Investment Objectives Help Stock Market Investors Focus on Goals

Post on: 16 Апрель, 2015 No Comment

Choose the Right Investment Tool for Long and Short Term Goals

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Investment Objectives Help Stock Market Investors Focus on Goals

Investors can use a variety of tools and strategies, but without clear investment goals they might not achieve their goals.

Investment objectives give you a target to aim for, and the right investment product is the tool that will help you reach your goal.

My grandfather was a carpenter and he and my dad impressed upon me the importance of using the right tool for the job — don’t use a wrench to hammer a nail.

Matching your investment objectives with the proper investment tool is an important part of a clear strategy and will help you better reach your goals.

Investment goals generally fall into two categories: long-term and short-term goals.

Long-term Objectives

Long-term objectives are at least five years in the future and for most investors fall into two major categories: funding a college education for the children and building a comfortable retirement fund.

We are not a society that easily works towards long-term goals. We are much more comfortable and familiar with goals and objectives that are immediate or in the near future, which may account for why so many retirement accounts are under-funded.

You can finance a college education if you don’t have enough saved, but you can’t borrow your way through retirement. Accomplishing this goal takes commitment and a willingness to sacrifice something now for a benefit in the future.

Rather than picturing a bank account, picture yourself in retirement doing what you want to do. If your dream is to sail to the Caribbean, go price the boat you want, start planning your trip, find out what it will cost to live on the islands, and so on.

Come up with a number to make your dream a reality and figure it will cost more by the time your retire. The point is to put some emotional energy behind your objectives rather than sterile numbers.

Short-term Objectives

Short-term objectives are less than five years away, and maybe in three years or less. These might include saving for a down payment on a house or a second home, buying a new car, or some other major expense.

Short-term objectives have immediacy that may draw your attention away from far-away objectives such as retirement. You must find a balance between those short-term needs (or wants) and your long-term goals.

It’s too easy to put retirement funding, in particular, on hold while other, more immediate (and fun) objectives are met. This is a mistake you will pay for in later years.

Appropriate Product Selection

Your best chance at reaching your long-term objectives is through stocks and bonds (either individual and/or mutual fund ownership). Historically, these vehicles working together have produced the best results over long periods.

However, stocks are not appropriate for investment objectives that are less than five years away. The volatility in the markets makes them too unpredictable for short-term objectives.

Long-term bonds (ten years or more) offer higher yields, but have higher risks. Intermediate bonds in the five to seven year range may be the best approach.

In the short-term, bonds and timed bank products such as CDs offer the best and safest way to meet investment objectives. Bonds of less than two years may not be competitive with bank products, but this is easy to check before investing.

If you have some small portion of your assets in real estate, you can target them at long-term objectives. This gives you a big window so you can choose when conditions are best to sell.

That window may come in five years, or seven, or ten, or never. The point is, you can’t count on selling at a specific time, because the real estate market operates on its own schedule.

The Solution

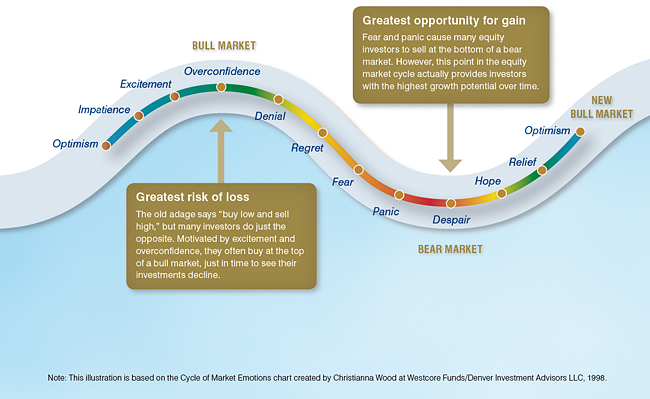

It may seem simple, but matching the appropriate tool with your investment objectives is often a problem. What happens is changes in the stock market and/or interest rates may cause investors to jump in or out of their choices either through fear of loss or the perceived opportunity to make a quick profit (crudely stated: greed).

The solution is to set your objectives (short and long term), make the appropriated investment selections and stick with your plan. Re-evaluate quarterly (or so), but don’t abandon your strategy on daily market changes.

And remember to keep your eye on your goals