Investing in Unit Investment Trusts

Post on: 17 Июнь, 2015 No Comment

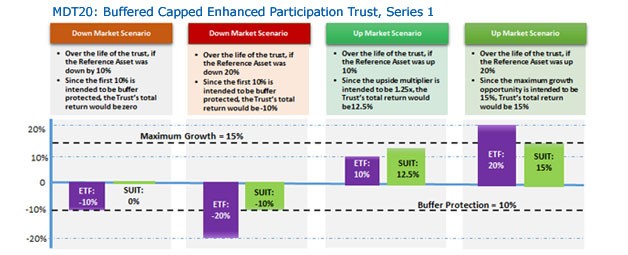

A Unit Investment Trust (UIT) is a trust that holds a fixed portfolio of securities that are offered to investors in “unit” increments. Investors purchase units of the trust and receive a share of the trust’s earned income, if any, and their share of the holdings at the trust’s maturity.

A UIT is similar to a mutual fund in that it pools together the funds raised by selling the units, and purchases a diversified portfolio of investments. However, UITs are created for a specific length of time and the portfolio of investments is fixed. In other words, a UIT will hold the same portfolio of investments at the time of its maturity as it does at the initial investment.

UITs are designed with a specific investment goal in mind – taxable or tax-free fixed income, or growth and income through trusts that follow a specific investment strategy, sector or market index.

Features to consider:

- A diversified portfolio of securities through a single investment

- Scheduled maturity

- Buy and hold strategy

- Daily liquidity (However, if sold prior to maturity, the trust may be worth more or less than its original cost and any outstanding sales charges will be deducted upon redemption.)

- Low administrative costs

- Low minimum investments (typically $1,000)

Learn more and discuss what opportunities are available today for investing in Unit Investment Trusts by contacting your Ziegler financial advisor.