Investing In Natural Gas Eye ETFs Seasonality (ung unl gaz nags kold boil dcng)

Post on: 19 Июнь, 2015 No Comment

Investing in natural gas sounds like a winner: demand keeps rising, fracking promises to meet that demand, and prices have jumped in the past several years. Meanwhile it’s touted as an alternative to coal, and to a lesser extent, oil. There’s a lot to like.

But investing in commodities on a futures market is still a complicated business for most retail investors. Taxes and expenses can be complicated to work out. Hence the exchange-traded fund can be a better vehicle. (For more, see: A Natural Gas Primer .)

A Few Ways To Invest

There’s two ways to think of being invested in natural gas. One is to look for stocks of natural gas extraction companies — basically the energy sector. The other is to target the commodity. We’ll examine here the commodity itself, as that’s the thing that’s harder to access minus an ETF.

There are several natural gas ETFs. Among them are the United States Natural Gas Fund (UNG ), ProShares Ultra Bloomberg Natural Gas (BOIL ), iPath Dow Jones UBS Natural Gas Subindex Total Return ETN (GAZ ), Proshares UltraShort Bloomberg Natural Gas (KOLD ), United States 12-Month Natural Gas Fund (UNL ), iPath Seasonal Natural Gas (DCNG ), and Teucrium Natural Gas Fund (NAGS ). (For more, see: Natural Gas ETF Future Prospects .)

They all invest in gas in slightly different ways. UNG, for example, has net assets of $715 million, about half of which is in natural gas futures and the other in cash and treasuries. The ETF is designed to track approximately the price of 3-month natural gas futures. UNL is much smaller — $17 million — and tracks 12-month futures. NAGS tracks a weighted average of NYMEX futures contracts .

BOIL is a much smaller fund — only about $40 million. It’s supposed to return twice the daily performance of the Bloomberg Natural Gas Subindex. That’s a slightly different remit than many commodity investors look for, as it tends to add volatility. (For more, see: Opportunities In Natural Gas .)

Exchange-traded notes (ETN), meanwhile offer cash payouts after a certain period, so for those who want the security of the guarantee GAZ and DCNG might be a good avenue. (For more, see: ETF or ETN? What’s The Difference? )

For the more bearish on natural gas prices there’s KOLD, which works like BOIL except that it tracks the inverse of the natural gas index. But year-to-date returns (as of the end of August) have been sharply negative, approaching -30%. Since the summer started, the ETF has looked better but that might be a function of the season, as natural gas prices tend to fluctuate with the weather. (For more, see: ETFs For Playing The Surge In Unconventional Energy .)

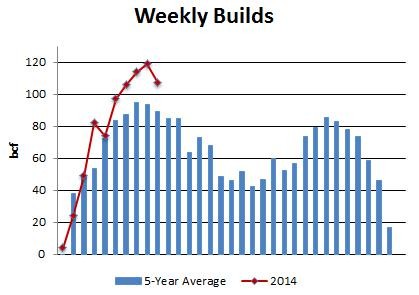

Don’t Forget Seasonality

Natural gas is a commodity, so despite the seasonal fluctuations, over longer periods the price is heavily influenced by production and distribution. As the infrastructure for getting the gas to customers improves, prices can drop despite increased demand. (For more, see: How Fracking Affects Natural Gas Prices .)

It’s also worth asking how long one plans to be in the market. In 2008 the commercial price of natural gas topped out at $15 per million cubic feet. The price fell drastically after that and hovers around $10 now. That would make it sound like a terrible long-term investment, but the market bottomed in late 2012, and anyone who bought shares of UNG in August of that year is still sitting on a healthy 20% return.

The seasonal — and sometimes volatile — nature of the gas market is reflected in the returns. Comparing UNL, UNG, GAZ and NAGS shows that all brought investors single-digit profits for the year so far, but anyone who bought in the dog days of August 2013 would be looking at an 18% return from UNG and about 6% from UNL, the lowest return of the four. Seasonality become important here.

The Bottom Line

If you want to be in the natural gas commodity market there are ETFs for you, but be aware of seasonal volatility and ask whether your bet is on current use of natural gas or longer-term demand. (For more, see: How To Ride The Natural Gas Boom . )