Investment Income Strategy During Retirement

Post on: 2 Июнь, 2015 No Comment

Steady and Dependable Investment Income is the

New Challenge for Many Investors

People often assume that managing money for income is simply a matter of selling investments as needed from a diversified portfolio. After all how hard can it be to spend money? The hard part is saving ; the rest is easy — right? Well, saving and accumulating financial resources can certainly be challenging, but investing for steady and dependable income poses its own unique challenges, especially when financial resources are tight and one needs to maximize investment income for many years to come.

The most common approach is Systematic Withdrawals whereby capital is first allocated according to Modern Portfolio Theory principles, and then a Monte Carlo Analysis is used to determine a low-risk withdrawal rate. The investor then systematically sells investments as needed for income, being careful not to exceed the calculated withdrawal rate. This is the industry standard method. But let’s think about this — where is the investment income plan? Which investments should be sold in the near term? Which ones should be held longer for growth? How do we achieve the competing objectives of near-term dependable income and long-term capital appreciation and inflation protection?

It’s import to realize that Modern Portfolio Theory was never meant for income distribution. It does not offer an Investment Income Plan. Systematic Withdrawals is not really an investment income plan either. It’s just the default situation that exists when one does not have a well-designed and deliberate plan for withdrawing income.

This topic would only be mildly important if most people still had pensions and investment income was a bonus. But more and more, retirees will be dependent on investment income. It’s not extra — it’s survival. We call it the 401(k) Experiment because it’s not yet clear how it will turn out. Saving for retirement is hard enough, and most people have not accumulated a surplus. making it all the more important for the spending phase to go well. So here’s the big question:

How does one maintain steady, dependable, and long-term income while investing in financial markets that can be anything but steady and dependable?

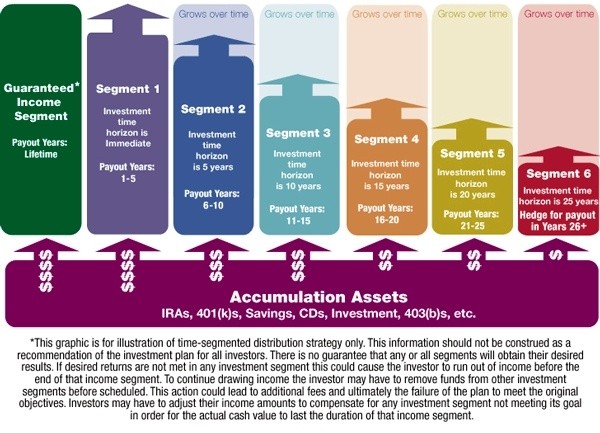

The answer is to use a Defined Withdrawals Strategy . Defined Withdrawals is a simple but powerful income withdrawal and investment allocation technique that balances the competing needs of dependable income and long-term growth. The premise is simple: One portion of the portfolio is invested in highly certain income-producing investments. The other portion is invested in stocks for long-term growth. It is the income certainty of the first portion that allows an investor to manage the second portion with a cool head. When an investor needs both dependable income and growth, then the plan should address both needs. If it seems like common sense, it is! Stock investments will occasionally be sold to replenish the highly certain income-producing investments. However rather than systematically selling stocks according to a regular schedule, the investor strives to sell stocks at favorable times using plan benchmarks and stock trend-lines as a guide. Stock dividends, which tend to offer a medium level of income certainty, will often be part of the withdrawal strategy too. especially when interest rates are low.

The Defined Withdrawals strategy itself is not complicated, but real-life income plans and personal financial situations can be. A powerful tool is needed to develop and optimize a comprehensive Defined Withdrawals plan for the real world. That tool is the Income Strategy Generator ™ or ISG ™ software, which we offer in cooperation with Brentmark Software, a leading provider of financial planning tools. The ISG ™ software will help you balance and optimize the allocation of capital to create a strategic and specific Investment Income Plan — while accounting for real-life factors such as non-investment sources of income and variable income needs. Download our free book, No Hype Investing for Income with the Income Strategy Generator . for a more complete explanation.

We are often asked whether the ISG ™ software is a professional or personal product. It is designed for professional planners. However many individuals will have no trouble following the examples in our Free Book and using the software to develop their own plans. Of course we still always recommend seeking professional assistance before making final decisions — from an advisor who specializes in developing Defined Withdrawals plans!

The ISG ™ software is a planning and optimization tool. It is not an investment simulation tool. But we also offer a free Investment Income Simulator that lets you practice managing investments for income. Find out for yourself what works and what doesn’t. It has the added advantage of being fun! It can be played like a game. Test your skills and see if you can reliably withdraw your desired income for up to 30 years without running out. Compare your results to what would have happened with a Systematic Withdrawals plan. It may take a little practice, but after you get the hang of it, you will find that a Defined Withdrawals strategy consistently outperforms and outlasts the Systematic Withdrawals benchmark. The free Nightmare on Wall Street presentation teaches some tricks for managing a Defined Withdrawals plan when times get tough, and we recommend viewing this presentation before using the Investment Income Simulator.