Investing Gurus To Follow For The Next 30 Years

Post on: 14 Август, 2015 No Comment

- Page Title:

- Page URL:

This page has been successfully added into your Bookmark.

44 followers

Follow

At GuruFocus we follow many of the top investment managers around the globe. I like to follow the investing gurus that are in control of a publicly traded company that I can buy. The gurus I follow include Warren Buffett (Berkshire Hathaway, BRK.A ), Carl Icahn (Icahn Enterprises, IEP ) and Prem Watsa (Fairfax Financial, TSX:FFH. FRFHF ). All of their stocks have performed well over the years. We can still make money with these gurus, but for how long? Warren Buffett (Trades. Portfolio ) is 83 years old and Carl Icahn (Trades. Portfolio ) is 78. Prem Watsa (Trades. Portfolio ) is the youngest of the three mentioned at 64. There are some great investment gurus in their early 50’s such as Daniel Loeb (Third Point Re, TPRE ) and Tom Gayner (Markel, MKL ) that we can follow for years, but I wanted to see if I could find gurus that are at even earlier stages in their careers.

Three gurus under the age of 50 that we can potentially follow for decades to come are David Einhorn (Greenlight Capital Re, GLRE ), Warren Lichtenstein (Steel Partners Holdings, SPLP ), and Sardar Biglari (Biglari Holdings, BH ). Each one is the chairman of their publicly traded company and makes investments that have direct effects on the performance of those companies. Another person to keep an eye on is Steven Toy, the chairman of the investment committee at Wilbur Ross’ Company, WL Ross & Company.

Chairman of the Board of Greenlight Capital Re Ltd (GLRE )

David Einhorn (Trades. Portfolio ) is the Chairman of Greenlight Capital Re, a reinsurance company named after his hedge fund, Greenlight Capital. He is the most well-known of the bunch and has an excellent track record to go with his fame. Einhorn started his hedge fund in May of 1996 and has delivered annualized returns of 19.5 percent, net of fees and expenses. During the same period (May 1996 – December 2013), the S&P 500 returned an annualized 7.8 percent including reinvested dividends.

Einhorn graduated summa cum laude from Cornell University with a B.A. from the College of Arts and Sciences. He is a guru that we follow at GuruFocus and has a long/short value-oriented strategy. Einhorn believes that an investment approach emphasizing intrinsic value will achieve consistent absolute returns and safeguard capital regardless of market conditions. He is a noted activist investor, taking positions in companies, and then pushing management to implement changes. On the short side, he was able to detect the wrongful accounting of Allied Capital in 2002 and also shorted Lehman Brothers a year before they went bankrupt.

Greenlight Re, the reinsurance company, is headquartered in the Cayman Islands. Reinsurance is the process by which the reinsurer takes on all or part of the risk covered under a policy issued by an insurance company in consideration of a premium payment. Einhorn has an experienced team of executives in place to run the company from an operational standpoint. The float and excess capital of Greenlight Re is handled by the hedge fund company to provide superior returns. The float of an insurance company is the cash on hand from premiums paid that have not had to be paid out yet. By having profitable underwriting on the insurance side, the float acts as free leverage for investments. The top five long holdings of his hedge fund are Apple (AAPL ), Micron Tech (MU ), Marvell Tech (MRVL ), Cigna (CI ), and Oil States International (OIS ). The company is relatively new and started underwriting in 2006. Greenlight Re had a tough stretch of underwriting losses from 2010-2012, but is operating with an underwriting profit again.

Greenlight Re has a market cap of $1.25 billion, making it a small cap stock. The price-to-book (P/B) ratio is 1.18. P/B ratios are commonly used when measuring the value of companies run by investing gurus. The book value is the value of the assets minus liabilities. Book value per share has been growing at a rate of 8.39 percent over the past five years, and the median P/B over the same time period has been 1.2. Berkshire Hathaway currently has a P/B ratio of 1.40.

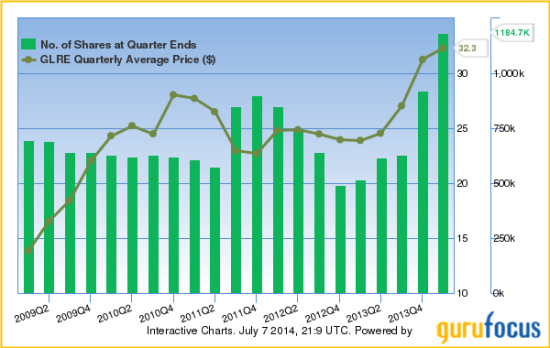

So far this year, the stock has been bought by four of the gurus we follow. Chuck Royce is the largest holder with 1,184,685 shares, representing about 3.2 percent of the shares outstanding. In total, there are 7 gurus currently holding the stock.

Warren Lichtenstein

Executive Chairman of Steel Partners Holdings, LP (SPLP )

Warren Lichtenstein has Bachelor of Arts from the University of Pennsylvania. He co-founded the Steel Partners hedge fund in 1990 and co-managed its business and operations. The fund later turned into the holding company that is trading today. According to OTC Adventures. the hedge fund had gross annual return of 22 percent from its 1990 inception to 2007. The financial crisis in 2008 nearly ended the fund. It was down 39 percent in 2008, similar to the S&P 500’s drop of 37 percent including dividends. The trouble was with redemption requests from clients. As mentioned in a January 2009 presentation from Steel Partners:

“At October 3, 2008, Steel Partners II had received withdrawal notices that totaled 38% AUM on November 30, 2008 – since that time, additional withdrawal notices and some rescission have come in”

Lichtenstein was able to liquidate much of its more liquid equity holdings, but most of their holdings were not readily available to be liquidated. At the end of 2008, 59.84 percent of their holdings were categorized as having a “time to liquidate” of more than three years. Instead of shutting down the hedge fund, Lichtenstein came up with the novel idea of taking the fund public by performing a reverse merger into WebFinancial, a holding that was majority owned by Steel Partners. A legal battle ensued with some of the fund holders, but the process was eventually completed. Steel Partners started trading on the pink sheets in 2011 and moved up to the NYSE in late 2012.

Steel Partners provides the following list about their philosophies and strategies:

- Invest in good companies with simple business models at prices that have a built-in margin of safety

- Create a continuous improve culture, and implement operational excellence programs

- Control costs and use leverage prudently, or not at all

- Avoid complex businesses or investment that cannot be easily explained or understood

- Reward people who deliver results

- Ensure the right core principles and culture exists

Currently its top five holdings are Steel Excel (SXCLD ), Handy & Harman (HNH ), GenCorp (GY ), ModusLink Global Solutions (MLNK ), and DGT Holdings (DGTC ).

*Holdings as of March 31, 2014

Steel Partners has a market cap of $461.01 million, making it a small cap stock. It is now trading at a discount to its book value with a P/B ratio of 0.85. The book value of the company is $19.54 per share, and the stock is now trading at $16.60 per share. The book value has increased 21.6 percent since the end of 2010. Although it has increased at a much lower rate than the S&P 500’s increase of 56 percent during the same period, it should not be trading at deep discount to its book value. Since the company is trading at a low value, Steel Partners has been buying back shares. In April, it bought back $49 million of its stocks, a little over 10 percent of the shares outstanding.

I first noticed this company by following Prem Watsa on GuruFocus’ website. His company, Fairfax Financial bought 30,000 shares in the first quarter of this year. So far, of the investing gurus we follow, he is the only one to buy the stock.

Sardar Biglari

Chairman and CEO of Biglari Holdings Inc (BH )

Biglari Holdings’ stock previously had the name of Steak ‘n Shake. Sardar Biglari gained control of Steak ‘n Shake in 2008 as it was bleeding cash flow and turned it into a cash flow generating machine. Biglari shies away from the press, but is open to spend five hours with investors during the annual meetings. From what I could find, Kevin Roose has done a great job of piecing together his background on DealBook with his article, “Taking a Page From Buffett for His Own Path .” While at Trinity University in San Antonio, Biglari and a friend started an internet service provider called INTX Networking and sold it in 1999. He also received investing experience when he was given the opportunity to help manage a small piece of the school’s endowment fund. After graduation, he started a hedge fund and soon gained control of the restaurant chain Western Sizzlin. His former professor at Trinity, Philip Cooley, joined his venture and is the Vice Chairman of Biglari Holdings.

Today Biglari Holdings is primarily in the restaurant industry with Steak ‘n Shake, but is working to further diversify its holdings. The marketable securities of Biglari are held in the hedge fund he started, The Lion Fund. The Lion Fund is managed by Biglari Capital Corp. Sardar Biglari is the sole shareholder in Biglari Capital Corp. The past performance of the fund has not been disclosed, but there are a few articles that claim that it has largely outperformed the S&P 500.

His investing style is a mix between Warren Buffett (Trades. Portfolio ) and Carl Icahn (Trades. Portfolio ). He is a value investor and strategically allocates capital within the businesses of his holding company. In Icahn fashion, he is known to buy stakes in a company to gain control of its board. That is how he gained control of Steak ‘n Shake. He is not always successful, though. He was rejected in his attempt to buy Fremont Michigan InsuraCorp in 2010-2011, and Cracker Barrel shareholders denied him a seat on their board. He currently has control over 19.9 percent of Cracker Barrel’s (CBRL ) shares.

His acquisitions of First Guard Insurance Company and Maxim Inc have gone smoothly this year. First Guard is a direct underwriter of commercial trucking insurance selling physical damage and non-trucking liability insurance to truckers. The amounts of the deals were not disclosed, but it is estimated that the deal for Maxim Magazine was for about $30 million.

Biglari Holdings has a market cap of $720.25 million, making it a small cap stock. It is trading at a P/B ratio of 1.32, in line with the average investment holding company. Sardar Biglari’s incentive compensation is based on book value. He gets paid 25 percent of the increase in book value above a 6 percent hurdle rate with a maximum payout of $10 million. Those kinds of numbers give him plenty of incentive to increase the book value. Also Mr. Biglari is required to use at least 30 percent of his compensation to buy Bilgari Holdings stock according to the compensation plan, giving him more of a reason to increase shareholder returns. For the year 2013, book value per share increased 39 percent.

Currently there are three gurus that are holding Biglari stock, Chuck Royce. Mario Gabelli. and Jim Simons. Gabelli is the largest holder with 100,024 shares.

Future Guru to Keep an Eye On

Director and President of WL Ross Holding Corp (WLRHU)

Stephen Toy has been a part of Wilbur Ross’ team since 2000 when Ross started his firm WL Ross & Co. In March, Ross, age 76, named Stephen Toy and Greg Stoeckle as co-leaders of the firm to further develop a second generation of management. Toy will lead the investment side and Stoeckle will be in charge of all other aspects.

WL Ross Holding Corp began trading on the market in early June. The actual stock is not on its own, yet. The symbol, WLRHU, represents a unit of common stock and a warrant to buy half a share at a price of $5.75 per half share. Currently, WL Ross Holding Corp is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. Stephen Toy is listed as Director and President of the company and second in command to Wilbur Ross (Trades. Portfolio ). There is no guarantee that anything will even happen with this company. If there are no suitable acquisitions found, the company could be dissolved with the capital going back to the shareholders, less any fees. An investor might have to wait for a year or two for anything to happen. At this point, I am taking a “wait and see” approach, but Stephen Toy should be on the radar.