantage, be aware if the agreement stipulates that you will be assuming certain responsibilities.

Lubitz Boone points to the example of an individual who did not review her adviser’s statements, even though she had agreed to do so regularly in the investment policy statement she set up with her adviser. When she filed a lawsuit against her adviser, her case did not hold up in court since the judge decided that she had not kept up her end of the commitment.

Of course, if you don’t want to make any such commitment, you should point that out at the time you set up the IPS or during a further review. After all, an investment policy statement is a document that may change as your needs change and is not set in stone.

Bankrate Audio

-   View transcript Embed Audio