Investing With Less Than $1 000 Part2 How To Pick The Right Brokerage Account Before Investing

Post on: 10 Июль, 2015 No Comment

Last week, I started a short series about dividend investing for beginners . I noticed that it had generated a few comments as I waved the first option that would be to start with stock picking right away. I still believe that starting with 1 or 2 stocks in your portfolio may put you at risk if you are just starting to learn the investing ropes and you are not fully aware of all the risks.

I remember when I first started trading back in 2003, I thought I knew how the stock markets worked since I was making money. I had invested a lot of money in oil income trusts and getting double digits dividends. I truly understood the meaning of trading stocks in 2006 when I pushed my luck to concentrate on trading penny stocks along with dividend paying companies. It would not have been that bad if I didn’t need the money 2 months after to buy my house

All that to say that when you start investing, you are better off with something that costs a little bit more (in transaction fees or management fees) but that is more diversified. But before picking any stocks, ETFs or mutual funds, you need an investment account. So how do choose the right brokerage house? Here are a few considerations before you make your decisions:

I guess that this is probably hits the nerve of all traders; the transaction fees! If you are going to buy and sell different stocks or ETFs you certainly want to have a low commission broker. This means you are better off with online brokers rather than the brokerage division of any big bank or financial institution.

You can usually find a low commission broker offering trades around $5. Here are a few examples:

Canadian:

If you are looking for more examples, you can always try Trade Wiser. a free comparable brokerage site.

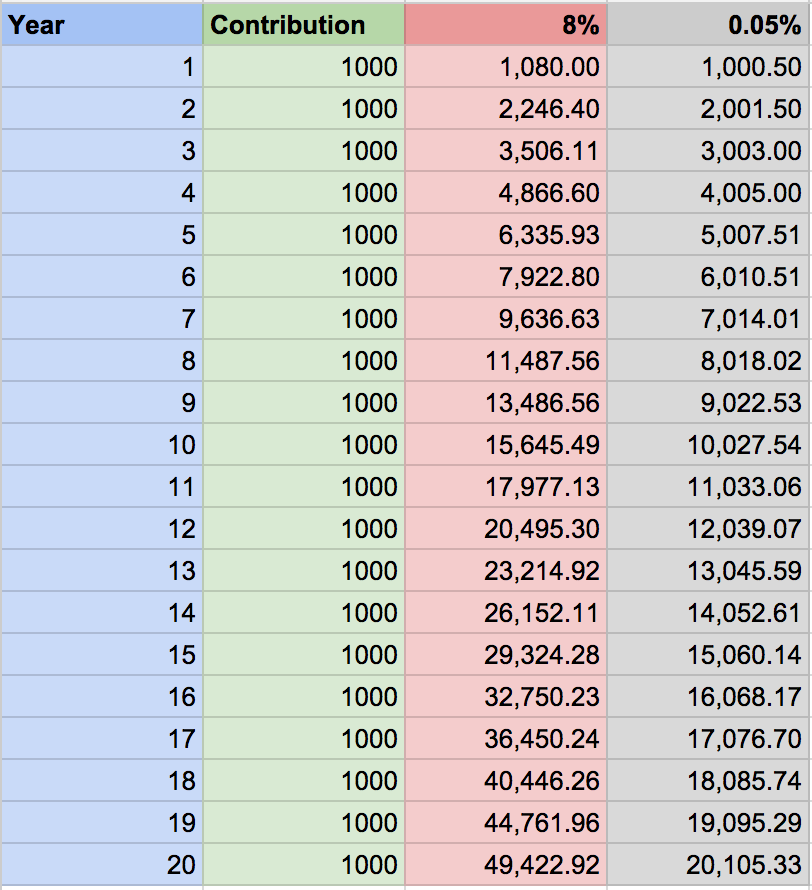

Another important point is that your broker allows DRIPs (Dividend ReInvestment Plans). The fact that you can increase the amount of stock in your account through the dividends received is an easy way to increase the value of your portfolio steadily without fees. While most brokers allow DRIPs, it is very important to validate if yours does! I’d say that it is also important to confirm that your broker offer DRIPs for all stocks (some, for some reasons, offer DRIPs only for specific stocks). This will help you avoid potential problems with your investment strategy later on.

Periodic Investment

You can obviously make periodic investments with any mutual fund with any brokers. However, some brokers also allow periodic investments with ETFs. When I did my own research to open a new brokerage account, I noticed that not all of the brokers offer the same service with major ETF companies.

Research Tools

How are you going to do your research to pick the right investments? Looking at financial blogs is a great start but I would push my analysis a little bit further if I were you. Some brokers offer technical analysis services, graphs, historical and even financial analysts recommendations and reports.

While you can easily find stats such as dividend payout ratios, history, dividend growth and yield, a more in-depth analysis done by CFAs couldn’t hurt either ;-).

Since the goal is to do dividend investing, I would not pay more for a high tech technical analysis system. Your goal is to purchase steady dividend payers and not to determine if it’s the right time to buy or sell according to momentum.

My Brokerage Account

As previously mentioned in the comment of my first post of this series . I just opened my company brokerage account. Since we are generating enough profit and we don’t have any projects to work on at the moment, we decided to diversify our portfolio (limited to online properties at the moment) through an investment account.

I will principally invest in dividend paying stocks along with a few trades on techno stocks (covered by our other blog; Intelligent Speculator ). We will be updating our portfolio on this blog so you can see our good and questionable investment decisions along the way ;-).

We have opted for Questrade since we are based in Canada and most brokerage accounts are offered by the 6 big banks. Questrade offers a low commission trade account with possibilities of DRIPs and periodic investments.

As for our research tools, my partner and I both work in the financial industry so it won’t be a problem to have access to a ton of information which we will share on this blog

What about your brokerage account?

Since it is impossible for us to look at all the brokerage account in details, we would like to gather as much information as possible on each brokers so we can put together a “best broker page” with your comments. So tell me what you like and dislike about your brokerage account and we will add your comments to our best broker categories.