Invest With an Edge Newsletter Fear Winning Out Over Greed

Post on: 8 Октябрь, 2015 No Comment

06/30/10 Fear Winning Out Over Greed

Editors Corner

Fear Winning Out Over Greed

The two dominant emotions of any market are fear and greed. This week greed seems to have gone on summer vacation while fear has taken up residence. After managing to hold its ground above the 10,000 level for the last three weeks, the Dow closed below that psychological level yesterday. Today, the decline continued and we reached the next line of support near 9800. If that support fails, we could see a significant leg down. The S&P 500 finds itself in a similar condition, closing at a new low for the year and the past eight months. Despite fighting for survival, the indexes are closer to capitulation than to climbing.

Fear is also showing up in the bond markets. Interest rates for the 10-Year Treasury Notes closed at 2.97 percent yesterday, the first time it has ventured below 3 percent since April 2009 – an early stage of the recovery. In addition, two-year notes hit a record low of 0.59%. Whenever Treasury yields fall, it signals investors’ flight to safety. Investors quickly forgot about any concerns they voiced about U.S. debt as the market slipped.

Fear is also taking hold in the consumer sector. After enduring the worst ever new home sales in May, American consumer confidence is under pressure as well. The New York-based Conference Boards Consumer Confidence Index fell nearly 10 points to 52.9 in May. Economists had forecast only a modest dip. Consumers are afraid to make new purchases of any kind. On Friday, we find out how many consumers kept their jobs in June. The mood has definitely stiffened with consumers, which doesn’t bode well for US markets.

The U.S. isn’t the only place where fear has taken hold. The slowing pace of global growth has caused additional concerns for international investors. Yesterday, the same Conference Board revised April’s leading economic indicator numbers for China down to 0.3% from 1.7%, its slowest growth in five months. This gave pause to emerging market investing causing the largest China ETF, iShares FTSE/Xinhua China 25 Index (FXI), to drop more than 4%. All the while the European sovereign debt crisis continues. The global markets may be in the middle of another meltdown. With the U.S. and international markets struggling, it’s difficult to see when fear will give way to greed. At this point, even a glimmer of hope would be helpful.

The market carnage of the past week took its toll on our sector rankings. These few signs of green shoots have been obliterated. Average sector momentum (annualized trend rate) plunged from -8% to -30% over the course of just one week. Every sector was hurt on “absolute” basis. As always, the average consists of both above-average and below-average sectors. The top two spots in the relative rankings remain unchanged and in the hands of Utilities and Telecommunications. Moving up to the #3 and #4 spots are the “defensive” sectors of Consumer Staples and Health Care. Keep in mind that “defensive” does not translate into positive performance. Those two sectors were the top performers last week while dropping an average of -2.8%. In contrast, the worst performing sector was Energy, dropping an eye-popping -7.4% the past week and reclaiming control of the bottom of the rankings. Consume r Discretionary continued its fall from grace, dropping to where only Energy is ranked lower.

Sure, there were differences in the returns of the various style boxes last week, but when the small cap stocks of the Russell 2000 are down -4.5%, it is little comfort to know the large caps of the S&P 500 were worse off at -4.9%. The relative rankings shifted around the past week, but everything is so negative at this point that small differences in relative strength are not worth chasing.

International

As with the Sector rankings, our Global rankings gave up all their positive momentum numbers. We had several minor scuffles for position in the middle of the rankings, but they remain within a few points of each other. The 48 point range from the top to the bottom is a different story. China still holds the top spot, which is fitting as it did relinquish the least momentum of our categories last weak. The EU remains stuck in last place, while giving up -31 points. That wasn’t the worst of our categories, though, Canada lost the most momentum at -33 but only had Emerging Markets pass it as a result.

The charts above depict both the relative strength and absolute strength of various market sectors, styles, and geographic locations on an intermediate-term basis. Each grouping is sorted (top to bottom) by relative strength. The magnitude of the displayed RSM value is a measure of absolute strength, which is our proprietary method of measuring and reporting the intermediate-term strength as an annualized value.

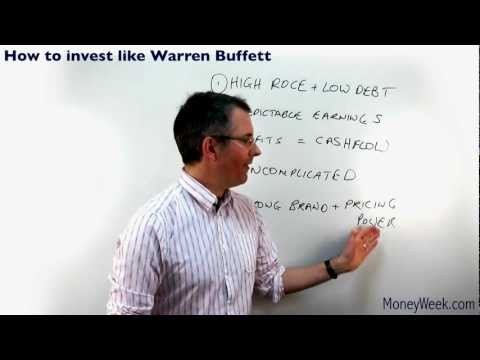

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.

Warren Buffett

DISCLOSURE

Distribution is encouraged. Please do not alter content.