Investing in Alternative Mutual Funds and ETFs (MORN)

Post on: 13 Апрель, 2015 No Comment

Alternative investments are gaining popularity, especially those offered in a liquid format by mutual fund and exchange-traded fund (ETF) providers. Mutual fund companies can’t develop new alternative products fast enough to offer to financial advisors or directly to individual investors .

In the past alternatives were offered primarily in investment products like hedge funds with requirements that investors be accredited. meaning they meet minimum income and net worth conditions. In the wake of the turbulence in the financial markets during the 2008-2009 financial crisis they are increasingly being packaged in more liquid and accessible formats. (For more, see: Are Hedged Mutual Funds for You? ).

What Are Alternative Investments?

Alternatives are investment vehicles that aren’t purely stocks, bonds or cash. The purpose of alternatives is to diversify an investment portfolio. At their best these alterative vehicles have a low correlation to the long -only stock and fixed income holdings that are the core of many portfolios. Alternative strategies include:

Once confined to hedge funds and similar restrictive investment vehicles, many of these strategies are now available in mutual fund and ETF wrappers. This is significant in that they can be purchased by all investors, not just accredited investors. This makes packaging these strategies especially attractive to mutual fund companies for distribution. (For more, see: Getting to Know Hedge-Like Mutual Funds ).

There is Big Money Involved

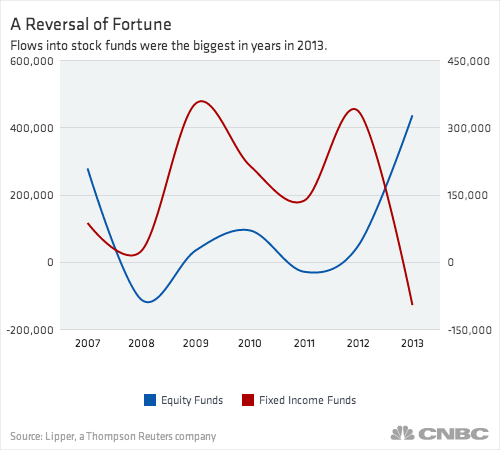

During 2013 about $40 billion in assets flowed into alternative mutual funds with another $19 billion in 2014 (through the end of November), according to Morningstar Inc. (MORN ). Alternative mutual funds had in excess of $206 billion in assets mostly from individual investors as of September of 2014. This is up tenfold over the past 10 years.

Loading the player.

There are nearly 500 alternative mutual funds but only a small portion of them existed before the 2008 market downturn. This means that the strategies and perhaps the underlying benchmarks were developed based on back-testing but have not been tested in a real down market.

You Are Not the Yale Endowment

Alternative investments have received a lot of favorable press over the years due to the success major university endowments such as those benefiting Yale University and Harvard University have had with them. When looking at this success investors need to remember that major institutional investors of this type have massive in house staffs plus the expertise of large investment consultants to help them choose, evaluate and monitor their exposure to alternatives. Additionally their buying power gives them access to many direct investment opportunities that smaller investors just don’t have. (For more, see: How to Invest Like an Endowment ).

Do You Understand These Investments?

Investing in anything that you don’t understand is rarely a good idea. If you are considering a mutual fund or ETF that invests in an alternative strategy do you understand what the fund does, what market factors cause it to gain or lose money and most importantly why an investment in this fund is a good idea for you? Can your financial advisor explain these points to you? Does he or she truly understand the proposed investment or is this something his or her firm is pushing to earn higher commissions and fees?

Investors who are sold on investing in alternatives but who don’t understand the complexities of some of these vehicles or the mechanics are less likely to stick with them when market forces go against them. This can defeat the whole purpose of using alternatives. (For more, see: Minimize Your Losses with Alternative Strategy Funds ).

Expenses and Liquidity

Many alternative mutual funds carry high expense ratios. This may be due to some of the complex strategies used or perhaps the relatively low asset base some of these funds have. Additionally there are relatively few players in this space so there is not much need to be price competitive.

Alternatives in more traditional hedge fund formats generally carry even higher expenses including performance fees in many cases. (For more, see: Hedge Fund Fees: Exotic Expenses ).

Liquidity has always been an issue to one extent or another with traditional alternative investments. Often redemptions can only be made at certain points during the year and then some sort of notification is generally required. This issue came to the forefront during the financial meltdown of 2008-2009 when a number of hedge funds suspended redemptions and clients needing their money had difficulties getting it in some cases.

Non-traded real estate investment trusts (REITS) have been a popular investment pitched by many commission-based financial advisors in recent years. These are essentially illiquid stock investments in company’s involved in some aspect of real estate. In many cases these investments have done well over the past several years but liquidity is limited and there is no secondary market for these securities. (For more, see: What Are the Potential Pitfalls of Owning REITs? ).

What is a Balanced Portfolio?

A traditional balanced portfolio might consist of 60% equities and 40% fixed income. Equities might be mutual funds and ETFs in traditional asset classes like large cap, mid cap, small cap and international. The fixed-income portion might consist of a core bond fund, a short-term bond, a Treasury inflation-protected securities (TIPs) fund and perhaps some exposure to foreign bonds. (For more, see: The Best Portfolio Balance ).

A recent piece in Investment News suggested that the new version of the balanced portfolio might become 30% equities, 30% fixed income and 40% tactical liquid alternatives. Frankly the use of traditional long-only allocations divided between stocks and fixed income has worked well as a diversifier. The impact of rising interest rates on bonds once this actually happens might spur more interest in liquid alternatives.

Like any investment if used correctly for a given client portfolio alternatives can provide diversification and can help manage risk.

The Bottom Line

Mutual fund and ETF providers have long been known to capitalize on trends and developments in the financial markets in terms of the products they introduce. Alternative investments packaged in accessible and liquid mutual fund and ETF formats are all the rage. Like anything else investors need to be sure that these products are right for them and their portfolio. If used correctly and care is taken in selecting the right alternative investment products these vehicles can serve investors well. (For related reading, see: Are Financial Advisors Abandoning Alternatives? )