Investing in Brazil with an ETF Financial Web

Post on: 17 Июнь, 2015 No Comment

A Brazil ETF is one that would be interested in tracking the performance of an index of Brazilian stocks. Brazil, like India, is an emerging market place that is of great interest for many investors. The use of an exchange traded fund provide investors with little capital an opportunity to participate in this emerging market opportunity without the same level of capital risk as larger investors.

Exchange Traded Funds (ETFs)

An ETF, or exchange traded fund, is a type of investment security that has risen in popularity over the past 10 years. The fund is based on the performance of an underlying securitys index such as the S&P 500 stock index or the Lehman Brothers Corporate Bond index. These indices are based on a grouping of underlying securities. The most common securities are stocks and bonds. The performance of the ETF is based on the performance of that index and as a passively managed fund does not seek to outperform the market. Instead an ETF seeks to keep pace and perform as well as the underlying stock.

ETFs are classified as securities under the Investment Company Act of 1940 and Securities Act of 1933. As such, certain disclosures and information must be given to the investor when considering an investment in an ETF, much the same as what is required for mutual fund investors.

Investing in Brazil ETFs

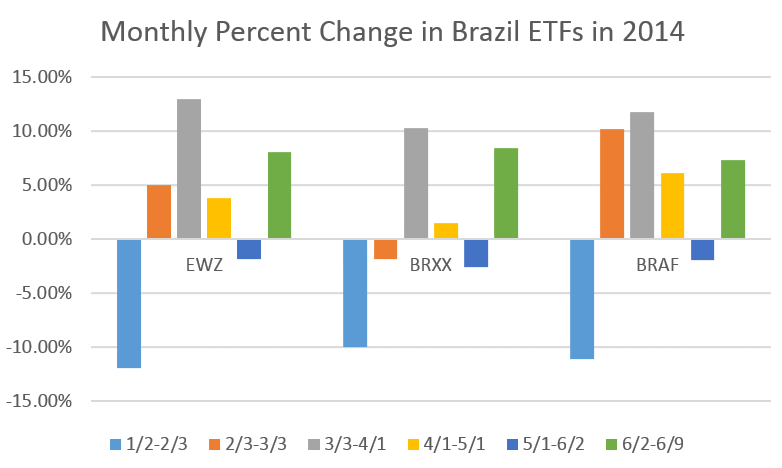

If you are a small investor with less than $100,000 or $1,000,000 to invest, an ETF may be the best way to mirror the returns of various securities groupings tracked in Brazil. Adding a Brazil ETF to your portfolio gives you overseas investment exposure while protecting some of the capital that you have at risk for investing. This means that instead of buying each of the individual securities that make up a particular Brazil ETF index you can make a smaller capital outlay in order to mimic the indexs performance.

Like any investment, there are risks associated. The biggest risk to you as an investor is the risk that the principal amount that you invest will be lost. Since all investments come with investment risk you should consider how purchasing a Brazil ETF fits into your overall investing strategy.

Considering a Brazil ETF

If you are considering investing in a Brazil ETF, research to determine what type of investment matches your needs. The first step in this process is to develop a plan that takes into account your investment goals and strategies. This plan should also weigh your time horizon and the amount of risk that you are willing to take on in order to accomplish your investment objectives. If you determine through this process that you are a type of investor who seeks high returns but do not want to experience a lot of fluctuation in your account values, you may consider investing a small amount of your investment assets in a Brazil ETF.