Investing With Purpose Target Date Funds

Post on: 15 Апрель, 2015 No Comment

If you’re saving for retirement through a target date fund. your goal is probably a straightforward one: retirement income that will last as long as you need it, maybe with some left over.

Yet there’s often a disconnect between the way target date portfolios are built and the retirement goal that you’re building toward. Traditional target date models, such as those that follow a prescribed asset allocation or aim to simply beat a benchmark, may in fact contain hidden risks or overlook strategies that can help get you where you need to go.

A goals-based target date fund takes a different approach. As the name suggests, this approach is designed to pursue specific outcomes, whether it’s minimizing volatility or generating consistent income in retirement. In practice, it means investing in a way that seeks to increase your chances of reaching your goal – by managing risk and potentially broadening the scope of your investments.

For investors looking to grow and protect their retirement spending, a goals-based target date portfolio doesn’t simply target higher income. Instead, it aims to minimize the risks that could lower your likelihood of generating the income you need.

Key Risks to Retirement Income

- Outliving your money. As of 2014, a 65-year-old man can expect to live to 84 or longer, and a woman to 86, according to the Social Security Administration. With a decades-long retirement to look forward to, you likely need to grow your nest egg, prudently, preferably in your younger years.

- Inflation. Even a modest increase in prices can do serious damage over several decades. You may want to consider an approach that seeks to protect your spending power with investments specifically meant to combat inflation.

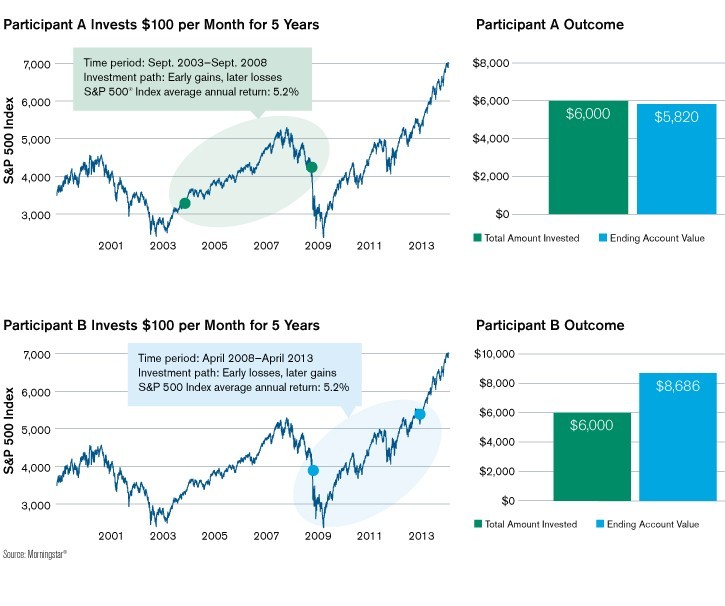

- Market turbulence. During the 2008 financial crisis, U.S. stocks lost half their value, a catastrophic event for those nearing retirement. Consider a target date fund that incorporates deliberate strategies to help avoid negative surprises that can wreak havoc on future retirement income.

Ultimately, this type of purpose-driven target date strategy should help you achieve a different, and potentially more risk-managed, outcome vs. more traditional approaches.

This material is provided for educational purposes only and is not intended to constitute “investment advice” or an investment recommendation within the meaning of federal, state, or local law. You are solely responsible for evaluating and acting upon the education and information contained in this material. BlackRock will not be liable for any direct or incidental loss resulting from applying any of the information obtained from these materials or from any other source mentioned. BlackRock does not render any legal, tax or accounting advice and the education and information contained in this material should not be construed as such. Please consult with a qualified professional for these types of advice.

Investing involves risk, including possible loss of principal.

Diversification and asset allocation may not protect against market risk or loss principal.

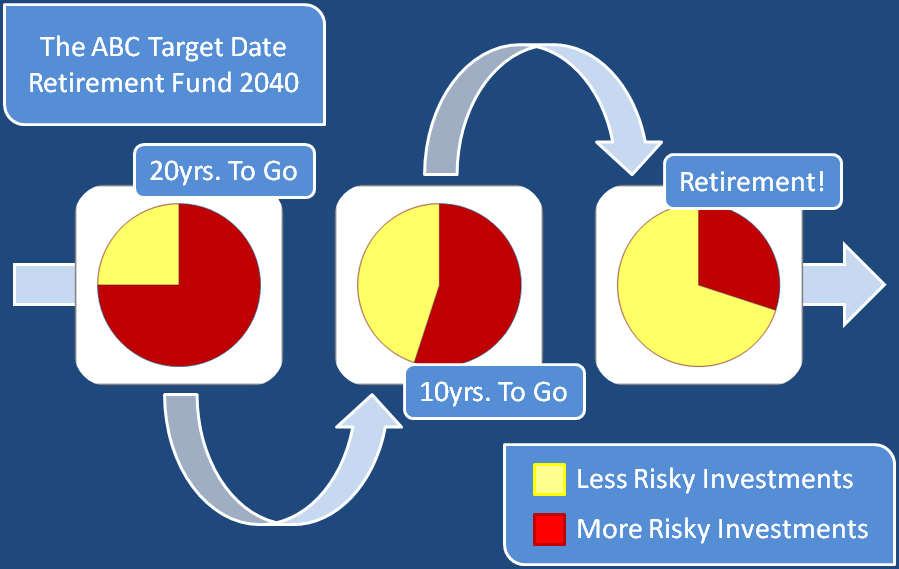

Investing in target date funds involves risk including loss of principal. The target date in the name of the fund is the approximate date when an investor plans to start withdrawing money. The blend of investments in each portfolio are determined by an asset allocation process that seeks to maximize assets based on an investor’s investment time horizon and tolerance for risk. Typically, the strategic asset mix in each portfolio systematically rebalances at varying intervals and becomes more conservative (less equity exposure) overtime as investors move closer to the target date. The principal value of a fund is not guaranteed at any time, including at the target date.

Please consider the investment objectives, risks, charges and expenses of each fund carefully before investing. The funds prospectuses and, if available, the summary prospectuses contain this and other information about the funds and are available, along with information on other BlackRock funds, by calling 800-882-0052. The prospectus and, if available, the summary prospectuses should be read carefully before investing.

Prepared by BlackRock Investments, LLC, member FINRA

Investopedia and BlackRock have or may have had an advertising relationship, either directly or indirectly. This post is not paid for or sponsored by BlackRock, and is separate from any advertising partnership that may exist between the companies. The views reflected within are solely those of BlackRock and their Authors.