Investing in Index Funds

Post on: 12 Октябрь, 2015 No Comment

Which is the best choice for people investing in funds? The bottom line is that investing in index funds has the potential to offer some of the best returns of all fund investing.

What Does Investing in Index Funds Mean?

If you’re at all familiar with investing in funds, you’ve probably heard of mutual funds; you might even have money in a few of them. Index investing works in a similar way, in that you’re buying a little stake in a lot of stocks when you buy into index funds. The difference between investing in index funds and investing in mutual funds is that index funds represent a broad sampling of the overall stock market, while mutual funds are specific combinations configured by fund managers, and they may cover only a specific sector or stock market niche.

How Is the Performance?

Index investing historically outperforms investing in other funds, as indexes follow the broad marketplace performance, and not a specific sector or niche. One sector may beat the market one year, but it’s difficult to predict which sectors will succeed, whereas an index fund has broader coverage.

However, index funds typically decline with stock market downtimes, so investing in index funds makes you vulnerable to market fluctuations. It is possible for some sectors to escape market declines, so index investing may perform poorly compared with sector-specific mutual funds in times of market turmoil.

Fees also impact a fund’s performance. When investing in a mutual fund, you’ll also be paying a percentage of your returns to a fund manager. Since index funds don’t have a single manager picking and choosing investments, those costs stay low. But there is a catch-some index funds have a high minimum investment, and you might not have enough cash on hand to jump into the pool. However, if you do your research, you can find funds with lower minimums.

Index or Mutual?

While the decision between index investing and investing in mutual funds may seem difficult, the fact is that some mutual funds are built around index funds, so you’re effectively investing in index funds when you buy into those mutual funds. If you don’t want to buy into a fund, you can also purchase Exchange-Traded Funds (ETFs) directly through a brokerage.

How Do Exchange-Traded Funds Fit in the Index Fund Picture?

Exchange-Traded Funds sell just like regular stocks through a brokerage firm, but they’re actually a collection of different stocks, just like an index. However, ETF transactions are treated as stock purchases by brokerage firms, so they’re subject to the same fees that any other stock transaction would garner through your broker.

If you pay commission or per-transaction fees on stock purchases, then purchasing ETFs through your broker may not be the most cost-effective way for you to invest in index funds. However, if you have small fees or no fees through your broker, ETFs can be beneficial because they don’t usually require the high minimum buy-in that many index funds require.

What Are the Most Popular Funds for Index Investing?

When people think about index investing, two funds immediately come to mind: the Dow Jones Industrial Average and the Standard & Poor’s 500 Index. The Dow Jones Industrial Average (DJIA), containing 30 of the most powerful companies in the United States, is typically thought to represent marketplace performance. However, since it represents only 30 of the 10,000 companies traded on the stock market, the DJIA isn’t necessarily an accurate reflection of performance across the marketplace.

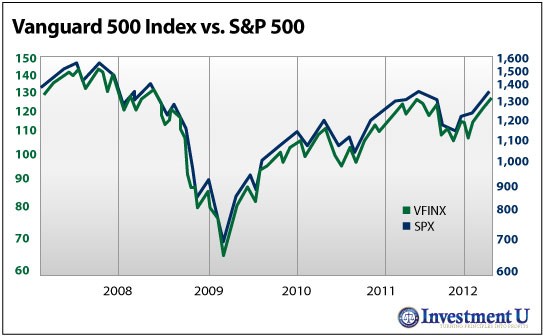

Stock market analysts are increasingly turning to the S&P 500 as the benchmark for stock market performance and index investing, since it represents the 500 most widely held companies. As a market index, you can’t buy stock directly in the S&P 500, but you can buy into an index or ETF that follows it.

What Is the NASDAQ?

Nickels and Dimes: How to Make Your Index Investing Grow

You can typically avoid the fees associated with index investing, including sometimes avoiding a minimum investment depending on your broker, by setting up an automatic contribution on a weekly or monthly basis. When you begin investing in index funds on an automatic schedule, you take the guesswork out of buying. You simply invest a set amount on a specific interval, regardless of market performance. While you may occasionally buy high and see the market decline, you’ll also buy low and see exponential growth, so the two extremes can average out over time.

If you buy into an index fund that pays dividends, you can also configure your dividends to be re-invested into your index fund automatically. Since you never actually see the dividends, you don’t feel like you’re paying out, and your index investing grows without your even watching it. Over time, the growth from dividend reinvestment and automatic contributions may increase your index investing exponentially, providing you a comfortable nest egg without as much research or as many fees. But, as always, past performance-in this case, of the markets that index funds represent-is not an indicator of future results.