Investing in Fracking Stocks

Post on: 18 Май, 2015 No Comment

Comments ( )

I love a good fight.

When it comes to U.S. energy production, I can’t think of a more controversial topic since Edwin Drake drilled his well on Pennsylvania soil over 150 years ago.

It all revolves around hydraulic fracturing.

Here’s the part that most people don’t seem to realize: Without fracking, the entire North American oil and gas industry would come to a screaming, painful halt. This is the reality we all need to face, regardless of protesters who abhor the fracturing process.

Fracking Stocks: Hydraulic Fracturing 101

Let’s start from the beginning.

Hydraulic fracturing is a simple process, really. It’s used to create fractures in a rock formation by injecting the rock with a mixture of water, proppant (think: sand), and chemicals.

Once opened, the fissures allow the oil and gas resources to flow more freely into the well, which can then be extracted through the well bore.

Here’s a video of this procedure in action.

Although fracturing technology has roots that date back to the Civil War, the first case of hydraulic fracturing actually took place in 1947 when a company by the name of Stanolind Oil Company used it on a well in Kansas.

In 1949, another company came along and began using their patented HydraFrac Process. You might have heard of the company before. It goes by the name of Halliburton.

The controversy surrounding the technique and its impact on the environment didn’t reach a feverish pitch until a few years ago.

Why did it take over fifty years to come under fire? The answer to that question can be found within the wildly successful developments in our tight oil and gas plays.

Something Old, Something New

It’s no secret that U.S. oil production peaked in 1970 nor is it that we increasingly rely on unconventional sources for oil and gas.

Even by using this projection from the EIA, we still won’t come within 20% of our Peak Oil output of 10.44 million barrels per day in October of 1970.

And we’re seeing the exact same situation in our domestic natural gas production:

Without taking advantage of hydraulic fracturing technology, we can go ahead and eliminate all of the tight oil and gas production on those charts.

Of course, the situation gets worse when you look deeper into the United States’ drilling stats: Right now, approximately 65% of all rigs operating on U.S. soil are drilling horizontal wells. And I can’t emphasize enough that every single one of those wells need to receive some form of fracture stimulation.

Some industry insiders have suggested nearly nine out of every 10 new wells will need to be fracked.

If you think the public is irate about $4/gallon gas prices (and I realize many readers have been and are paying much more than that now), imagine how they’ll feel when they’re being charged double, even triple, that amount.

The Water Crisis

First let’s dive into the gripes people have with hydraulic fracturing.

It all comes down to water. To be more specific, it all comes down to the fluid that is flushed down the well during the process. millions of gallons of frac fluid.

Since the composition of this frac fluid is the issue, it’s good to know 99.5% of it is water and sand.

And here we come to the point of no return for most anti-frackers: water contamination that is, the threat of this frac fluid reaching someone’s water source.

Note: No matter how many times they argue it, there’s never been a case of frac fluid migrating up to the water table.

In a typical well, the rock formation being fractured lies at a depth of more than 7,500 feet. Water aquifers are usually found at a depth of 1,000 feet. Between the two is a mass of solid rock.

Pick and Shovel Profits

When I talk about the picks and shovels of hydraulic fracturing, I’m referring to investing in companies that deal with the two biggest components in the process: sand and water.

Keep in mind that each shale well requires about five million pounds of proppant. Proppants are materials used to keep the fractures in the rock open. For the most part, we’re talking about sand or ceramic material.

One play that warrants a second look from investors is U.S. Silica Holdings (NYSE: SLCA ). which mines, processes, and sells commercial silica in the United States.

In other words, they’re selling frac sand to the oil and gas industry.

And as far as performance is concerned, this pick would have doubled your money within the last 12 months:

There’s also another side to frac sand investments ceramic proppant.

One company, CARBO Ceramics (NYSE: CRR), manufactures ceramic proppant to use in place of sand. And the results speak for themselves, as drillers are able to increase production and EURs (the quantity oil and gas believed to be ultimately recoverable in a reserve or well) due to the uniformity of the ceramic proppants compared to sand.

How to Play the Water Crisis

If one of the most controversial issues when it comes to fracking is wastewater then the companies solving how to deal with it will become infinitely valuable for the future of the U.S. shale boom.

A few of you may have heard or even seen the wastewater ponds associated with hydraulic fracturing operations.

I’ll be the first to tell you it isn’t a pretty sight.

Interesting players in this group include GasFrac Energy Services (TSX: GFS ). a company using a waterless fracturing technology. The company completely side-steps the water issue altogether by using a proprietary process involving a gelled liquefied petroleum gas (LPG) instead of water.

Not only does it reduce truck traffic by up to 90%, but most of the LPG injected into the shale formation can be extracted and resold on the market. In conventional hydraulic fracturing, more than 80% of the water and frac fluid stays in the rock formation.

More traditional water plays include Nuverra Environmental Solutions (NYSE: NES ). which offers a variety services for shale drillers, including the hauling and treatment of water used for frac jobs.

Fracking Companies: Traditional Investments in Hydraulic Fracturing

Contrary to popular belief, hydraulic fracturing didn’t start five years ago.

That’s just when people began to notice the flood of oil from North American shale formations like the Bakken.

And it certainly didn’t start at the birth of the shale boom, when George Mitchell was tinkering with horizontal drilling and hydraulic fracturing back in the early 1980s in the Barnett Shale.

Believe it or not, this technology has been around for over six decades.

The first time an oil well was successfully fractured was back in 1949, at the Hugoton gas field in Kansas although things were quite different back then. Rather than injecting millions of gallons of water, like drillers do today, Stanolind Oil actually used a thousand gallons of gelled gasoline to fracture the limestone at a depth of more than 2,400 feet. (Can you imagine how the use of napalm would go over today?)

Fortunately, companies have gotten much better at the process and investors have been cleaning up ever since.

Industry Savior. or Necessary Evil?

While we’ve been pumping wells with water, sand, and chemicals for 64 years, the uproar didn’t really start until the U.S. kick-started its tight oil and gas boom in the mid-2000s.

And let’s be honest about something: No administration will ever place a blanket moratorium on hydraulic fracturing in the United States. And a few state bans that we’ve seen in places like New Jersey are laughable when you consider it has no oil or gas drilling activity to curtail!

Truth is a nationwide moratorium would cripple the U.S. oil and gas industry. That’s not hyperbole. It’s the reality of our country’s energy situation.

To date, there have been an estimated 2.5 million frac jobs worldwide. Since 1949, well over a million frac jobs have been performed on oil and gas wells in U.S.

And as many as nine out of every ten new onshore wells will undergo some sort of fracture stimulation.

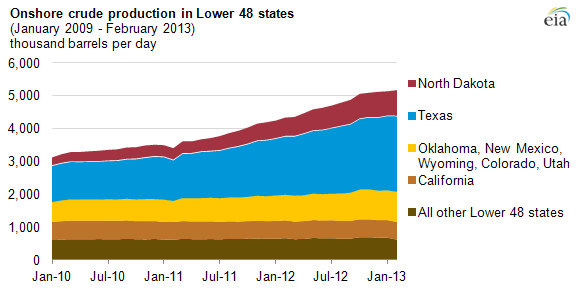

It’s these onshore wells that are driving U.S. oil production.

During the last three years, our domestic crude output has jumped a little more than 1.6 million barrels per day.

You can see in the chart above where much of that production increase took place. Texas and North Dakota just two states have accounted for 72%.

To say the shale boom has been explosive would be an understatement.

Back in 2010, insiders were projecting that production in the Eagle Ford Shale would be 800,000 barrels per day by 2016 (for perspective’s sake, that amount equates to approximately 68% of the state’s average production in 2010).

Those insiders were off by a long shot. Oil production in the Eagle Ford broke passed that mark last year four years ahead of schedule!

I’ve seen predictions that it’ll top a million and a half barrels per day within the next three years.

And in case you were wondering, there wouldn’t be a single drop of production in the Eagle Ford, Bakken, or any other of the now-famous shale plays now in the media spotlight without hydraulic fracturing.

How to Gouge Big Oil

Lately, we’ve talked a lot about how game-changing drilling technology is quickly becoming the norm in the biggest shale hot spots in North America.

For proof of just how effective technology has been in producing North America’s resources, look no further than the change in production time: The average well in the Eagle Ford took about 40 days to drill in 2010. In 2013, just three years later, companies have nearly cut that time in half.

So, where do we as investors go from here?

Well, today I want to talk about the purer investments out there for individual investors.

Take one look at the chart below, and you’ll see why we’re sticking with traditional service companies like Halliburton over the major integrated oil companies like ExxonMobil.

Even despite having a market cap only one-tenth of ExxonMobil’s, Halliburton’s recent returns have crushed what XOM has delivered shareholders.

Just think of how much capital ExxonMobil and friends are pouring into unconventional oil here in the States. You might recall when they shelled out $41 billion for XTO Energy a few years back or their more recent $1.6 billion deal for Denbury’s Bakken acreage.

For an even broader play into traditional hydraulic fracturing companies, the Market Vectors Unconventional Oil & Gas ETF (FRAK) might be more attractive. This investment attempts to mirror the performance of the Market Vectors Unconventional Oil & Gas Index, which is made up of companies that derive at least half of their revenues from unconventional oil and gas. At least 80% of the ETF’s holdings are stocks found within that index.

In fact, FRAK’s top holdings are a list of who’s who in the U.S. oil and gas industry, including Occidental Petroleum, Anadarko Petroleum, EOG Resources, and Hess.

Until next time,

Keith Kohl

Related Articles on Investing in Fracking Stocks

The debate continues, but it is likely that California will give in to get a piece of all that fracking action.

How to drive an electric car for practically nothing.