Investing for Beginner Investment Strategy by Age

Post on: 19 Июль, 2015 No Comment

Investment Strategy by Age

It is very popular to allocate asset classes in investment portfolio according to investors age. And it has some reasonable justification: when investors age is changing his risk tolerance also do not stay the same. So how does investment strategy change by age?

You may often find an opinion that older people should avoid stocks at all and invest only in fixed income investments (bonds. money market investments etc.) So how should asset allocation change by investor’s age? The fact is that no one exactly knows how long he still has to live. If somebody would know, it would make investing (but not the other things) easier, because investment period is the main criterion for asset allocation.

If exact investment period would be known it would make investment strategy simple. we should only calculate payments for the investor in a way, that they would stay approximately stable until the end of investing period. Investment portfolio should be composed of fixed income investments only about 10 years before the end of the period.

Now we have to get back to the fact that we dont know when will start those 10 years before the end. If we will move all (or the biggest part) investments to a low risk zone the return yield will contract inevitably. If well do that prematurely, then our investments will not be efficient. If the main part of the investment portfolio will be money market investments or short-medium term secure bonds, then the returns from investing will be really low over long term.

And if you are now 60 years old, it doesnt mean that you have to completely avoid equities in your investment portfolio. Of course it shouldnt be a 100% of equities, but with our days achievements you can easily expect for 90. If it would go true, then you still would have 30 years of investing, and only few percent differences in return would make a huge distinction in results over such a long period.

Asset Allocation by Age

A well chosen assets allocation is a hard task to every investor. It is even more difficult to find right proportion when age is a changing parameter. It can’t be asset allocation that would fit all investors, because peculiarities play a critical role for risk tolerance determination.

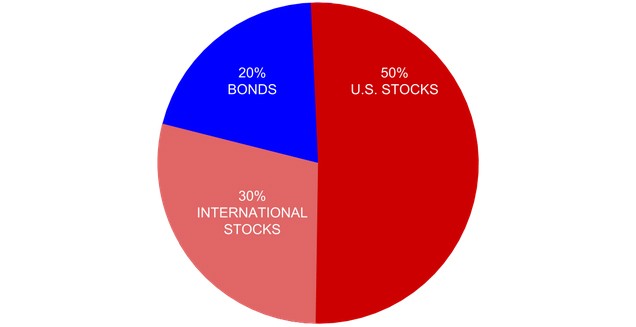

But if we would try to meet average investor’s requirements and ignore specific need of every investor, asset allocation by age should referrer to such proportion for long term investing:

- 20 years 100% stocks ; 0% bonds (or other fixed income, low risk investments)

- 30 years 80% stocks; 20% bonds

- 40 years 65% stocks; 35% bonds

- 50 years 50% stocks; 50% bonds

- 60 years 35% stocks; 65% bonds

- 70 years 20% stocks; 80% bonds

Of course it is very rough allocation, because every person is very different and has different goals for life and investing. You should prepare an investment strategy that meets your personality the best.