Investment Diversification Basics

Post on: 15 Июнь, 2015 No Comment

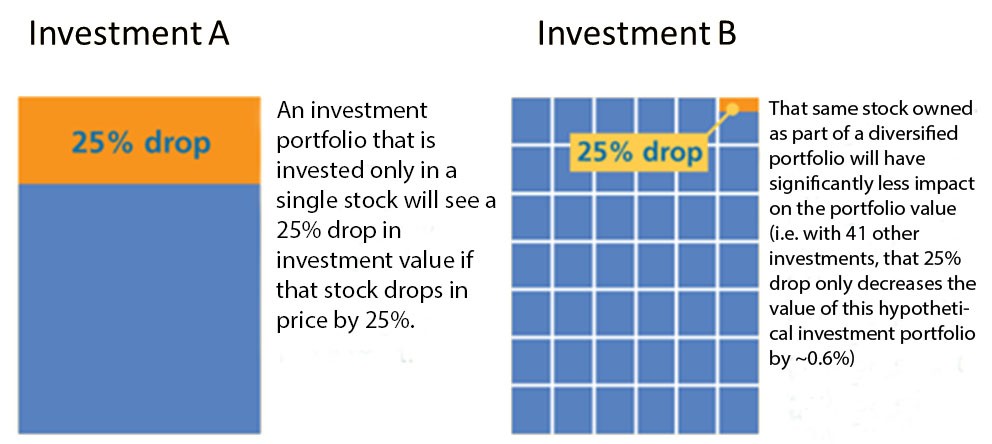

Diversification is one crucial aspect of a solid investment strategy. To diversify means to spread your portfolio over many types of investments and over different specific investments within each category. A basic process for diversifying your investments is described below.

- Liquidity Considerations

First, you should establish how much of your portfolio you will need to have invested in relatively liquid assets that can be quickly converted to cash if you need it. Many investment managers advise that keeping 10% to 15% of your portfolio in these types of investments is an adequate amount for most people.

Next, you should establish your investment goals and objectives. If you’re looking for long-term results, you might concentrate on growth investments-real estate or growth stocks, for instance. However, if you’re investing to develop a source of yearly income, you might concentrate on income-generating investments such as high-dividend stocks or bonds. A qualified investment manager can analyze your goals with you and help you determine appropriate proportions for each type of investment and various categories of investments.

The last step in the diversification process is selecting specific investments. Of course, you will need to consider the tax consequences of various instruments-municipal vs. corporate bonds, for instance. To maintain appropriate diversification, you will need to regularly evaluate your strategy and analyze how your investments are performing and whether or not your goals have changed.

The information provided here is obtained from sources deemed to be reliable, however, neither KeyCorp nor any subsidiaries guarantee the timeliness, sequence, accuracy or completeness of such information. Any discussion of investment or other financial products is not to be construed as to constitute an offer to sell or solicitation to buy such investment / financial product. A decision to buy or sell any investment or other financial product referenced should not be based solely on the inclusion of the investment / financial product in these articles. The information provided here is general in nature and should not be construed as specific or comprehensive advice, but is provided for informational purposes only. You should discuss the specifics concerning your business, financial, legal or tax matters with an appropriate independent, professional consultant or advisor before making any financial decisions. KeyCorp and certain subsidiaries, on their own behalf or as agents for their clients, any of their officers or employees may have a beneficial interest or position in any of the investment products mentioned, which may be contrary to any opinion or strategy expressed in these articles. Past performance of markets or investment products mentioned in these commentaries should not be considered to be indicative of future results.

Contact Information

For more information about retirement planning, talk to a Key Retirement Specialist at 1-888-KEY-2020. or send us an email .