Investing in Frontier Markets

Post on: 16 Март, 2015 No Comment

Why I’m Investing in Frontier Markets

Comments ( )

By Carl Delfeld

Tuesday, August 12th, 2014

To get ahead in today’s market, you need to scour the world for future value.

More often that not, when investors think of emerging markets, nations like China come to mind. Unfortunately, Chinas Shanghai market is down 10.9% over the last five years.

But many other countries are zooming ahead.

I call these markets motorcycle markets because they have many more motorcycles than cars on the road. Some dont even have a McDonalds yet.

While the S&P 500 is up 4.5% and emerging markets are up 6% year to date, frontier emerging markets are up a sizzling 19%. This has brought the stocks in the MSCI frontier index to a value of $109 billion.

These frontier markets offer investors a combination of great value, huge upside, and unique challenges. As giants like China run into growing pains like higher costs and negative returns, frontier markets are up propelled by a bit more political stability and easy access to modern communications, technology, and capital.

The simple smartphone has connected every citizen to the global economy, as has MITs free online education.

Making the Case for Frontier Markets

My case for you to leapfrog over emerging markets to the new frontier markets is simple and powerful: While frontier countries are far behind developed countries like Japan and America and are even playing catch-up with countries like Thailand, South Korea. and China, they are catching up. fast .

Imagine a chance to invest right now in the China of 1980 when its wages were at rock-bottom levels and it exported in a year what it now does every day.

Youthful populations and the move of workers from rural areas to cities with higher-income jobs are supercharging growth in these economies. The median age in many of these countries is at the demographic sweet spot of 25 years, compared to 35 years in China and South Korea and 45 years in Germany and Japan.

This explains the optimism driving families to open their first bank accounts and purchase new houses, washing machines, refrigerators, cars, and better food and medical care. This, in turn, explains why big companies from Japan, China, the U.S. Europe, and South Korea are falling over themselves and each other to invest in frontier Asia.

And its not just lucrative new consumer markets and rising tourism thats driving this wave of capital it’s also the need to access the regions ample natural resources.

Evidence of this optimism and virtuous cycle of growth is everywhere. Since 2009 and the cooling of its civil war, Sri Lankas GDP has surged 40% and is now double that of India’s on a per-capita basis.

Meanwhile, the 12th-largest shopping mall in the world is in Dhaka, Bangladesh, and a $20 billion energy investment by Exxon Mobil in Papua New Guinea has the potential to double the size of its economy.

The Best Free Investment You’ll Ever Make

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, Gold & Silver Mining Stocks.

Enter your email:

Risk Reduction

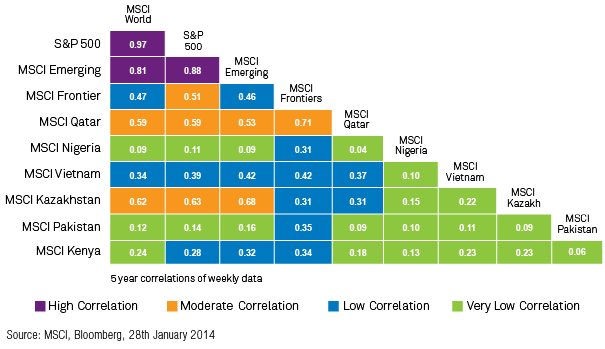

To top it all off, having a slice of frontier Asia in your portfolio actually reduces risk and volatility.

Why? Because rather than moving up and down in time with global stock markets, these markets march to the beat of their own drums.

And right now, frontier markets are on sale. One fund portfolio I follow is trading at just six times earnings and just a tad over book value while offering a juicy 5.3% dividend yield.

But like maneuvering a motorbike in and out of chaotic traffic, investing in these frontier markets requires experience and steady hands. so choose your investments carefully.

The Templeton Frontier Market fund (TFMAX) is perhaps the best known but has recently closed to new investors.

The iShares MSCI Frontier ETF (NYSE: FM) is a more accessible option, and it is up 14.3% year to date.

You might also consider the Asia Frontier Fund, which I like for a number of reasons.

First, 46% of its portfolio is in consumer stocks aiming to capture the young and rising consumer class.

Second, I agree with the funds 20% top weighting to Vietnam and the intelligent strategy of investing in each countrys strengths, such as tourism in Sri Lanka, mining in Mongolia. food companies in Vietnam, and textiles in Bangladesh.

Heres the kicker: Many of the companies in the portfolio have significantly lower valuations compared to similar emerging and Western companies, making them attractive acquisition targets.

As a bonus, the portfolio, up 18.7% so far in 2014, sports a nice 4.4% dividend yield to cushion risk.

Frontier Asian markets are on the move. Get on board for a piece of the action.

Until next time,

Carl Delfeld for Wealth Daily