Investing ABCs teaching your children about stocks 360 Degrees of Financial Literacy

Post on: 16 Март, 2015 No Comment

More and more youngsters and teens are becoming fascinated by the stock market. Choosing stocks, tracking their performance, and making money can be exciting, challenging and rewarding. But, as experienced investors know, the market also can be frustrating and risky, especially during volatile times. To help kids understand the risks and rewards of the stock market, parents need to talk to their children about investing. Here is some advice to help parents get started.

Explain the importance of financial goals

Don’t start off by trying to explain options, selling short, margin calls, and other complicated concepts. Instead, begin by explaining the difference between short- and long-term financial goals and between saving and investing. To help your child understand that investing is about making money grow to meet long-term financial goals, use examples he or she will understand. For example, if your child wants to buy a new video game, he or she should focus on saving. However, if he or she hopes to buy a Harley in ten years, investing in stocks or mutual funds may be more appropriate.

Teach the about risk and rewards

The safest way to make money in the stock market is to buy shares in strong companies with the potential to grow, and to hold onto them. Young investors (and older ones, too) need to understand the concept of risk versus reward — the higher the potential reward from a particular investment, the higher the risk of losing money.

Let them test the waters

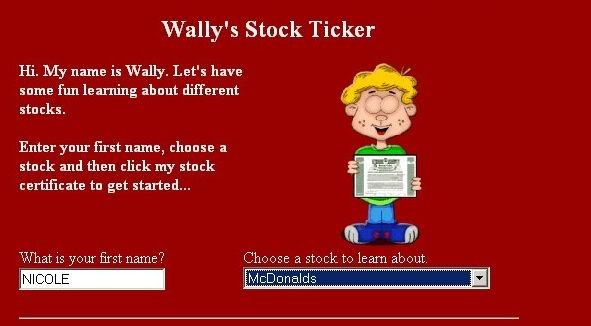

Before putting real money on the line, your child can test his or her stock selection skills and interest level by choosing two or three stocks and following their performance. Teach your child how to find the stock price in the newspaper financial listings or online. Each day, he or she can check to see how the stocks are doing. Watch for stories on the company and share them with your child. Discuss how the story is likely to impact the stock’s performance and, then, monitor the financial listings for changes in share price.

Making the purchase

While minors can’t own stocks or open brokerage accounts in their own names, parents can set up custodial accounts under the Uniform Gifts to Minors Act or Uniform Transfer to Minors Act, depending on state laws. You simply complete a form with the child’s name and Social Security number and the name of the custodian.

You and your child should first decide which companies you want to invest in. One of the best strategies is to select stocks in kid-friendly companies, such as McDonalds, Disney, and Microsoft, that are associated with products your child knows and can identify with.

Buying a small number of shares without paying high commissions can be a challenge. Some companies will let you make an initial purchase directly without going through a broker, after which you can enroll in the company’s dividend reinvestment plan (DRIP) and buy additional shares. The non-profit National Association of Investors Corp. (NAIC) (www.better-investing.org ) has a stock purchase program that lets you buy a small number of shares in quality companies. At First Share (800 683-0743 or www.firstshare.com ), you can buy a single share of stock in companies that have a direct purchase program. An online discount broker is another possibility.

By getting your kids interested in investing you’re buying more than shares of stock. You’re teaching your child financial skills he or she can use for a lifetime.

2004-2015 The American Institute of Certified Public Accountants