Investing in Fine Wine_5

Post on: 18 Июнь, 2015 No Comment

Wednesday, September 05, 2012

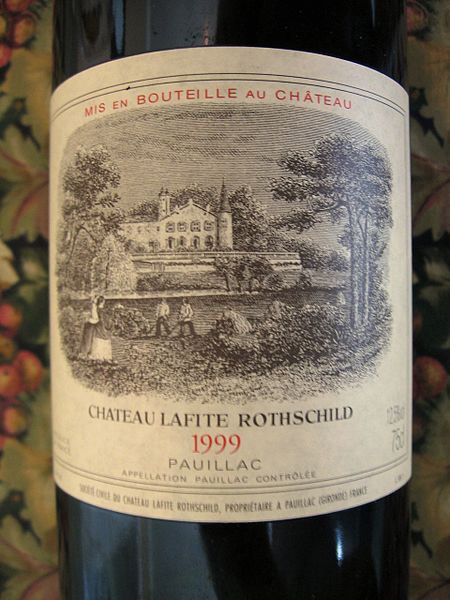

Two hundred years ago, SWAG was a term used to describe property stolen by pirates. Today, SWAG is an acronym for the latest rage in non-traditional investing: Silver, Wine, Art and Gold. Traditional investments like stocks, bonds, mortgages, and mutual funds have taken a beating in recent years, so investors have begun looking at SWAG. Silver and gold have always been investors’ (and pirates) favorites. Art, too, has always been a good investment for those knowledgeable about what to buy and rich enough to buy it. But wine? Wine is relatively new to the investment scene. Although wine is not a top recommendation from many financial advisors, wine is an affordable investment for even those of modest means.

How Good is Wine as an Investment?

www.liv-ex.com/ ) documents a 300 percent increase in the prices of fine wines over the past 10 years. In the same period, wine has out- performed both the Dow and the Nasdaq indexes. Swiss economists Phillipe Masset and Jean-Phillipe Weisskopf, in their study “Raise Your Glass: Wine Investment and the Financial Crisis” conclude: “Our findings show that the inclusion of wine in a portfolio and, especially, more prestigious wines, increases the portfolio’s returns while reducing its risk, particularly during the financial crisis”. Data for the study was taken from 144 auctions with a combined value of $237 million with vintages from 1981 to 2005.

So why has wine performed so well as an investment? For the same reasons that silver, gold, and art have done well: they are physical assets rather than paper assets, they are easy to store and easy to access (try moving your money on a banking holiday) they are rare, and they are in demand. It’s no wonder investors want to top off their portfolios with a touch of SWAG.

How Do I Invest in Wine?

Wine investing is much like other investments: the more you know, the greater your chance of success. And, like other investments, it helps to have the advice of an experienced broker. Successful wine investors suggest that new investors follow these guidelines:

- Find a reputable wine broker with a documented track record

- Store the wine properly. All wines have a proper storage temperature that will vary for each type of wine. Wines must be kept at a certain humidity and in a certain position so the corks don’t shrink and spoil the wine. If you don’t have the proper facility for storing your investment wine, ask your broker for suggestions about where to rent proper space.

- Invest in a mixed portfolio of wines. Some wines will perform well as an investment, others won’t. Spread the risk.

Try Before You Buy

www.winemarket-news.com ) will allow you to set up an online virtual portfolio without investing any money. You will be able to track the value of your portfolio daily, add to your portfolio at any time, and hold the wine for as long as you desire. When you feel you are ready for the real deal, you will have already established a relationship with an experienced wine broker.

www.winemarket-news.com/set-up-a-free-virtual-fine-wine-investment-portfolio/ and type in your information.

Of course, you may be tempted to drink some of your investment wine. Don’t do it. A world-famous antique dealer once admitted to me that the antiques in his home were not particularly valuable. I can be a collector he said, or a dealer; I can’t be both at the same time. That’s good advice. If you decide to invest in wine, keep your investment wines and your consumable wines separate. You can simultaneously be a wine aficionado and a wine investor, but never with the same wines.

And remember: if you decide to invest in SWAG, make it part of your investment portfolio, not the whole thing. If all you seek is swag, then you’d be a pirate.

— Wayne Jordan