Invest a Lump Sum or Use Dollar Cost Averaging

Post on: 5 Май, 2015 No Comment

by Hank

Many Soldiers receive large bonuses to reenlist in the military. But, what should they do with all that money? Many just spend it on frivolous toys, flat screen TVs, cars, trips, etc. Some legitimately pay down their debt with the money or save it for a down payment on a home. Many look back and wonder where all the money went. These scenarios are not just confined to the military. The same can be said for civilians who come into large inheritances or receive a bonus at their work. What should you do with that money? If you are going to invest it for the future, is it better to invest a large one-time lump sum or parcel the money out into smaller portions?

Many people are leery of investing a large sum of money all at once in the stock market for fear that they will be buying their stocks or mutual fund shares at a high price in a constantly fluctuating market. The age old truth to making money in the stock market is still buy low and sell high. I understand the concern, but let me tell you why its unfounded.

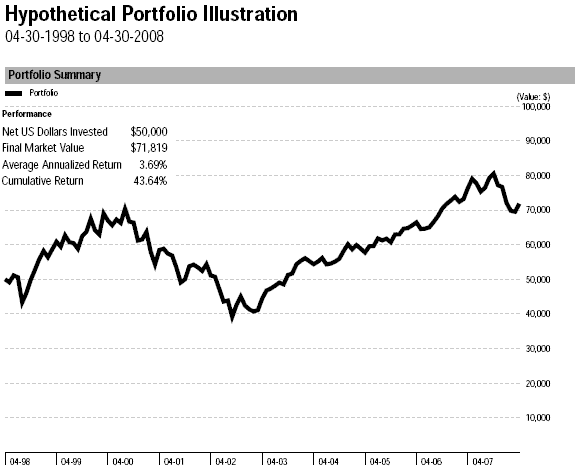

Keeping your money out of the market is a bad idea at any price. You are missing out on compounding interest, dividend payments, stock splits, etc. Youre money is not working for you on the sidelines or under your mattress. Get that money into the stock market. There have been many academic studies that show that the benefit of systematic investing is negligible to the error of buying at a high point when investing all the money in a lump sum. The interest earned even while buying shares at a higher price offsets the potential dangers of buying high with a one time investment or keeping a large portion of your money out of the market while dollar cost averaging.

You can check out the Money Chimps cool investing calculator that will show you just how negligible the advantage of dollar cost averaging is. Some years, dollar cost averaging will beat out the lump sum method, and other years the reverse is true.

Dont get me wrong. Im a huge fan, believer, and practitioner of dollar cost averaging. Dollar cost averaging is when you invest a set amount of money at certain intervals of time (i.e. monthly). I have committed to paying myself first and investing a fixed amount of my salary every month. For example, I invest $415 every month into my Roth IRA ($415 x 12 = $5,000 the max for a Roth IRA). Some days the share price of the mutual fund its invested in is up (so I buy a fewer number of shares) and some days the funds price is down, and I buy a lot of shares that month. It makes my cost basis an average and smoothes out the markets volatility. Im both buying high and buying low with dollar cost averaging.

The point of the story is that no matter what you do, do something! Get your money in the market. Start investing now. Waiting is not helping you earn the kind of money you need for retirement, college savings, etc. The best thing young investors have on their side is time. The longer your money is in the market, the more money you will have in retirement.