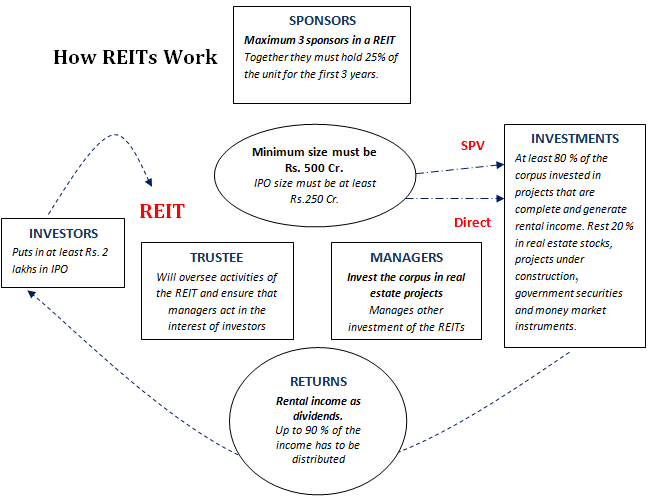

Investing in REITs How REITs Work

Post on: 30 Март, 2015 No Comment

Investing in REITs

Because many REITs are publicly traded, they offer investors a powerful tool for portfolio balancing and diversification. They also provide investors with ongoing dividend income. while offering the potential for long-term capital gains through share price appreciation.

REITs have an advantage over other types of stocks. Because of their pass-through taxation, REITs have greater profits from which to pay shareholder dividends than similar sized corporations. As long as a REIT maintains its tax-qualified status by paying out 90 percent of its net income to common shareholders, it doesn’t have to pay federal income taxes. Without a tax bite to reduce profits, shareholders get more of the REIT’s earnings.

REIT investors receive value in the form of dividend income and potential share value appreciation. Because REIT income often comes from commercial properties with long lease periods, REITs can offer a relatively predictable revenue stream. They also are somewhat resistant to inflation. Unlike bonds with pre-determined rates of interest, which lose relative value in times of high inflation, REITs with rental incomes adjust themselves in line with the cost of living. This makes them less vulnerable to inflation-related devaluation.

Another benefit is the potential for a nontaxable return of capital. Depending on the REITs distribution policy and annual earnings, a portion of the dividend may be deemed a nontaxable return of capital. Not only does the investor not have to pay taxes on that part of the dividend in the year it is distributed, that amount is also not taxable until the stock is sold. So the return of capital defers taxes as well as lowers an investor’s taxable income during the time the REIT stock is held, increasing the after-tax dividend yield.

REITs do have some disadvantages. Because their distributions to shareholders bypass corporate taxation, their dividends aren’t eligible for the 15 percent dividend tax rate that was put into place in 2003. That means investors usually pay taxes at their higher ordinary income rates, which can run as high as 35 percent. Nontaxable distributions are taxed as capital gains (currently 15 percent for shares held for more than a year) when shares are sold.

Unfortunately, it is difficult for investors to predict what category of income a REIT will pay out in a given year (dividends or return of capital). According to NAREIT, however, the proportion of distributions that qualifies for the lower tax rate has risen every year since 1998.

So how do you go about choosing a REIT? Even though REITs are somewhat diversified by definition, it is still important to determine whether or not a specific REIT focuses on one type of commercial development or one geographic area that could leave it vulnerable to a downturn. For this reason, many investors invest in more than one REIT. Consider demographic information such as population growth, employment growth and the level of economic activity for the particular area or industry. These will have a direct impact on rent levels and occupancy rates — which in turn affect cash flow and dividends.

Most investors know that past performance is no guarantee of future performance. With REITs, however, you should look at past dividend payments. Be wary of high yields. If there have been excessive capital gain distributions, this can be a sign that the income is coming from nonrecurring events and will not continue for long. Make sure the REIT is not selling off properties to provide income, because future rental income will be affected.

Evaluate your own needs. REITs can provide both current income and long-term appreciation. Depending on what you’re looking for, examine how the REIT management and trustees are compensated. If compensation is based on the value of the REIT’s assets, management is usually concentrating on investing in additional properties for capital appreciation. If the basis for determining compensation includes dividends or current earnings, the REIT’s management may be motivated to increase dividend yield, possibly at the expense of long-term appreciation.

Study the REIT’s management. Before investing, make sure the management has a personal stake in the company. This information should be available in their latest prospectus. There is often a REIT option in most 401(k) plans .

If you want to invest in income-generating real estate, a REIT might be the way to go. For more information on REITs and related topics, check out the links on the next page.